Disney is beefing up for its digital future.

Disney (NYSE:DIS) topped earnings estimates when it announced earnings Thursday November 7, sending shares up more than 3% in after hours trading.

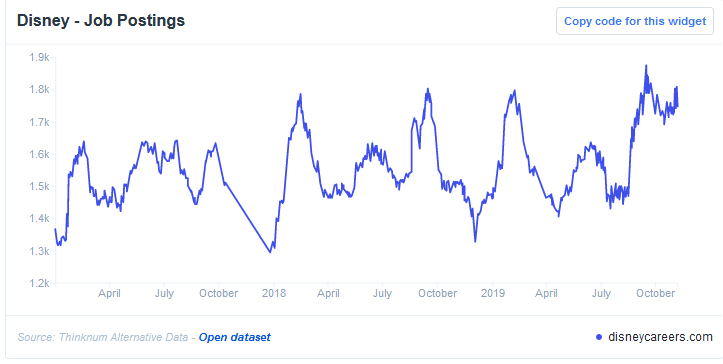

The global entertainment player saw job postings just a few months after its $70-billion-plus M&A deal to tuck in Fox. Our first chart, above, tracks Disney job postings rising nearly 10% over the course of the third quarter (this chart, does not factor in Fox jobs). With a data history several years long, we can gauge Disney hiring typically picking up heading into the final quarter of the calendar year - but its growth in postings is closing in on all-time highs, and should serve as an encouraging sign for investors.

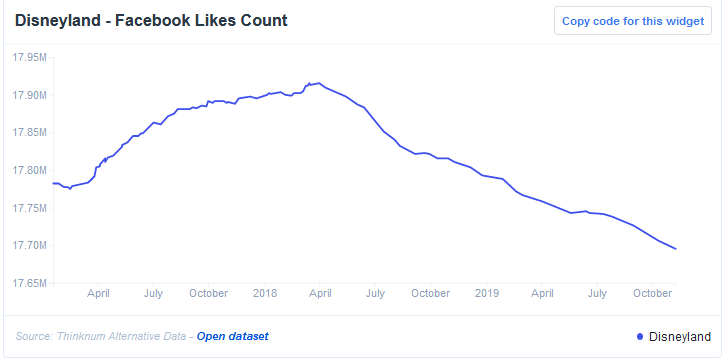

There's something simply astonishing happening, taking a look at Facebook (NASDAQ:FB) Likes data applied to Disney's flagship theme park in California - consumers are liking it less, a sign that they are actively clicking out of their relationship with the global tourist attraction.

It is surprising on a number of levels; first Disney's dominance at the box office should be helping to draw more - and not less - attention to its theme parks in 2019. But, additionally, the addition of Star Wars: Galaxy's Edge parks in West and East Coast locations should have done more to push consumer Disney's way. While Disneyland isn't quite feeling the love, that's not the case for every Disney property.

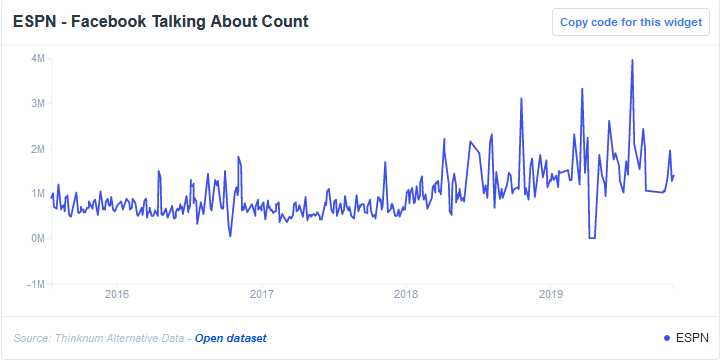

But, not everyone is seeing social stats suffer. Take ESPN, which, over the last few years, has managed to substantially drive up social attention on Facebook (NASDAQ:FB), as tracked in our last chart, the Facebook Talking About Count.

The sum of these charts reflects a company that is seeing growth, but less so at brick-and-mortar sites - and is gaining attention on digital platforms. It's not unlike the challenges facing so many US retailers, that are forced to wedge a physical business model into an increasingly digitized marketplace. But, we can tell from Disney's "Plus-sized" ambitions to harness more web content and revenue derived for it, that the company is positioning itself for a digitized future - and this is the beginning.

About the Data:

Thinknum tracks companies using the information they post online - jobs, social and web traffic, product sales and app ratings - and creates data sets that measure factors like hiring, revenue and foot traffic. Data sets may not be fully comprehensive (they only account for what is available on the web), but they can be used to gauge performance factors like staffing and sales.