Strong performances by The Walt Disney Company’s (NYSE:DIS) Parks & Resorts in the previous fiscal year, has aided the House of Mouse time and again to avoid the rut. In fact, the onus fell on this segment to offer a smooth ride with the company’s primary cash cow, ESPN, struggling. Now the question lingering in the investors mind is that whether the Parks & Resorts segment can sustain its good run in first-quarter fiscal 2018, when Disney reports on Feb 6.

Disney’s Parks & Resorts division, which has done exceptionally well in fiscal 2017, is likely to sustain the momentum in first-quarter fiscal 2018. In fourth-quarter fiscal 2017, the segment reported revenue increase of 6% following gains of 12%, 9% and 6% in the third, second and first quarter, respectively. The consensus mark for revenues from the segment for the first-quarter fiscal 2018 is pegged at $4,866 million, reflecting an increase of 6.8% year over year. Disney is focused on deploying its capital toward expansion of the Parks and Resorts business, consequently increasing market share and creating long-term growth opportunities.

The segment continues to show robust performances both domestically and internationally owing to rise in customer spending, higher ticket prices and attendance. Moreover, the company is on the verge of completing Toy Story Lands in Shanghai and Orlando, which are likely to open doors by this summer. Further, constructions of Star Wars Lands in Disneyland as well as Walt Disney World are in progress.

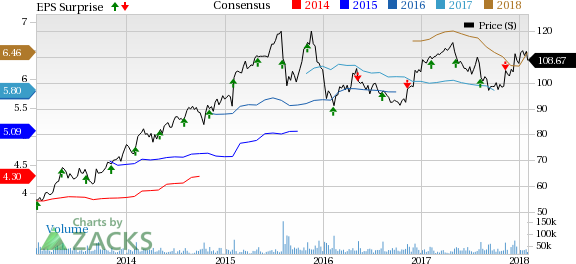

Walt Disney Company (The) Price, Consensus and EPS Surprise

Moreover, the company’s overall top and bottom-lines are expected to increase in the first quarter driven by robust performance of Parks & Resorts and Studio entertainment segments. The Zacks Consensus Estimate of earnings for first-quarter fiscal 2018 is currently pegged at $1.62. We observed that the consensus estimate has increased by 2 cents in the past 7 days, which reflects a year-over-year increase of nearly 4.5%. (Read more: Disney Q1 Earnings: Parks & Resorts, Studio Holds Key)

Disney currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Stocks to Watch for Earnings

Investors following the media stocks may watch out for earnings of Liberty Global plc (NASDAQ:LBTYA) , Viacom, Inc. (NASDAQ:VIAB) and Twenty-First Century Fox, Inc. (NASDAQ:FOXA) , which are anticipated to report quarterly results on Feb 15, 8 and 7, respectively. You can also uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Walt Disney Company (The) (DIS): Free Stock Analysis Report

Viacom Inc. (VIAB): Free Stock Analysis Report

Liberty Global PLC (LBTYA): Free Stock Analysis Report

Twenty-First Century Fox, Inc. (FOXA): Free Stock Analysis Report

Original post