Walt Disney Company (NYSE:DIS) reports preliminary financial results for the quarter ended December 31, 2014.

Walt Disney (DIS) handily beat analyst expectations when it reported quarterly earnings this week. The company’s stellar performance is a result of its success at converting film franchises like Frozen into consumer products and attractions.

Operating income grew in every business, with big profit growth in its consumer products, studio, and parks and recreations divisions. The only negative was a decline in advertising revenue, a challenge affecting the entire content owner industry.

Walt Disney Company (NYSE:DIS) is one of the first companies amongst its peer group to announce earnings for this period.

Highlights

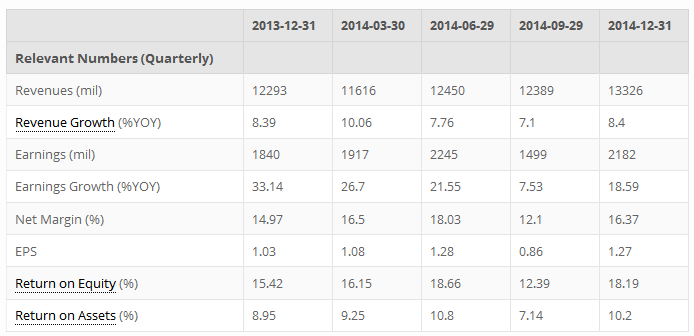

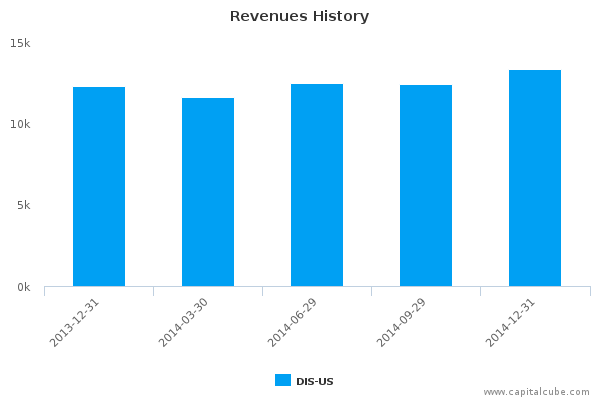

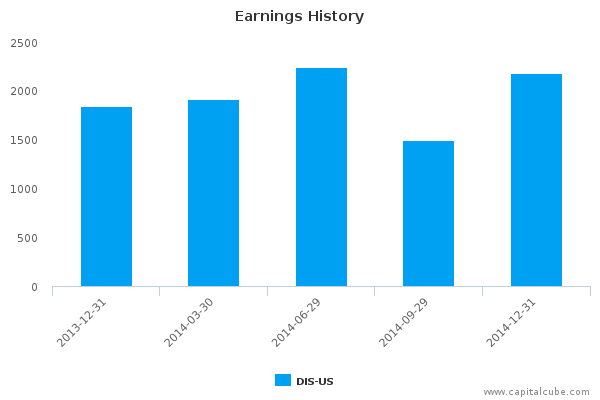

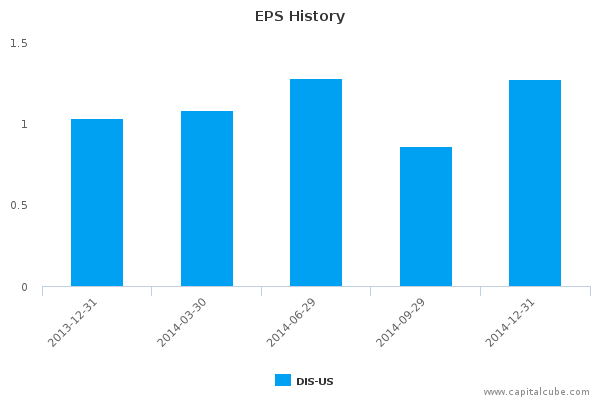

- Summary numbers: Revenues of $13.33 billion, Net Earnings of $2.18 billion, and Earnings per Share (EPS) of $1.27.

