Forex News and Events

Shinzo Abe’s new plans (by Yann Quelenn)

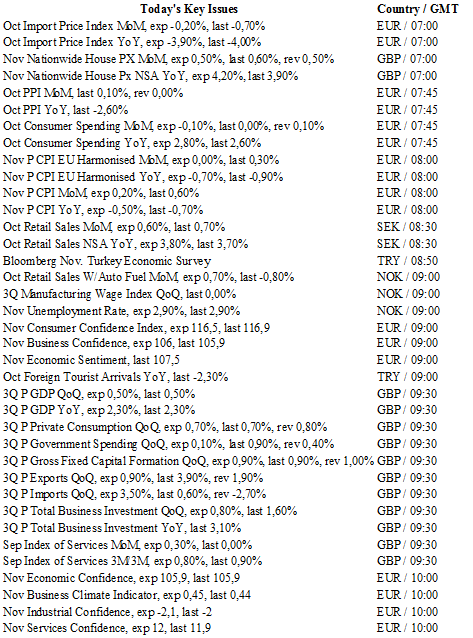

Not a single week goes by in Japan without the announcement of a new plan. Abenomics has still not provided sufficient results and there seems to be no light at the end of the tunnel - Abe’s dubious strategy and the concerning deflation period are both far from being over. The Core CPI in Tokyo printed flat for November and nationwide inflation (excluding food and energy) fell 0.2% to +0.7 y/y.

Abe has announced that he is trying to improve the size of the workforce by providing cash handouts to elderly people to encourage them to re-enter and stay in the workforce. Despite this, Japan is not far off full employment as unemployment has fallen to 3.1%, the lowest level since July 1995.

A second phase to Abe’s plan has also been announced with Abe announcing that the Japanese Economy will expand by 20% by 2020, which is clearly a pipedream. We believe that the charges on Japan’s colossal debt will simply consume any created growth and are clearly bullish on the USD/JPY.

ECB ready to act (by Peter Rosenstreich)

While it’s nearly universally expected that the ECB council meeting will deliver further easing on December 3, the exact make-up of the package remain uncertain. Yesterday, under conditions of anonymity, an ECB official indicated that options for next week’s ECB rate decision meeting are still being debated. One official was quoted as saying the ECB "are still trying to figure out what will be in the package. A lot of people have different views." One such option would include introducing two-tiered deposit rates and buying re-bundled loans on non-performing loans. The news has introduced the possibility of a surprise move by ECB President Draghi.

The easing options for the ECB are extensive but we think a more vanilla policy mixed would be more effective and the likely direction. Draghi is likely to withhold more exotic easing measures in the event that inflation and growth projections move downwards again. That said, given Draghi’s historical reputation for over-delivering we suspect that he will not disappoint the high market expectations in whatever makeup of the final package hits the market. We are anticipating that Draghi will go big with a full suite of policy actions. The main deposit rate is expected to be cut 20bp (10bp consensus). There is expected to be a €10bn monthly increase in purchase accounts and 12-month extension of the program to September 2017. Also, Draghi’s language will be significantly dovish indicating that more easing is possible should economic conditions warrant. The additional easing is keeping EUR/USD under selling pressure, despite the already crowded nature of the long {{|USD}} trade.

This aggressive strategy will have a real effect on EUR/CHF indicating that the SNB will have to respond with policy action of their own. The SNB is likely to tighten current negative rates loopholes and cut deposit rate further (near -1.00%) from current -0.75% level. We view the CHF as one of the best short opportunities against EUR, USD and higher yielding EM currencies.

The Risk Today

Yann Quelenn

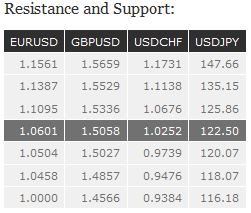

EUR/USD is consolidating around 1.0600 and remains in a downtrend channel. The technical structure is clearly negative. Hourly support lies at 1.0566 (intraday low). Hourly resistance can be found at 1.0763 (19/11/2015 high). Stronger resistance stands at 1.0897 (05/11/2015 high). Expected to show continued weakness. In the longer term, the technical structure favours a bearish bias as long as resistance holds. Key resistance is located region at 1.1453 (range high) and 1.1640 (11/11/2005 low) is likely to cap any price appreciation. The current technical deteriorations favours a gradual decline towards the support at 1.0504 (21/03/2003 low).

GBP/USD remains in a medium term downtrend channel. Hourly support is given at 1.5027 (06/11/2015 low). Hourly resistance is given at 1.5336 (19/11/2015 high). Strong resistance can be found at 1.5529 (22/09/2015 high). Expected to show continued weakness. The long-term technical pattern is negative and favours a further decline towards the key support at 1.5089 , as long as prices remain below the resistance at 1.5340/64 (04/11/2015 low see also the 200 day moving average). However, the general oversold conditions and the recent pick-up in buying interest pave the way for a rebound.

USD/JPY has reversed recent bullish momentum, correcting sharply lower. Resistance is given at 123.76 (18/11/2015 high). Support is located at 122.23 (16/11/2015 low). Expected bounce from the support at 122.23. A long-term bullish bias is favored as long as the strong support at 115.57 (16/12/2014 low) holds. A gradual rise towards the major resistance at 135.15 (01/02/2002 high) is favored. A key support can be found at 116.18 (24/08/2015 low).

USD/CHF is still trading around its five-year high. Hourly support is given at 1.0122 (18/11/2015 low) while hourly resistance is given at 1.0261 (intraday high). The technical structure still suggests that the upside momentum should continue. In the long-term, the pair has broken resistance at 0.9448 and key resistance at 0.9957 suggesting further uptrend. Key support can be found 0.8986 (30/01/2015 low). As long as these levels hold, a long term bullish bias is favoured.