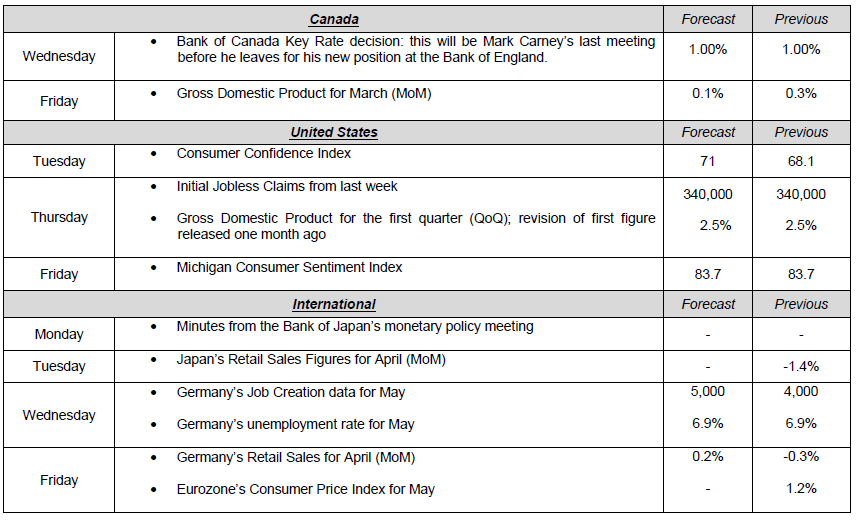

Retail Sales figures for March released last Tuesday proved to be somewhat disappointing. They stood unchanged, even though analysts had expected a 0.1% increase. The primary market movements were spurred on Wednesday when Ben Bernanke mentioned that a tighter monetary policy could slow down the strong economic recovery in the U.S. On Friday we were pleasantly surprised by the 3.3% growth in Durable Goods orders in April; analysts had expected an increase of only 1.5%. The Nikkei 225 lost over 7% only last Thursday! This was connected to the explosion yields of Japanese government bonds and disappointing manufacturing data in China. This market was the worst day in the land of the rising sun since April 2005. Have a good week!

For many months, prices for stocks and other risky assets have been driven by freshly printed money. When a central bank buys assets like government bonds (known as quantitative easing), the result is an increase in the amount of money available on the market and, therefore, a devaluation of the country’s currency. The U.S. dollar garners considerable attention because it serves as the standard of measure for all other assets: rising values of stocks, gold, oil, etc. have been based in large part on the devaluation of the U.S. dollar over the last five years.

The Fed’s asset purchasing program has had a major impact on who holds U.S. government debt. The following chart shows how in 2008, China (red line) surpassed Japan (pink line) to become the largest holder of such debt; both were far ahead of groups such as OPEC and the Caribbean (green and yellow), and were neck-and-neck with the Fed. Five years later, three rounds of quantitative easing have changed everything: the Fed is now in first place, far ahead of China and Japan. The Fed holds $1,870 billion worth of securities, or almost 50% more than China, which is in second place with $1,250 billion. If markets start demanding higher yields on the debt at some point, the Fed’s balance sheet will be the primary victim.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Disappointing Retail Sales Figures For March

Published 05/29/2013, 08:40 AM

Updated 05/14/2017, 06:45 AM

Disappointing Retail Sales Figures For March

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.