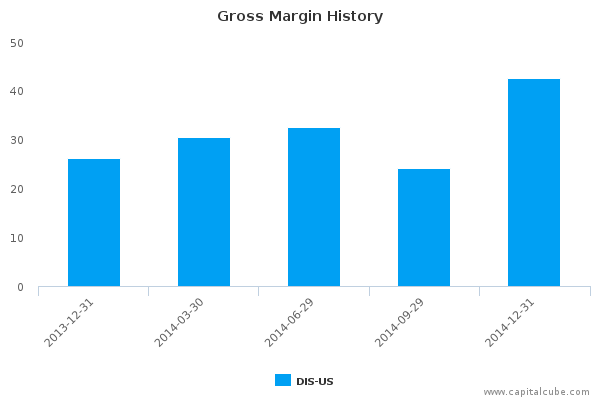

- Gross margins widened from 26.22% to 42.62% compared to the same quarter last year, operating (EBITDA) margins now 28.10% from 26.22%.

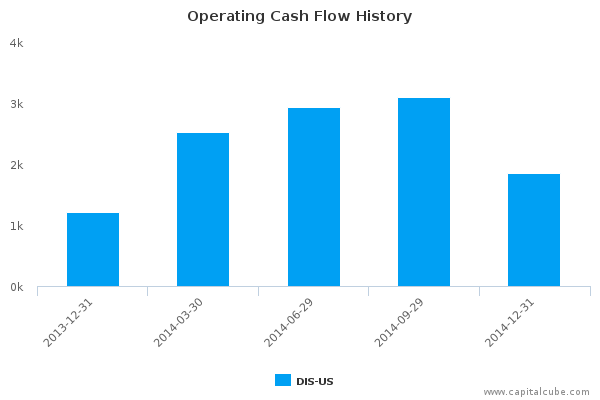

- Ability to strengthen the balance sheet? Change in operating cash flow of 53.05% compared to same quarter last year better than change in earnings

- Earnings growth from operating margin improvements as well as one-time items.

- Earnings per Share (EPS) growth exceeded earnings growth.

The table below shows the preliminary results and recent trends for key metrics such as revenues and net income growth:

Market Share Versus Profits

Companies sometimes focus on market share at the expense of profits or earnings growth.

Earnings Growth Analysis

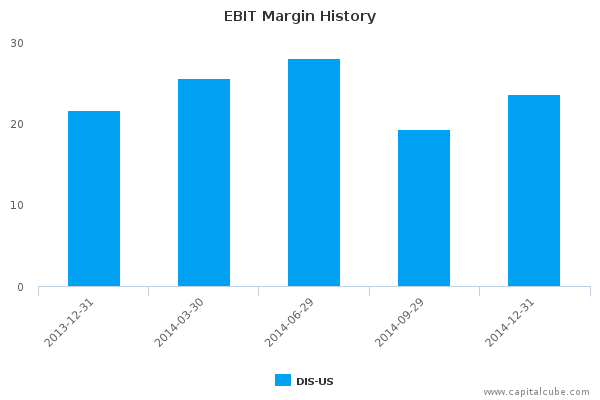

The company's earnings growth was influenced by year-on-year improvement in gross margins from 26.22% to 42.62% as well as better cost controls. As a result, operating margins (EBITDA margins) rose from 26.22% to 28.10% compared to the same period last year. For comparison, gross margins were 24.10% and EBITDA margins were 24.10% in the quarter ending September 30, 2014.

Gross Margin Trend

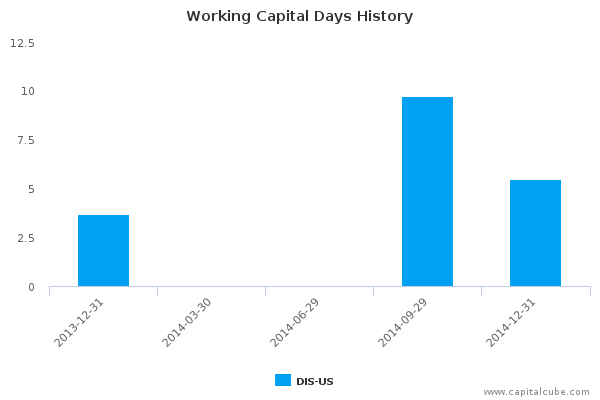

Companies sometimes sacrifice improvements in revenues and margins in order to extend friendlier terms to customers and vendors. Capital Cube probes for such activity by comparing the changes in gross margins with any changes in working capital. If the gross margins improved without a worsening of working capital, it is possible that the company's performance is a result of truly delivering in the marketplace and not simply an accounting prop-up using the balance sheet.

