discoverIE has announced the acquisition of Sens-Tech for an initial cash consideration of £58m, partially funded by a £33m placing at 415p per share. Sens-Tech designs and manufactures specialist sensing technology and fits with discoverIE’s strategy to buy businesses supplying niche, highly customised products for critical applications. The business increases the group’s international revenues and boosts its presence in target markets such as transportation and healthcare. This is discoverIE’s largest acquisition since Noratel in FY15; we estimate the deal is immediately earnings enhancing (FY20e EPS +2%, FY21e +5%).

High margin Design & Manufacturing acquisition

Sens-Tech is a UK-based designer and manufacturer of specialist sensing and data acquisition modules for X-ray and optical detection applications to the transport security, medical, food processing and industrial markets. It provides customised solutions to industries with high regulatory and certification requirements, resulting in high barriers to entry and long product lifecycles. In FY18, Sens-Tech generated revenues of £15.0m at a 35% operating margin, well ahead of the Design & Manufacturing (D&M) division’s 11.2% in FY19. Management expects the deal to enhance D&M margins by c 1.2pp and group margins by c 0.8pp. With c 70% of revenues generated in North America and Asia, discoverIE estimates that on a pro-forma basis, Sens-Tech increases D&M non-European revenues by 2pp to 29%.

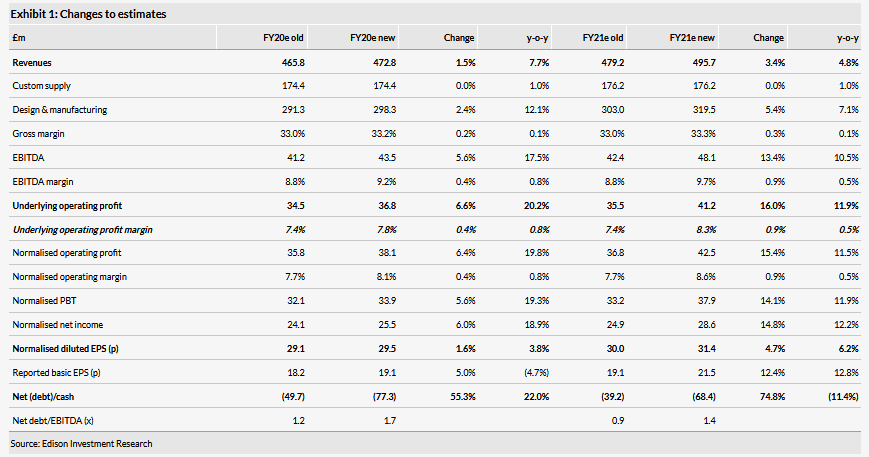

Upgrading EPS estimates

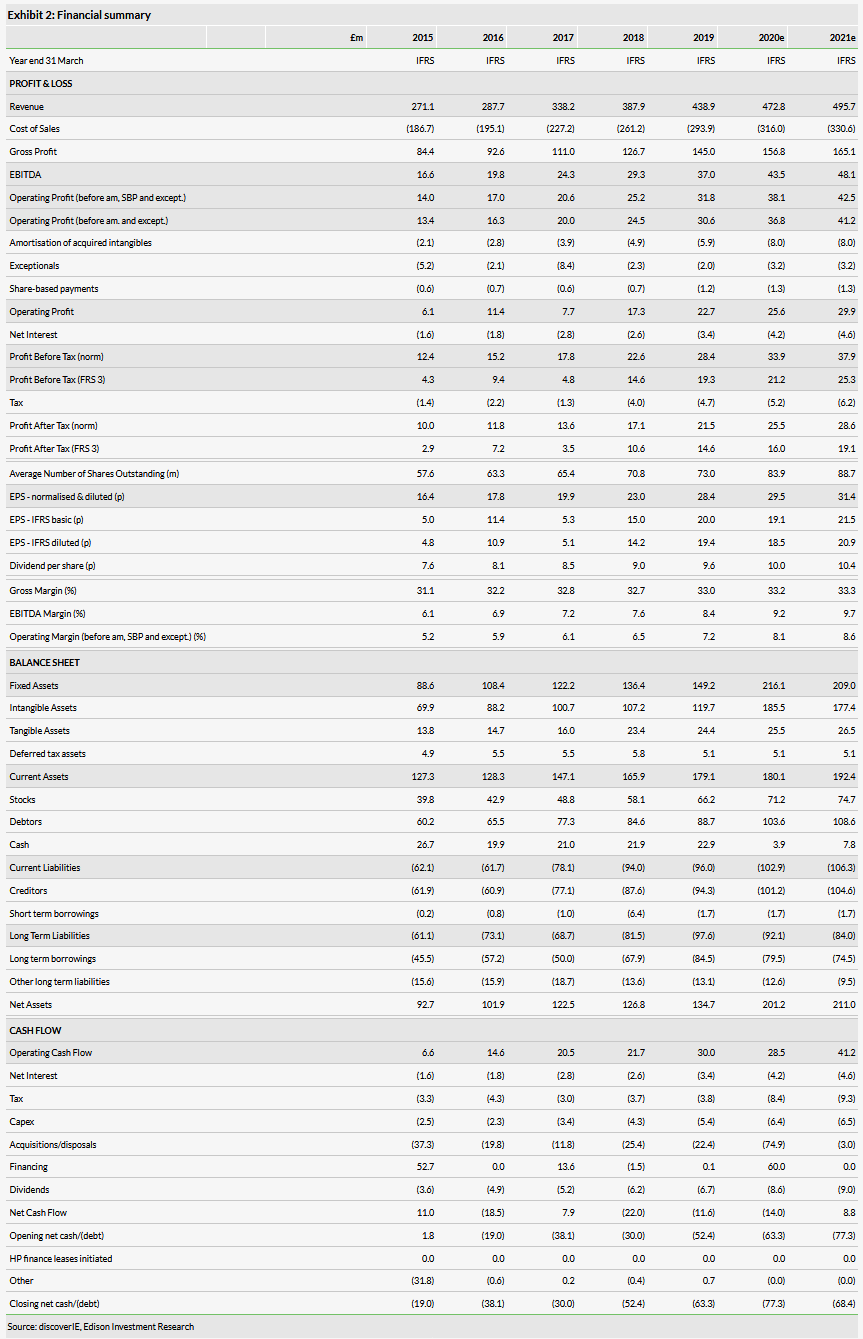

Management expects the deal to be immediately enhancing to underlying EPS; we upgrade our normalised diluted EPS forecasts by 2% in FY20e and 5% in FY21e. While the acquisition increases net debt/EBITDA from 1.2x to 1.7x by the end of FY20e, this is still within the company’s target range of 1.5–2.0x. We estimate that by FY21e, D&M will make up 65% of group revenues and 82% of operating profit.

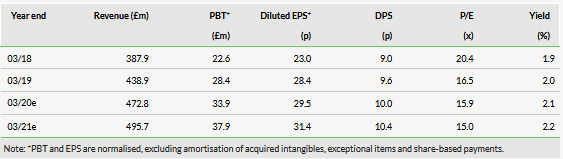

Valuation: D&M focus supports upside

discoverIE continues to trade at a discount to peers (13% discount based on FY20e P/E, 8% FY21e). Further progress in increasing the weighting of business towards the higher growth and margin D&M business (64% of H120 revenues vs 61% in FY19), combined with maintaining the profitability of the Custom Supply business, should help to reduce the discount. The stock is supported by a dividend yield above 2%.

Share price performance

Business description

discoverIE is a leading international designer and manufacturer of customised electronics to industry, supplying customer-specific electronic products and solutions to 25,000 industrial manufacturers.

Acquisition of Sens-Tech

Background on Sens-Tech

Sens-Tech is a UK-based designer and manufacturer of specialist sensing and data acquisition modules for X-ray and optical detection applications. The company was founded in 1994 following a management buy-out from Thorn EMI and was acquired by current management through a subsequent buy-out in 2010.

