During the past 10 days or so, there was the rare opportunity to hear the decisions of some of the world’s most important central banks within days of each other. The European Central Bank, the Bank of Japan, the Federal Reserve, the Swiss National Bank and the Bank of England all met and discussed policy within the same 8-day period. This was perhaps a lot of information to digest all at once, but some key conclusions have emerged behind the official policy statements and the carefully-crafted answers to journalists.

The first common conclusion is that the world’s major central banks sound concerned about the uncertainties in the global environment. While the theme of ‘we are doing ok at home - it is the rest of the world that has us worried’ was spoken more often than it should, there were mostly downgrades to inflation and growth forecasts across the board. The downgrades were not dramatic, but they did convey a note of caution. At this point in time, it looks like every major central bank is keen to err on the side of caution, that is to say to keep rates low for longer by delaying rate hikes or injecting even more monetary stimulus, even if it means using untested methods.

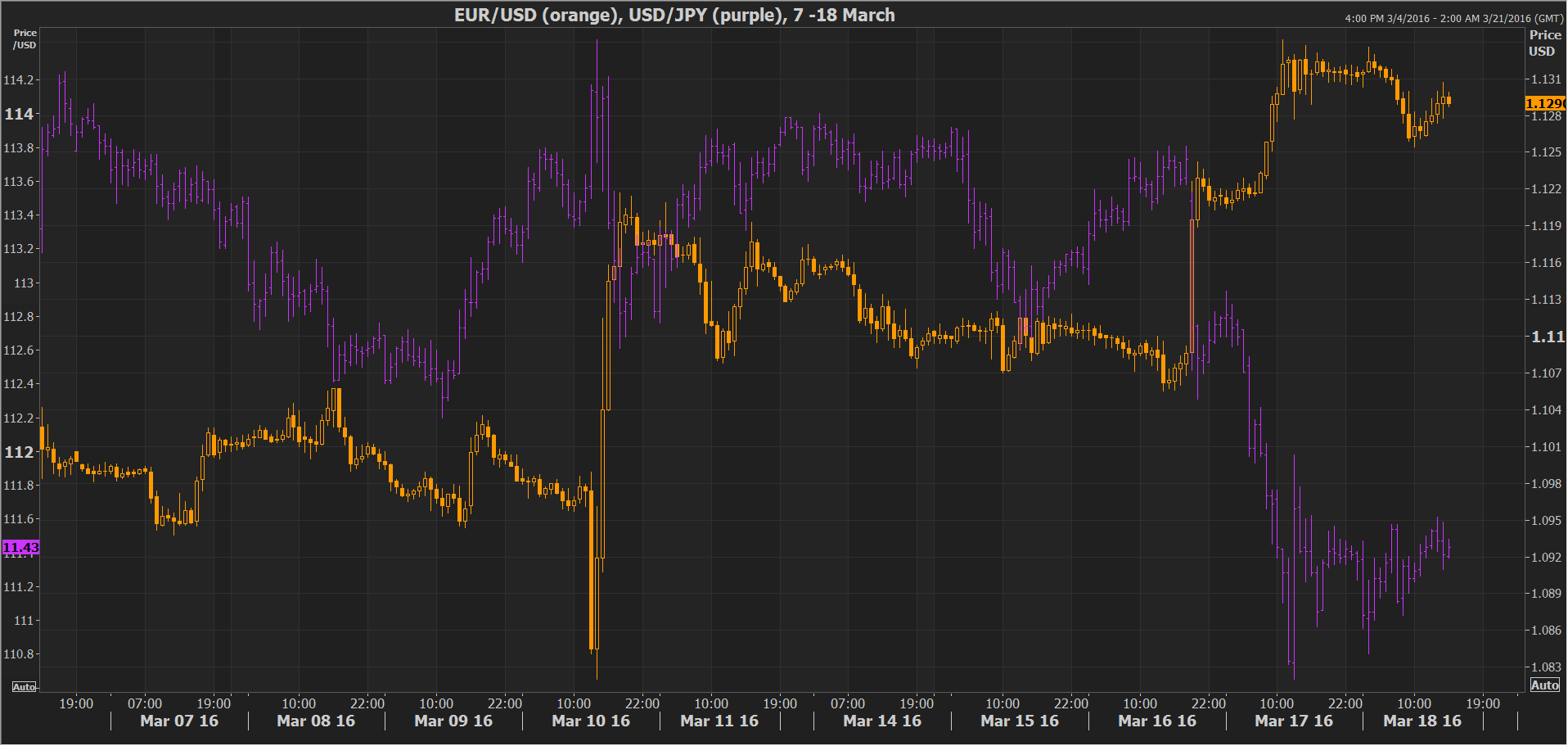

The second point that is worth making is that the market reaction to some of the central bank announcements – particularly that of the ECB – has been itself surprising. This has been particularly true in foreign exchange markets as both the euro and the yen, the currencies of those central banks that are injecting the most stimulus, appeared strong. One possible explanation is that currencies do not exist in a vacuum – they are always rising or falling against another currency. So what happens if all central banks are exceeding expectations in terms of either refusing to increase rates or pushing rates deeper into negative territory? It is very possible that this results in some choppy and surprising action.

Expectations of deepening policy divergence have already resulted in sharp depreciation of the yen and the euro, and a lot of ‘bad’ news was already priced in, particularly for these two currencies. The fact that the ‘good’ news that was expected in currencies such as the US dollar and the UK pound for example, did not play out as initially expected, may also have led to the lack of direction for the pairs involving these currencies. For the pound of course, the issue of the EU in/out referendum is also paramount during the period up to June.

Finally, it appears that under the current conditions for global monetary policy, ‘divergence’ for central banks that are leaning on tighter policy is less easy than it first appears. The Federal Reserve’s latest meeting outcome is an interesting illustration of this. Whereas one could claim that domestic economic data for the United States such as core inflation and unemployment are calling for the normalization of monetary policy, policymakers are still reluctant. A possible justification is that during a period where major central banks such as the ECB and the Bank of Japan are keen to reduce rates further into negative territory, heading in the other direction by regularly raising rates as if nothing is happening can attract a lot of unwanted short-term capital flows to your domestic currency. This could cause the US dollar to extend its current rally for example, potentially making the US ‘the consumer of last resort’ for the rest of the world. This is an outcome that the US would like to avoid, as the US Treasury Secretary himself stated in the recent G20 summit.

Besides the conflicting signals from currency markets, central bank ‘dovishness’ is more clearly portrayed by the significant recovery of risk asset prices in recent weeks, as most stock markets have erased the losses they had registered since the beginning of the year. This has happened despite the slight deterioration in growth forecasts, which shows that the recovery could be the result of fresh stimulus hopes. Therefore the “liquidity party” as one market participant called it, is continuing for now, after the brief scare during January and February when Chinese slowdown fears and falling oil prices were casting a cloud over investors.