DIS-US's improvement in gross margins have been accompanied by a deterioration in the management of working capital. This leads Capital Cube to conclude that the improvements in gross margins are likely accounting trade-offs with the balance sheet and not strictly from operating decisions. Its working capital days have risen to 5.49 days from last year's levels of 3.67 days.

Cash Versus Earnings – Sustainable Performance?

DIS-US's year-on-year change in operating cash flow of 53.05% is better than its change in earnings. This suggests there is some ability to strengthen the balance sheet.

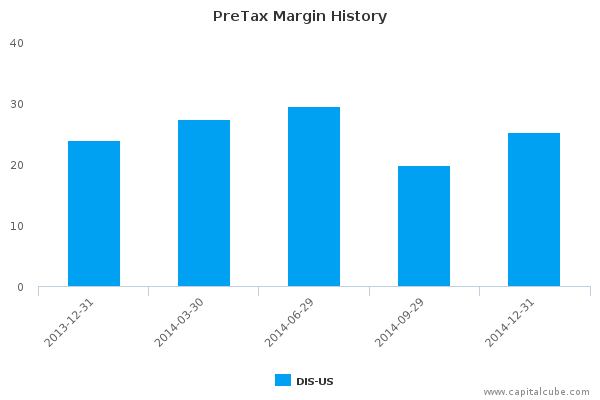

Margins

The company's earnings growth has also been influenced by the following factors: (1) Improvements in operating (EBIT) margins from 21.65% to 23.66% and (2) one-time items. The company's pretax margins are now 25.23% compared to 23.92% for the same period last year.

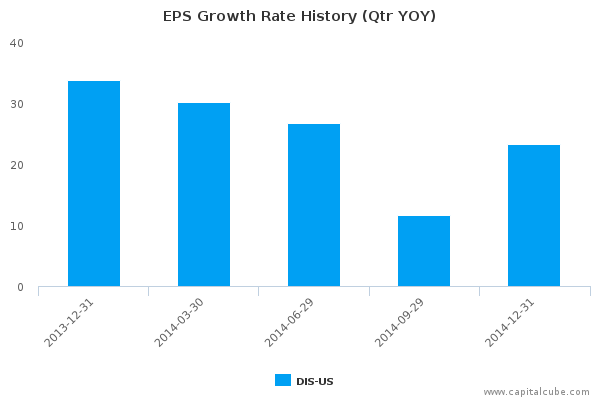

EPS Growth Versus Earnings Growth

DIS-US's change in Earnings per Share (EPS) of 23.30% compared to the same quarter last year is better than its change in earnings.

Company Profile

The Walt Disney Co. together with its subsidiaries and affiliates is a diversified international family entertainment and media enterprise. It operates through five business segments: Media Networks, Parks & Resorts, Studio Entertainment, Consumer Products and Interactive Media. The Media Networks segment is comprised of a domestic broadcast television network, television production and distribution operations, domestic television stations, international and domestic cable networks, domestic broadcast radio networks and stations, and publishing and digital operations. This segment operates through consolidated subsidiaries, the ESPN, Disney Channels Worldwide, ABC Family, SOAPnet and UTV/Bindass networks. This segment also operates ABC Television Network and television stations, as well as the ESPN Radio Network, Radio Disney Network and owns and operates radio stations. Additionally, it operates ABC, ESPN, ABC Family and SOAPnet-branded internet businesses. The Parks & Resorts segment owns and operates the Walt Disney World Resort in Florida and the Disneyland Resort in California.

Original post