Sens-Tech supplies OEMs in the transport security, medical, food processing and industrial markets with customised products. Systems are typically used in industries with high regulatory and certification requirements, which creates high barriers to entry and results in long product life cycles. Examples of applications include baggage screening at airports, bone density measurement and food inspection. As Sens-Tech systems are used in critical applications and the cost of a Sens-Tech system makes up a relatively small proportion of the final OEM product cost, the customer’s focus tends to be on functionality rather than price.

The majority of revenues are generated from the US (51%), with a further 29% from Europe (ex-UK) and 17% from Asia. Only 3% of revenues are generated in the UK. The business outsources the manufacturing of product components and undertakes final assembly and testing at its facility in Egham, Surrey.

In FY18 (year to 31 March 2018, the most recently available audited results), Sens-Tech generated revenue of £15.0m, EBIT1 of £5.3m (35% EBIT margin) and PBT of £4.4m. The business is significantly more profitable than the existing Design & Manufacturing business, which generated an EBIT margin of 11.2% in FY19. The company estimates that the addition of the business will increase D&M margins by c 1.2pp and group margins by c 0.8pp.

The business will sit within the D&M division and will retain its own brand identity. Sens-Tech sees scope for good future growth in the X-ray detector market from the following areas:

growing demand for air and public transportation driving the need for better transport security;

the increasing trend towards preventative screening in healthcare; and

increasing requirements for screening and testing in food safety and industrial markets.

Sens-Tech is also investigating additional opportunities in medical diagnostics, computerised tomography (CT) security screening, plastic detection and industrial inspection and measurement.

Terms of the deal

discoverIE Is acquiring Sens-Tech for £58m in initial cash consideration, on a debt-free/cash-free basis. It may also pay contingent cash consideration of up to £12m, dependent on the achievement of profit growth targets over the next three years. The initial consideration will be satisfied from existing debt facilities and proceeds from the placing.

Based on the initial consideration, this values Sens-Tech at EV/trailing EBIT of 10.9x (discoverIE 13.0x).

Placing to raise £33m

The company is placing 8,034,840 shares (9.96% of shares outstanding) at a price of 415p per share to generate gross proceeds of £33.3m. Net proceeds are expected to be c £32m. The shares are to be admitted on 21 October. The placing price is at a 3.9% discount to the closing price of 432p on 16 October, but we note that over the course of the last two weeks, the share has traded in the range 405–445p.

Changes to forecasts

The table below summarises the changes to our forecasts. Based on annualising the EBITDA increase in FY20, we estimate that net debt/EBITDA increases from 1.2x to 1.7x in FY20 (within the company’s target range of 1.5–2.0x) and from 0.9x to 1.4x in FY21.