Dismal performance by The Walt Disney Company’s (NYSE:DIS) Media Network has been a major concern for investors in the recent past. ESPN, which forms part of Media Network, will be once again under investors’ glare, when Disney report first-quarter fiscal 2018 results on Feb 6.

For some time now, declining subscriber count and higher programming costs have been a cause of concern for investors. Disney’s primary cash cow, ESPN, has been under immense pressure as the Pay-TV landscape continues to change due to migration of subscribers to online TV. Fresh NBA agreement and increase in contractual rate for NFL programming has been driving the overall programming cost higher for ESPN.

Media Network’s Strategic Efforts Bode Well

However, after witnessing a decline of 3% in the preceding quarter, the segment is likely to register a year-over-year improvement of 1.8% to $6,346 million, per analysts surveyed by Zacks, driven by gain in revenues at Cable Networks. Meanwhile, Cable Networks and Broadcasting are anticipated to report revenues of $4,531 million and $1,813 million, up 2.3% and 0.4%, respectively.

Disney is striving to bring back ESPN’s golden days. However, it will take some time before the segment makes a strong come back. In an effort to attract online viewers, the company has inked a deal with video streaming, data analytics as well as commerce management company BAMTech. Moreover, the company will start online streaming services for ESPN sports in early this year and its branded direct-to-consumer streaming service in 2019 will carry Disney movies as well as TV shows. The ESPN-branded multi-sport streaming service will give an option to enjoy 10,000 live international, national and regional games every year. Tournaments like Major League Baseball, National Hockey League, Major League Soccer, Grand Slam tennis, and college sports will be live streamed.

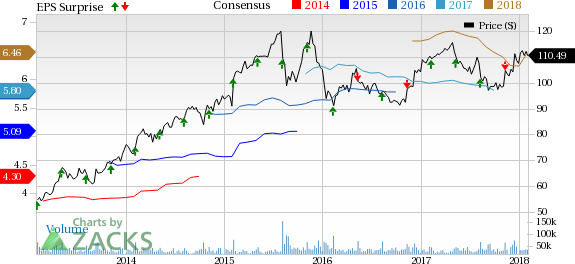

Walt Disney Company (The) Price, Consensus and EPS Surprise

Moreover, the company’s overall top and bottom-lines are expected to increase in the first quarter driven by robust performance of Parks & Resorts and Studio entertainment segments. The Zacks Consensus Estimate of earnings for first-quarter fiscal 2018 is currently pegged at $1.62. We observed that the consensus estimate has increased by 2 cents in the past seven days, which reflects a year-over-year increase of nearly 4.5%. %. (Read more: Disney Q1 Earnings: Parks & Resorts, Studio Holds Key)

Disney currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Stocks to Watch for Earnings

Investors following the media stocks may watch out for earnings of Liberty Global plc (NASDAQ:LBTYA) , Viacom, Inc. (NASDAQ:VIAB) and Twenty-First Century Fox, Inc. (NASDAQ:FOXA) , which are anticipated to report quarterly results on Feb 15, 8 and 7, respectively. You can also uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Breaking News: Cryptocurrencies Now Bigger than Visa

The total market cap of all cryptos recently surpassed $700 billion – more than a 3,800% increase in the previous 12 months. They’re now bigger than Morgan Stanley (NYSE:MS), Goldman Sachs (NYSE:GS) and even Visa! The new asset class may expand even more rapidly in 2018 as new investors continue pouring in and Wall Street becomes increasingly involved.

Zacks has just named 4 companies that enable investors to take advantage of the explosive growth of cryptocurrencies via the stock market.

Click here to access these stocks >>

Walt Disney Company (The) (DIS): Free Stock Analysis Report

Viacom Inc. (VIAB): Free Stock Analysis Report

Liberty Global PLC (LBTYA): Free Stock Analysis Report

Twenty-First Century Fox, Inc. (FOXA): Free Stock Analysis Report

Original post