The Walt Disney Company ( (NYSE:DIS) ) just released its third-quarter financial results, posting earnings of $1.51 per share and revenues of $14.2 billion. Currently, DIS is a Zacks Rank #4 (Sell) and is down 3.05% to $103.72 per share in trading shortly after its earnings report was released.

Disney:

Beat earnings estimates. The company posted diluted earnings of $1.51 per share. Adjusting for certain items affecting comparability, Disney posted earnings of $1.58 per share, beating Street estimates of $1.55.

Missed revenue estimates. The company saw revenue figures of $14.238 billion, missing our consensus estimate of $14.442 billion.

Total revenue was about flat from the year-ago period. Media Networks revenue was down 1% to $5.866 billion. Parks and Resorts revenue gained about 12% to $4.894 billion. Studio Entertainment revenue was down roughly 16% to $2.393 billion. Consumer Products and Interactive Media revenue slipped 5% to %1.085 billion.

Breaking things down further, Cable Networks revenues for the quarter decreased 3% to $4.1 billion and operating income decreased 23% to $1.5 billion. Disney cited a decline at ESPN for the lower segment operating income.

“The decrease at ESPN was due to higher programming costs, lower advertising revenue and severance and contract termination costs, partially offset by affiliate revenue growth,” the report said.

“Today we announced a strategic shift in the way we distribute our content. The media landscape is increasingly defined by direct relationships between content creators and consumers, and our control of BAMTech’s full array of innovative technology will give us the power to forge those connections, along with the flexibility to quickly adapt to shifts in the market,” Disney CEO Bob Iger added.

“This acquisition and the launch of our direct-to-consumer services mark an entirely new growth strategy for the Company, one that takes advantage of the incredible opportunity that changing technology provides us to leverage the strength of our great brands.”

The gain in the Parks and Resorts segment was due to increases at Shanghai Disney Resort and Disneyland Paris, the report said.

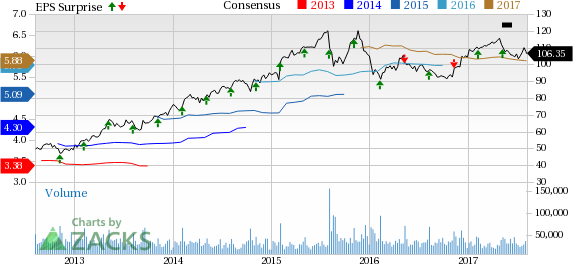

Here’s a graph that looks at Disney’s earnings performance history:

The Walt Disney Company, together with its subsidiaries and affiliates, is a leading diversified international family entertainment and media enterprise with five business segments: media networks, parks and resorts, studio entertainment, consumer products and interactive media.

Check back later for our full analysis on Disney’s earnings report!

Want more stock market analysis from this author? Make sure to follow @Ryan_McQueeney on Twitter!

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look. See the pot trades we're targeting>>

Walt Disney Company (The) (DIS): Free Stock Analysis Report

Original post

Zacks Investment Research