Gold and gold miners have been diverging recently. What does it mean for the gold market?

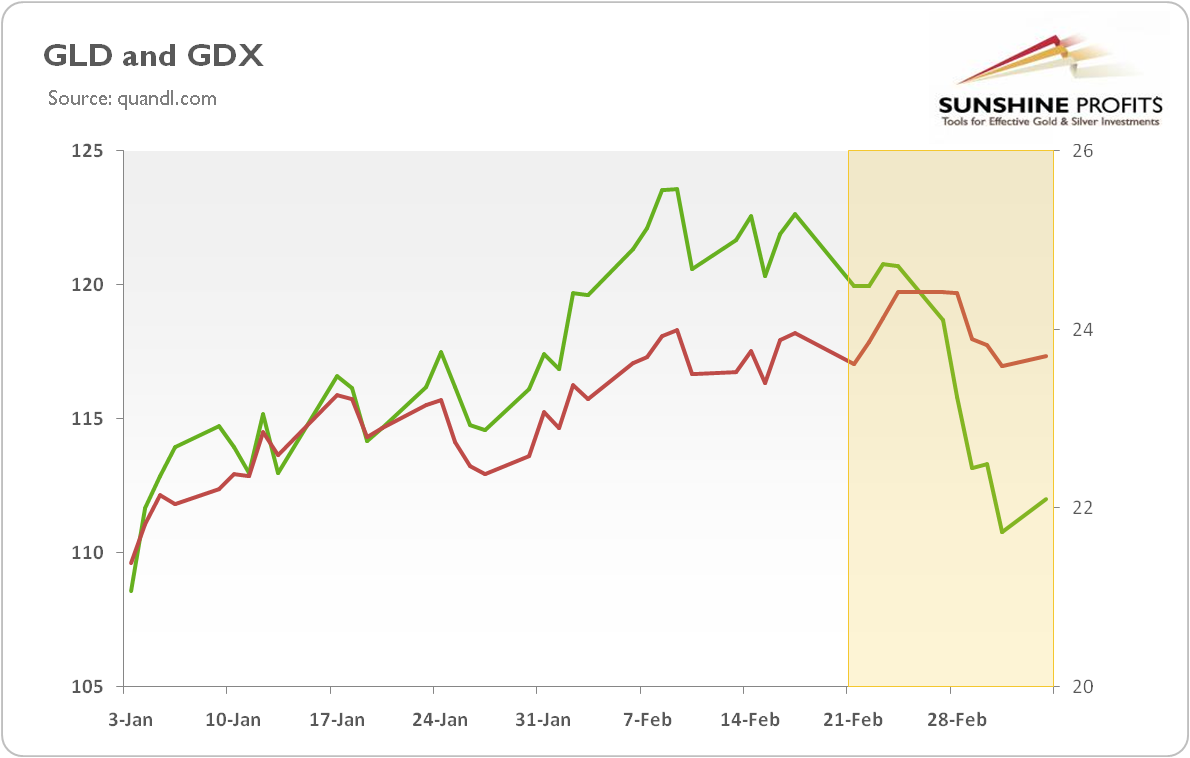

As we showed in one of the editions of the Market Overview, there is a strong correlation between the price of gold and the value of gold mining companies. However, that relation sometimes breaks. Indeed, as the chart below paints, at the end of February, the price of gold and the value of gold stocks diverged. GDX, or the Market Vectors Gold Miners ETF (NYSE:GDX), went down, while the price of gold, or actually the shares of SPDR Gold Shares (NYSE:GLD), went up initially and later were only moderately lower.

Chart 1: SPDR Gold Shares (NYSE:GLD) (green line, right axis) and GDX (red line, left axis) from January 3 to March 6, 2017.

What is the reason behind such a divergence? Well, it’s not easy to say, as there are many possible explanations. However, it may be the case that Trump’s protectionist stance is negative for the gold stocks. As a reminder, foreign companies control most of the U.S. gold mine production. Therefore, the worries over the effects of possible protectionist policies may explain why GDX has diverged from gold prices a bit.

It’s even harder to determine what all this means for the gold market. If the reason behind the divergence is concerns about protectionism, it may last until the fears wane. But if it’s just a short-term disturbance, then either gold miners could go up, or the yellow metal could decline. From the fundamental perspective, and given the current macroeconomic outlook, the latter scenario is more probable.

Actually, we now see some pullback in gold prices due to pressures from the higher odds of the Fed hike in March. If history is any guide, this downward pressure should last until the FOMC meeting this month. What will happen next depends on the Fed’s message. We will elaborate on that topic in the near future – stay tuned!

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.