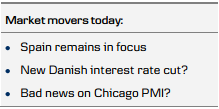

- The increasingly dire Spanish situation is affecting global risk sentiment.

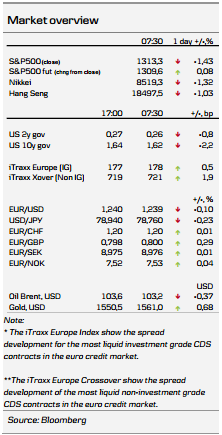

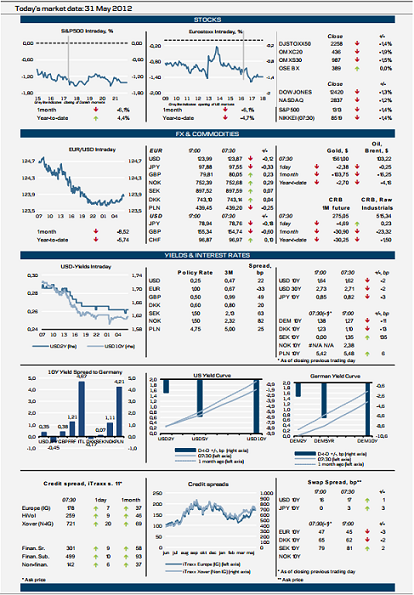

- The sell-off in the global stock markets continues with both US and Asian stock markets following the sell-off in the European markets yesterday.

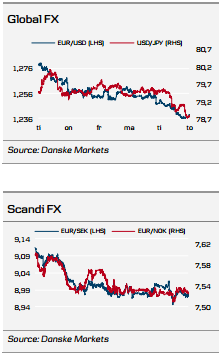

- Safe-haven currencies like dollar and yen continue to strengthen and the euro has come under further pressure.

Markets Overnight

Escalating investor nervousness about Spain's economic and financial situation has taken centre stage in the global financial markets and risk sentiment continues to deteriorate. This morning Asian stocks markets are generally trading lower, following the trend from yesterday's European and US sessions. The major US stock indices fell 1-1.5%.

Yesterday data for money supply (M3) growth in the eurozone showed a relatively sharp deterioration to 2.5% in April from 3.1% y/y in March. The weak money supply numbers underscore that - if anything - monetary conditions in the eurozone are getting tighter and inflationary pressure is nowhere to be seen. We expect the ECB to take the consequence of the escalating crisis including the slowdown in money supply growth and cut its key policy rate by 25bp at the June rate setting meeting.

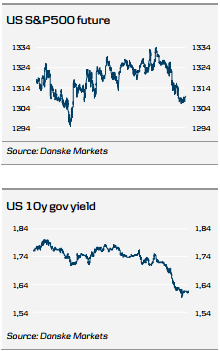

The reaction overnight in the global currency markets has been exactly as predicted with risk aversion increasing. The euro remains under pressure and both the dollar and the yen are strengthening, while commodity and emerging market currencies in general havetaken a beating. This morning EUR/USD is trading close to the lowest level in nearly two years around just below 1.24. The increasing deflationary and financial risks in the eurozone have triggered a continued inflow into safe-haven bond markets with US, German and Scandinavian bond yields now at record low levels across the curve. In Germany the 10% government bond yield is now getting closer and closer to 1% and for now there does not seem to be much that can change that sentiment and in the absence of decisive action from the ECB yields could inch even lower as the crisis deepens.

Overnight the Brazilian central bank moved to cut its key policy rate by 50bp to a recordlow 8.50% in response to the clear deterioration in Brazilian growth on the back of weaker Chinese growth and lower commodity prices. More rate cuts certainly could be in the pipeline from the Brazilian central bank. The continued sharp drop in commodity prices has continued over the last 24 hours. This is obviously not good news for Emerging Markets commodity exporters like Brazil, Russia and South Africa and the selloff in commodity prices should render investors more cautious about the outlook for the commodity currencies in general.

