The European Central Bank (ECB) added another dose of monetary easing on 3 December. The latest measures include reducing the deposit rate by 10 basis points, taking it further into negative territory(-0.3%), and extendingthe quantitative easing programme by six months to March 2017. But that was not enough to satisfy markets, which had expected a larger stimulus. As a result, the euro rose by 3.1% against the US dollar on the day. However, diverging global monetary policies,with an easing ECB and a tightening US Federal Reserve (Fed), could push the euro down again. The depreciation of the euro could benefit Euro Area’s (EA) growth by boosting its exports. It could also help inflation to rise back to its near 2% target.

Why did the ECB feel the need to add another dose of monetary stimulus? The recent data from the Euro Area have been broadly in line with expectations, but the ECB might have been motivated by a worsening outlook given the headwinds facing emerging markets (EMs). The clouds gathering around EMs could lead to disappointing growth and a longer period of below-target inflation, and the ECB decided to act before these risks materialise.

But markets had had high expectations which the ECB failed to meet. These expectations were fuelled by the ECB’s guidance before the meeting, including speeches of its president, Mario Draghi. And when the guidance failed to materialise, markets responded aggressively with equities falling, European bond yields rising and the euro experiencing one of its strongest ever rallies.

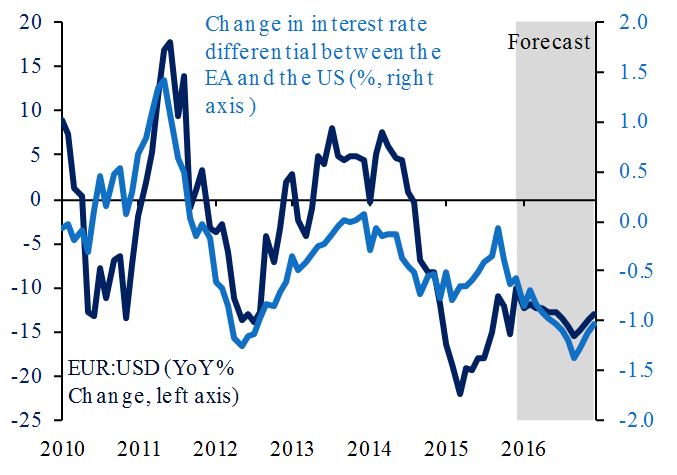

However, the appreciation of the euro against the US dollar could soon reverse with the rise in interest rates in the US. Short-term movements in currencies tend to be dominated by interest rate differentials. As investors borrow funds from lowinterest rate countries and invest them in higher interest rate countries, the resulting portfolio flows cause high-yielding currencies to appreciate against low-yield ones.

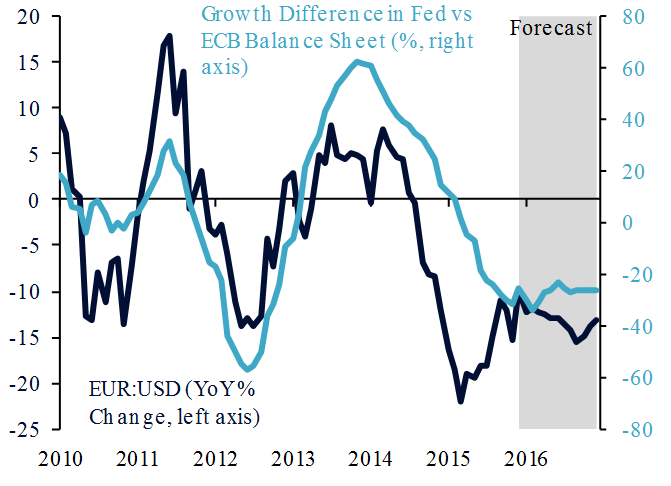

Since the financial crisis of 2008, short-term interest rates have fallen to zero in most advanced economies. Investors have therefore focused instead on the impact of quantitative easing on the relative size of major central banks’ balance sheets as an alternative measure of monetary conditions. In particular, the difference in the growth rate between the Fed’s balance sheet and that of the ECB’s has become an important driver of the euro-dollar exchange rate. If the ECB’s balance sheet is growing faster than the Fed’s, investors interpret that as an easing of monetary conditions in the Euro Area relative to the US. As a result, the euro would depreciate against the dollar. This has been the case since early 2015.

With the imminent rise of interest rates in the US, the differential between short-term interest rates is back as an important driver of the euro-dollar movement in addition to the size of balance sheets and quantitative easing. So while the euro-dollar movement was driven mainly by the interest rate differential pre-2008 and mainly by balance sheet differences in 2009-15, both factors are expected to play an important role in the future.

EA vs. US interest rate differential and EUR:USD % Change

Fed vs. ECB Balance Sheet Growth and EUR:USD % Change

What does this imply about the euro-dollar going forward? The Fed is expected to raise interest rates this month and to continue raising rates at the pace of four 25-basis-point hikes per year. Furthermore, it is expected to maintain the size of its balance sheet at around USD4.5tn. Meanwhile, the ECB is expected to keep its interest rates near zero until late 2018 and to increase the size of its balance sheet by EUR60bn a month, from EUR2.7tn as of November 2015. Based on the historical relationship between interest rate, balance sheet differentials and the euro-dollar exchange rate,diverging monetary policies should lead to a depreciation of the EUR/USD to 0.95 by end-2016. Even if we assume a more gradual pace of interest rate hikes in the US (two hikes per year), then the euro-dollar should still fall to near parity by end-2016.

The depreciation of the euro could boost the Euro Area’s exports and help inflation in the region to creep up to target. This, together with low oil prices and support from fiscal policy, could help the region to sustain its recovery in the short term. But growth is still held back by structural issues related to slow productivity gains and unfavourable demographics. These issues still need to be tackled. And for these, another episode of monetary easing will not be the answer.