Disney (DIS: $102/share) sent a shockwave through the media industry on Tuesday when it announced it would pull its movies from Netflix (NASDAQ:NFLX: $171/share) and start two streaming services – one for ESPN and one for Disney/Pixar content – over the next two years. As part of this move, Disney is investing an additional $1.6 billion to take controlling ownership of BAMTech, the company behind the streaming services of HBO, MLB, and NHL.

We raised the possibility of Disney creating a standalone streaming service in our original long idea on the stock, and this development only furthers our conviction that the company can continue to monetize its content in a changing media market.

At the same time, the loss of Disney’s movies continues the trend for Netflix that we first identified over a year ago in our article “The Spell Is Broken: Netflix Is More Like A Traditional TV Network.” Netflix’s first mover advantage in the streaming video world is on the decline, and the fundamental outlook of the company does not justify its premium valuation.

Both stocks dropped in the aftermath of the announcement, but their outlooks couldn’t be more different. Disney looks like a great value at the current price, while Netflix could be at the beginning of a significant correction. Investors should look past the market’s overreaction to Disney’s quarter and capitalize on the opportunity to buy into a great company and an attractive valuation. In the case of Netflix, investors should view this development as yet another headwind for its challenged business model and sell the overvalued stock.

Is Netflix The Most Valuable TV Network In The World?

As Netflix plows more money into original programming and scales back its licensed content, the service looks more and more like a traditional TV network. Netflix is no longer a one-stop shop for all your streaming video needs, it’s now one of many streaming services to mix and match together depending on your preferences.

Outside of the content itself, there’s not much to differentiate Netflix from Hulu, Prime Video, HBO, CBS All Access, or the soon-to-be Disney streaming service. Netflix has successfully created some highly popular original shows and movies, but so have all these competitors.

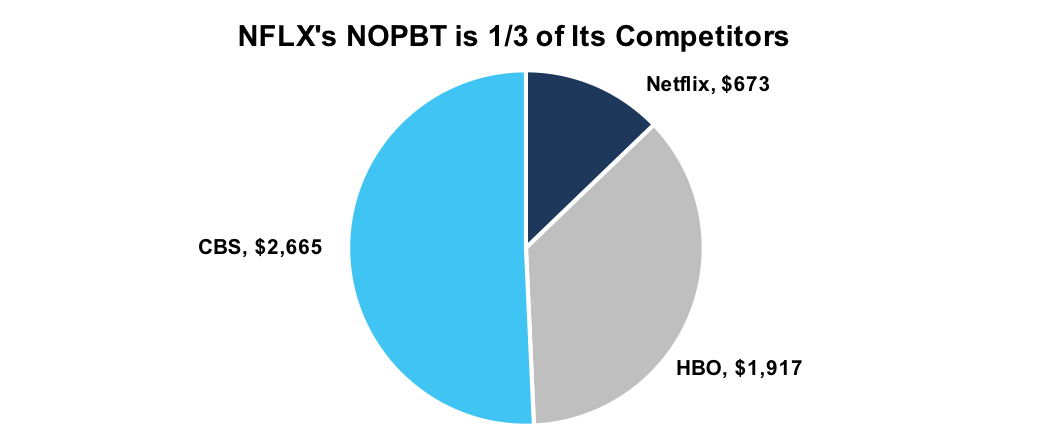

Figure 1: Net Operating Profit Before Tax (NOPBT) For Netflix, CBS, and HBO

Sources: New Constructs, LLC and company filings.

Despite their similarities, the market values Netflix as a completely different type of company. Figures 1 and 2 compare Netflix to CBS and HBO on the basis of net operating profit before tax (NOPBT) and enterprise value. We utilized business segment operating income from TWX filings as a proxy for HBO’s NOPBT, and a rough assumption that HBO comprises 1/3 of Time Warner’s (TWX) enterprise value.

As Figure 1 shows, Netflix earns roughly 1/3 the NOPBT of HBO and 1/4 the NOPBT of CBS. Add the three companies operating income together, and Netflix accounts for less than 13%.

