Finding income across the market cap spectrum

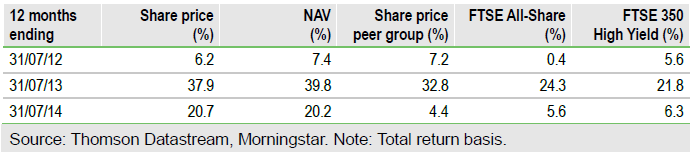

The Diverse Income Trust (DIVI) is a relatively new trust, launched in 2011 by Miton, aiming to achieve a growing income and some capital appreciation from a portfolio of UK companies. Unlike many equity income funds it has a strong bias towards smaller companies, which its managers say are better able to outperform in the uncertain economic conditions they expect in the post-credit boom years. Managers Gervais Williams and Martin Turner maintain a relatively long stock list (c 140 holdings) and market risk is reduced by a FTSE 100 put option covering c 25% of the portfolio. Risk-adjusted performance has been strong and the trust consistently trades at a premium; it recently raised £50m in a C share issue.

Investment strategy: Focus on sustainable dividends

DIVI is a UK equity income investment trust that invests across the market cap spectrum to achieve an attractive and growing income and long-term capital growth. There is a bias towards smaller companies; the managers prefer conservatively run businesses operating in less economically sensitive areas and favour companies with net cash over those with debt. Stocks are chosen on the basis of financial analysis and company meetings to answer five key questions, focusing on prospects for turnover and margins, management and balance sheet strength and whether unjustly low expectations are reflected in the share price.

Outlook: UK equities struggling to advance in 2014

After a strong run from all parts of the UK stock market in 2013, small and mid caps have fallen back a little so far this year, with the meagre gains from the FTSE All-Share driven largely by some of the biggest FTSE 100 stocks such as AstraZeneca. Investors seem unconvinced by evidence of improvements in the UK economy, with the looming end of quantitative easing in the US and geopolitical tension in Ukraine and the Middle East further dampening risk appetite. However, among UK stocks, small caps appear to offer better value on a P/E basis than their larger brethren, in spite of significantly better performance (+43.9% total return for the FTSE Small Cap versus +18.6% for the FTSE 100) in 2013.

Valuation: Premium maintained; C shares issued

DIVI has traded at a premium for most of its three-year life, and at 15 August the cum-fair premium to net asset value was 1.1%, compared with a one-year average of 3.1% and a three-year average of 2.3%. While the trust has share buyback and allotment powers to manage supply and demand, in practice it has preferred to meet excess demand through C share issues; the third of these took place in June 2014, raising £50m. Once the proceeds are invested the C shares will be converted into ordinary shares, bringing the market capitalisation to c £310m.

To Read the Entire Report Please Click on the pdf File Below