The USD reversed some of its earlier gains on Friday, following a worse-than-expected nonfarm payrolls figure which highlighted just how slowly the US economic recovery is progressing. The USD/JPY dropped well over 100 pips following the news, reaching as low as 81.28 before correcting itself to close out the week at 81.57. Turning to today, traders will want to note that European markets are closed for the Easter holiday. A low liquidity trading environment means that unexpected volatility could occur for seemingly no reason.

Following several days of upward momentum, the US dollar's bullish trend came to an end on Friday, following a disappointing US jobs report. The Nonfarm Employment Change figure came in at 120K, well below the 207K analysts had been forecasting. The news prompted fears among investors that the Fed would initiate a new round of quantitative easing in the near future. The news caused the USD/JPY to tumble, while the EUR/USD shot up around 60 pips for the day. The pair closed the week out at 1.3094.

Turning to today, traders will want to remember that most international markets are closed for the Easter holiday. The lack of news is likely to lead to a low liquidity trading environment and typically means that major price shifts may occur in the market place for seemingly no reason. A speech from the Fed Chairman, scheduled for 23:15 GMT, could lead to dollar volatility if anything regarding another round of quantitative easing is mentioned.

EUR - Weak Eurozone Fundamentals Keep EUR Low

The euro remained stuck in its bearish trend for much of the day on Friday, as ongoing debt concerns out of Spain caused investors to revert their funds to safe-haven assets. In addition, a worse-than-expected US employment report generated fears regarding the pace of the global economic recovery and led to some risk aversion. The EUR/USD saw a mild upward correction of 50 pips on Friday, but still closed out the week below the psychologically significant 1.3000 level. The EUR/CHF continued to move down to close the week out just above the 1.2000 level.

Turning to today, traders will want to note that investor sentiment toward the euro is for the most part still bearish. With no eurozone news scheduled for today due to the Easter holiday, the common currency may take further losses against its main currency rivals as we begin the week. On Tuesday, attention will want to be given to a batch of significant Chinese data. Last month, poor news out of China led to an increase in risk aversion which hurt the euro. This week's news may be able to generate some risk taking, providing it shows positive growth in the Chinese economy.

JPY - Yen Gets A Boost Following US Data

A worse-than-expected US jobs report last Friday led to an increase in risk aversion, which gave the safe haven Japanese yen a boost to close out the week. The USD/JPY tumbled over 100 pips following the news, and eventually closed out the week at 81.57. The EUR/JPY fell around 140 pips, reaching as low as 106.49. The pair eventually closed the week at 106.85.

Turning to today, the yen may see additional gains, as investors continue to digest Friday's news and weigh the prospects of a new round of quantitative easing in the US. Furthermore, with fundamental data out of Spain and Portugal weighing down on the euro, investors may choose to keep their funds with more stable assets to start off the week.

Crude Oil - Crude Oil Stages Upward Correction On Friday

Despite negative fundamental news out of the US and eurozone, crude oil was able to stage a mild upward correction to close out last week's trading session at $103.22 a barrel. That being said, the commodity still dropped well over $2 a barrel last week, as higher than expected US crude oil inventories highlighted a decrease in demand in the world's largest energy consumer.

Turning to this week, traders will want to continue monitoring any announcements out of the eurozone, particularly with regards to the Spanish and Portuguese economies. Debt concerns out of both countries have fueled risk aversion as of late. Any additional negative news could weigh down on the price of crude oil. Additionally, a speech from US Fed Chairman Bernanke today could generate some market volatility. Any mention of another round of quantitative easing in the US could cause oil to resume its bearish trend.

While most long-term technical indicators show this pair in neutral territory, the weekly chart's Bollinger Bands are narrowing, which is typically a sign of an impending price shift. Traders will want to take a wait-and-see approach for this pair, as a clearer picture is likely to present itself in the near future.

GBP/USD

The weekly chart's Williams Percent Range is currently at -20, indicating that this pair could see downward movement in the coming days. That being said, most other long-term indicators show this pair trading in neutral territory. Traders will want to monitor the Relative Strength Index on the weekly chart. If it crosses above the 70 line, a bearish correction may take place.

USD/JPY

After tumbling in Friday's trading session, long-term technical indicators show that this pair may extend its bearish run. The weekly chart's Williams Percent Range and Relative Strength Index are both showing that further downward movement may occur. Traders may want to go short in their positions ahead of a downward breach.

