Media giant, The Walt Disney Company (NYSE:DIS) is all set to purchase one-third stake in Major League Baseball’s (“MLB”) video streaming division, MLB Advanced Media, as was revealed by Bloomberg on Thursday. Sources expect the deal to be valued at nearly $3.5 billion.

MLB Advanced Media, which was founded in the year 2000, is engaged in various online services like digital ticketing, live streams, and sponsorships. The company not only distributes 10 million stream on a regular basis but also distributes 25,000 live events annually.

Jointly controlled by 30 baseball teams, MLB Advanced Media already monitors video streaming for WatchESPN. This allows television viewers to watch live telecasts and other programs using the Internet.

According to the deal, Disney will receive a four-year option to acquire additional one-third stake in MLB Advanced Media’s streaming-video unit. Notably, WME-IMG was also among the bidders for the aforementioned stake.

This deal is very crucial for Disney as its subscriber count has been decreasing over the past few years due to the increasing popularity of online TV. For some time now, declining subscriber count and higher programming costs have been a cause of concern for investors. Disney’s primary cash cow, ESPN, has been under immense pressure as the Pay-TV landscape continues to change owing to migration of subscribers to online TV. We expect falling subscriptions to have a telling effect on the network’s ad revenues. In the reported quarter, ESPN’s ratings were affected by change in the time of bowl games. ESPN’s ad revenues declined 13%.

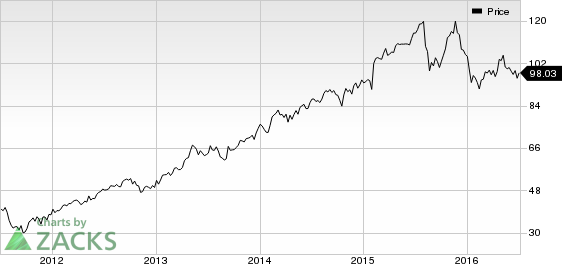

Despite Disney’s movie and park and resort business doing exceedingly well its shares declined more than 15% primarily due to the underperformance of ESPN.

In an effort to gain subscribers, Disney is trying to utilize its online options. If the deal is finalized Disney will be able to use the platform to provide additional content from ESPN online.

Disney, which also owns the TV network ABC, currently carries a Zacks Rank #3 (Hold). The company shares the space with the likes of Twenty-First Century Fox, Inc. (NASDAQ:FOXA) , Time Warner Inc. (NYSE:TWX) and Comcast Corporation (NASDAQ:CMCSA) .

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report >>

TIME WARNER INC (TWX): Free Stock Analysis Report

DISNEY WALT (DIS): Free Stock Analysis Report

COMCAST CORP A (CMCSA): Free Stock Analysis Report

TWENTY-FST CF-A (FOXA): Free Stock Analysis Report

Original post

Zacks Investment Research