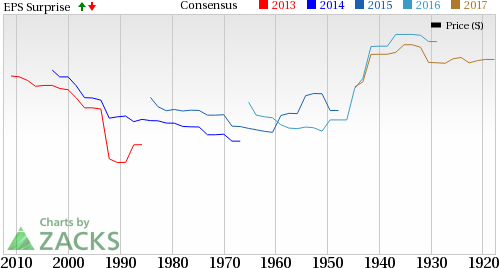

DISH Network Corp. (NASDAQ:DISH) reported weak financial results in the second quarter of 2017. Both the top and bottom line lagged the Zacks Consensus Estimate.

Quarterly net income came in at $40.1 million or 9 cents per share compared with $424.1 million or 91 cents in the year-ago quarter. Second quarter adjusted earnings per share of 69 cents fell below the Zacks Consensus Estimate of 76 cents.

Total revenue in the reported quarter was approximately $3,643.6 million, down 5.7% year over year and lagging the Zacks Consensus Estimate of $3,717 million.

In the second quarter of 2017, segment-wise, subscriber-related revenues grossed $3,614.3 million, down 5.5% year over year. Equipment sales & other revenues totaled $29.4 million, down 23.5% year over year.

In the reported quarter, operating expenses were a little over $3,391.5 million, up 5.2% year over year. Operating income was $252.1 million compared with $640.3 million in the year-ago quarter. EBITDA in the second quarter of 2017 was $448.3 million compared with $911.3 million in the prior-year quarter.

As of Jun 30, 2017, DISH Network had approximately 13.332 million pay-TV subscribers, down 1.9% year over year. The company lost a net 196,000 pay-TV subscribers in the reported quarter compared with a loss of 281,000 in the year-ago quarter.

Moreover, DISH Network lost 46,000 broadband subscribers in the reported quarter compared with a loss of 15,000 in the year-ago quarter. As of Jun 30, 2017, DISH Network had 509,000 broadband subscribers, down 17% year over year.

Pay-TV churn rate in the second quarter of 2017 was 1.59% compared with 1.96% in the year-ago quarter. Pay-TV ARPU (average revenue per user) was $87.25 compared with $89.98 in the year-ago quarter. Pay-TV average subscriber acquisition cost was $690 compared with $756 in the year-ago quarter.

In the first half of 2017, DISH Network generated $1,493.1 million of cash from operations compared with $1,591.7 million in the prior-year period. Free cash flow in the reported period was $828.3 million compared with $866.8 million in the year-ago period.

At the end of the second quarter of 2017, DISH Network had $2,386.5 million of cash and marketable securities and $18,146.8 million of outstanding debt on its balance sheet compared with $5,359.3 million and $16,478.9 million, respectively, at the end of 2016. The debt-to-capitalization ratio at the end of the reported quarter was 0.78 compared with 0.77 at 2016-end.

DISH Network faces intense competition in the pay-TV market from rival players like AT&T Inc. (NYSE:T) , Comcast Corp. (NASDAQ:CMCSA) and Charter Communications Inc. (NYSE:T) . The company currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

AT&T Inc. (T): Free Stock Analysis Report

DISH Network Corporation (DISH): Free Stock Analysis Report

Comcast Corporation (CMCSA): Free Stock Analysis Report

Charter Communications, Inc. (CHTR): Free Stock Analysis Report

Original post

Zacks Investment Research