USD/CHF

The weekly chart's Slow Stochastic, Williams Percent Range and Relative Strength Index all show this pair trading in neutral territory, meaning that no major price shift is forecasted at the moment. Taking a wait-and-see approach for this pair may be the wisest choice, as a clearer picture is likely to present itself in the near future.

The daily chart's Slow Stochastic has formed a bearish cross, indicating that this pair could see downward movement in the near future. Additionally, the Williams Percent Range on the same chart has crossed into the overbought zone. This may be a good opportunity for forex traders to go short in their positions ahead of a downward breach.

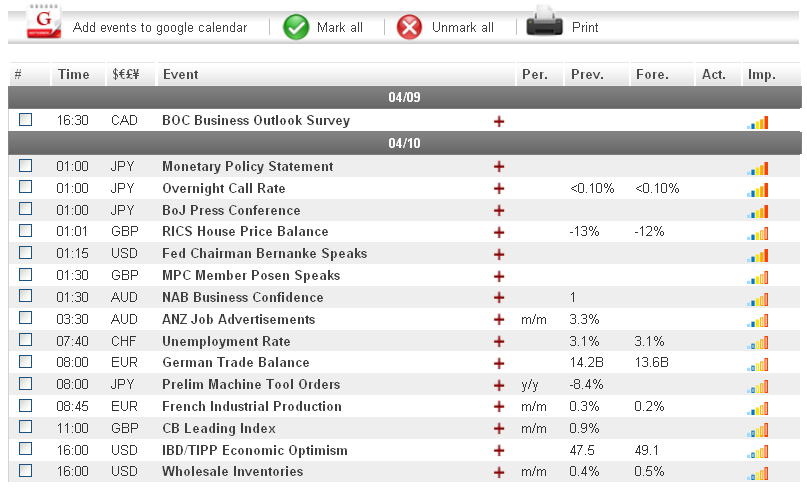

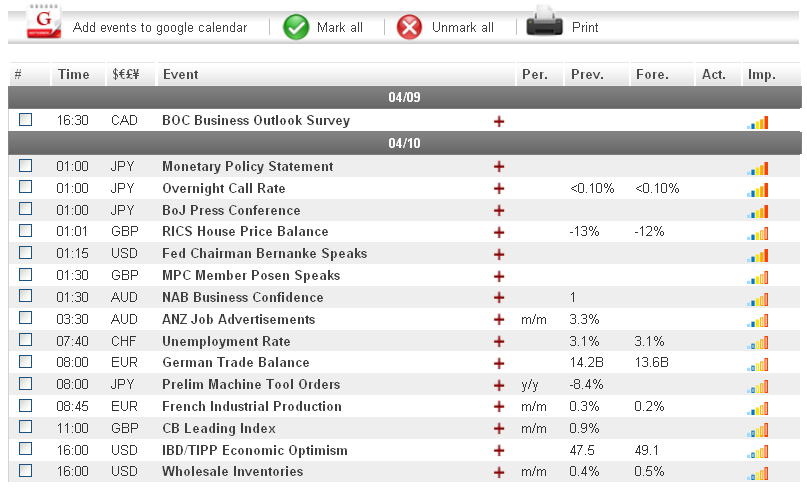

Economic News

USD - Nonfarms Report Turns Dollar BearishFollowing several days of upward momentum, the US dollar's bullish trend came to an end on Friday, following a disappointing US jobs report. The Nonfarm Employment Change figure came in at 120K, well below the 207K analysts had been forecasting. The news prompted fears among investors that the Fed would initiate a new round of quantitative easing in the near future. The news caused the USD/JPY to tumble, while the EUR/USD shot up around 60 pips for the day. The pair closed the week out at 1.3094.

Turning to today, traders will want to remember that most international markets are closed for the Easter holiday. The lack of news is likely to lead to a low liquidity trading environment and typically means that major price shifts may occur in the market place for seemingly no reason. A speech from the Fed Chairman, scheduled for 23:15 GMT, could lead to dollar volatility if anything regarding another round of quantitative easing is mentioned.

EUR - Weak Eurozone Fundamentals Keep EUR Low

The euro remained stuck in its bearish trend for much of the day on Friday, as ongoing debt concerns out of Spain caused investors to revert their funds to safe-haven assets. In addition, a worse-than-expected US employment report generated fears regarding the pace of the global economic recovery and led to some risk aversion. The EUR/USD saw a mild upward correction of 50 pips on Friday, but still closed out the week below the psychologically significant 1.3000 level. The EUR/CHF continued to move down to close the week out just above the 1.2000 level.