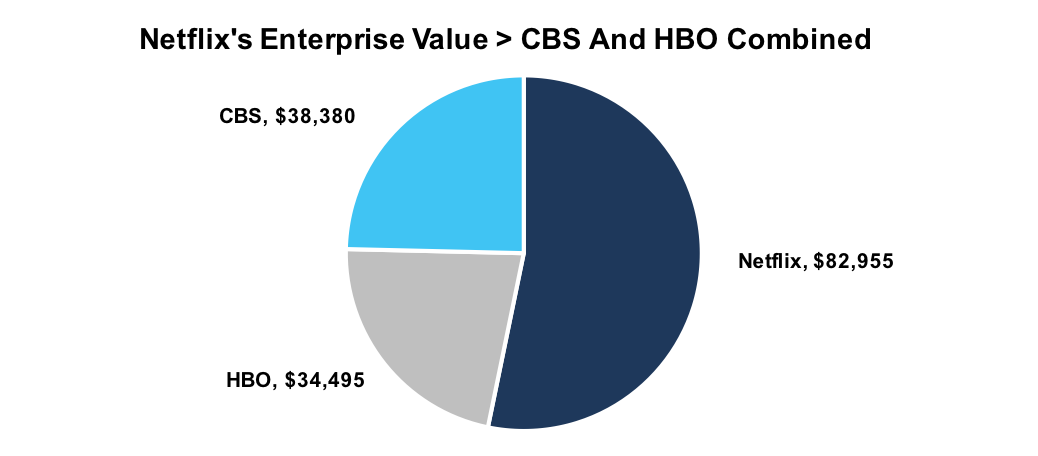

Figure 2: Enterprise Value For Netflix, CBS, and HBO

Sources: New Constructs, LLC and company filings.

Despite the difference in their NOPBT, the market currently considers Netflix to be more valuable than CBS and HBO combined. Both CBS and HBO have standalone streaming services. Both have massive hit shows (Big Bang Theory for CBS, Game of Thrones for HBO) and large content libraries built up over decades.

While Netflix still has first mover advantage, it is dwindling. As these companies become more similar, it becomes harder to justify the valuation gap and why it exists in the first place. Long-term, Netflix should trade at a valuation closer to its peers.

What Does This Move Mean For Disney?

The move to a standalone streaming service is exactly want we wanted to see from Disney. ESPN’s content still has tremendous value. 94 out of the top 100 TV shows in 2016 were sporting events. Moving ESPN to an over the top option should help Disney retain the value of its live sports rights as the cable TV model declines.

Disney’s decision to take a controlling stake in BAMTech should also pay off handsomely in the future. Some analysts have called the deal overpriced, but they said the same thing about Marvel in 2009. BAMTech gives Disney the platform it needs to monetize its incredibly valuable brand and content in the streaming era.

However, the market appears to have taken a shortsighted view of the matter by reacting more to Disney’s poor quarterly earnings than to this major strategic shift. The stock’s 4% drop on Wednesday was especially unwarranted due to the unusual circumstances behind Disney’s earnings disappointment.

On the Media Networks side of the business, the low number of NBA playoffs games this year hurt revenues, and the beginning of the new NBA contract for ESPN led to sharp increase in costs. There are still headwinds in this segment, but the Q3 results do not accurately reflect the prospects going forward.

Studio Entertainment also saw a decline due to a very difficult comparison to the year before. We should start to see this segment return to growth with the new Star Wars movie in December, and a new Avengers movie and a Han Solo film in 2018.

Meanwhile, the Parks segment continues to be a strong driver of growth, with operating income up 18% year over year. Shanghai Disney has exceeded all expectations in its first year of operation, and the company continues to add new attractions to increase attendance in its Domestic parks.

Despite its rough quarter, Disney still earns a solid 12% return on invested capital (ROIC). The company has a growing Parks segment, a Studio segment primed to deliver several massive blockbusters in the next 12 months, and it’s making prudent moves to preserve the value of its cash cow ESPN.

Disclosure: David Trainer and Sam McBride receive no compensation to write about any specific stock, sector, style, or theme.