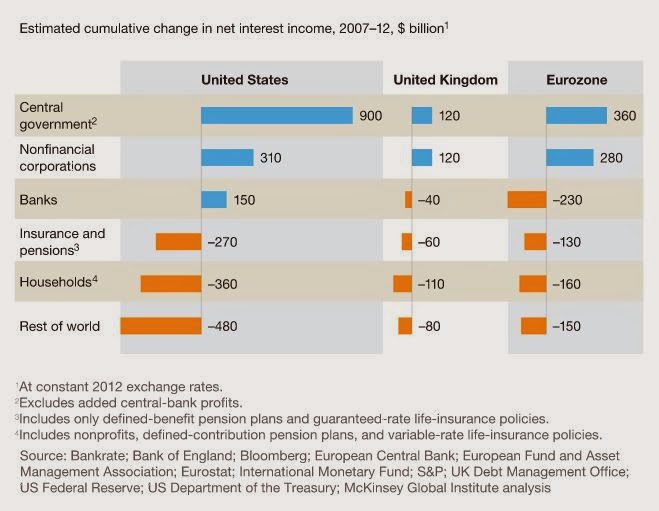

This Great Graphic was in a recent paper by McKinsey Global Institute. It estimates how the historic low nominal interest rates impact various economic sectors in terms net interest income for the US, UK and euro zone.

Governments and non-financial corporations have been helped the most through lower debt servicing costs. The impact on banks has been mixed. They have been helped in the US, but not in Europe. Insurance, pensions and households have suffered as they typically net earners of interest income.

McKinsey's report makes a controversial claim:

We found little evidence that ultra-low interest rates have boosted equity markets. We cannot discern a large-scale shift into equities as part of a search for yield by investors, and price-earnings ratios and price-book ratios in stock markets are no higher than long-term averages. Although stock prices do react to announcements by central banks, these are transitory effects that do not persist.

The report is skeptical of that the wealth effect of higher bond prices (the counterpart of lower yields) and increase house prices has boosted consumption. The fact that house prices are remain well below their peaks means that many homeowners do not feel the wealth effect. In addition, it is harder to borrow against the increase in asset prices because of tighter credit conditions.

McKinsey does see the low interest rates in Europe and the US as fostering flows into emerging market bonds. The inflows were $92 bln in 2007 and rose to $264 bln in 2011, according to McKinsey's figures. They draw the same conclusion as we do: countries with high foreign bond ownership and large current account deficits are the most vulnerable as interest rates begin to rise in the US and Europe.