Turning to today, traders will want to note that investor sentiment toward the euro is for the most part still bearish. With no eurozone news scheduled for today due to the Easter holiday, the common currency may take further losses against its main currency rivals as we begin the week. On Tuesday, attention will want to be given to a batch of significant Chinese data. Last month, poor news out of China led to an increase in risk aversion which hurt the euro. This week's news may be able to generate some risk taking, providing it shows positive growth in the Chinese economy.

JPY - Yen Gets A Boost Following US Data

A worse-than-expected US jobs report last Friday led to an increase in risk aversion, which gave the safe haven Japanese yen a boost to close out the week. The USD/JPY tumbled over 100 pips following the news, and eventually closed out the week at 81.57. The EUR/JPY fell around 140 pips, reaching as low as 106.49. The pair eventually closed the week at 106.85.

Turning to today, the yen may see additional gains, as investors continue to digest Friday's news and weigh the prospects of a new round of quantitative easing in the US. Furthermore, with fundamental data out of Spain and Portugal weighing down on the euro, investors may choose to keep their funds with more stable assets to start off the week.

Crude Oil - Crude Oil Stages Upward Correction On Friday

Despite negative fundamental news out of the US and eurozone, crude oil was able to stage a mild upward correction to close out last week's trading session at $103.22 a barrel. That being said, the commodity still dropped well over $2 a barrel last week, as higher than expected US crude oil inventories highlighted a decrease in demand in the world's largest energy consumer.

Turning to this week, traders will want to continue monitoring any announcements out of the eurozone, particularly with regards to the Spanish and Portuguese economies. Debt concerns out of both countries have fueled risk aversion as of late. Any additional negative news could weigh down on the price of crude oil. Additionally, a speech from US Fed Chairman Bernanke today could generate some market volatility. Any mention of another round of quantitative easing in the US could cause oil to resume its bearish trend.

Technical News

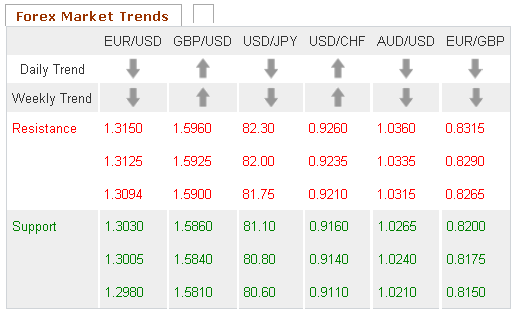

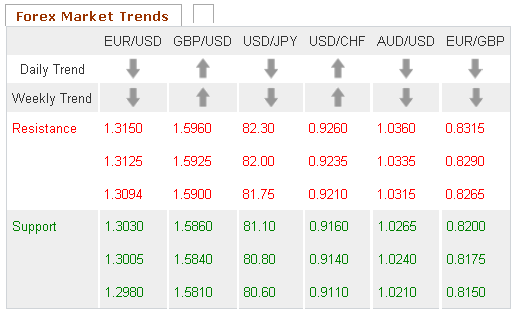

EUR/USDWhile most long-term technical indicators show this pair in neutral territory, the weekly chart's Bollinger Bands are narrowing, which is typically a sign of an impending price shift. Traders will want to take a wait-and-see approach for this pair, as a clearer picture is likely to present itself in the near future.

GBP/USD

The weekly chart's Williams Percent Range is currently at -20, indicating that this pair could see downward movement in the coming days. That being said, most other long-term indicators show this pair trading in neutral territory. Traders will want to monitor the Relative Strength Index on the weekly chart. If it crosses above the 70 line, a bearish correction may take place.

USD/JPY

After tumbling in Friday's trading session, long-term technical indicators show that this pair may extend its bearish run. The weekly chart's Williams Percent Range and Relative Strength Index are both showing that further downward movement may occur. Traders may want to go short in their positions ahead of a downward breach.

USD/CHF

The weekly chart's Slow Stochastic, Williams Percent Range and Relative Strength Index all show this pair trading in neutral territory, meaning that no major price shift is forecasted at the moment. Taking a wait-and-see approach for this pair may be the wisest choice, as a clearer picture is likely to present itself in the near future.

The Wild Card

GBP/CHFThe daily chart's Slow Stochastic has formed a bearish cross, indicating that this pair could see downward movement in the near future. Additionally, the Williams Percent Range on the same chart has crossed into the overbought zone. This may be a good opportunity for forex traders to go short in their positions ahead of a downward breach.