Global Daily

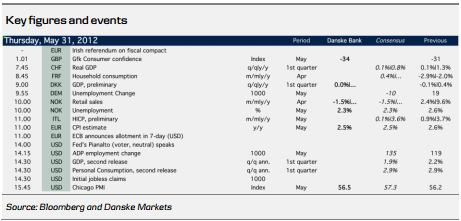

Focus Today: Today's main event is Ireland‟s referendum on the fiscal treaty. It would be a big surprise if the fiscal treaty is not approved, as all polls have shown a comfortable "yes"-lead, but many undecided voters still could still tip the balance. A "no"-vote cannot block the fiscal treaty, because the treaty will come into effect when 12 out of 17 eurozone countries ratify it. However, a "no" will have substantial implications for Ireland, as it will block Ireland‟s future access to the ESM and question Ireland‟s future position within the eurozone, see. ECB president Draghi is scheduled to speak at 09:00 CET but his speech is expected to cover mainly macro-prudential regulatory issues. Only data of secondary importance are scheduled in Europe today.

German retail unemployment and retail sales should give some idea of the current strength of the German economy. In the US the ADP-employment report will give the first indication on the important US employment data to be released on Friday. The weekly initial unemployment data in the US are always interesting but they are outside the survey period for the May labour market report and hence will have no direct impact on our employment estimates for May. Revised Q2 GDP and Chicago manufacturing PMI will also be released in the US today.

Fixed income markets remain nervous and yesterday's poorly received Italian auction was another blow to those who believe that things will just calm down. Italy sold less of 5- and 10-year debt than projected at substantially higher costs than just a month ago. Spreads to Germany are widening and peripheral yields are rising towards unsustainable levels. The ECB meeting is still six days away and it is tough to see where relief should come from before that. Today we will keep an eye on Irish bonds, which might outperform peers if Ireland says "yes" to the EU fiscal treaty. Ireland has been hard hit lately on the back of the turmoil in Spain and Greece, which is a bit unjustified in our view, taking into account that Ireland is in much better shape and at a completely different point in the business cycle. Spain is in the negative spotlight after 2-year government yields briefly rose above 5% yesterday. Data for housing permits and current account are being released today.

In the FX markets all eyes continue to be on the European debt crisis. We might see some support for the euro when the expected „yes‟ in the Irish referendum is (most likely) confirmed by the exit-polls this morning and officially tonight. However, any euro performance is expected to be short-lived and we would continue to sell both EUR/USD and EUR/GBP on up-ticks. The situation in Spain has brought the European debt crisis into uncharted territory once again and is expected to continue to weigh on the euro in June. not least ahead of the Greek election. The Scandi currencies continue to be well supported despite the low risk appetite.

In general strong numbers and strong underlying fundamentals have supported both NOK and SEK, i.e. the strong Swedish GDP numbers yesterday. However, keep an eye on the Norges Bank announcement regarding the daily purchases of foreign currency at 10:00 CET (see below) as it might weigh temporarily on NOK. Also focus on DKK as the Danish central bank is expected to cut rates once again today.

Scandi Daily

In Denmark we will get important news on the state of the Danish economy as Statistics Denmark is due to publish the National Account figures for the first quarter. The Danish economy fell into recession in H2 11 and the Q1 figures will thus show whether the economy has started to grow again. We do not expect that to be the case and we forecast zero GDP growth in Q1, which is in line with consensus. Declining private consumption and a slowdown in exports have limited growth in the first three months of this year.

EUR/DKK continues to trade below the level that triggered intervention and a subsequent rate cut last week. That, combined with very strong performance for Danish bonds and concerns about the eurozone debt crisis, indicates that foreign currency has continued to flow into Denmark during the past week. Hence, we expect the Danish central bank, Nationalbanken, to cut rates independently by 10bp today at 16:00 CET. It will bring the Lending rate down to 0.50% and the important Certificates of Deposit rate down to a record low 0.10%. However, it is a possibility that the central bank keeps rates unchanged and waits with its independent rate cut until next week when the ECB is expected to cut rates and Nationalbanken will have to change rates anyway. The marginal move higher in EUR/DKK yesterday could also point in that direction. All in all, the probability of an independent Danish rate cut is close to 50% with risk in our view slightly tilted towards a cut. If we see a rate cut, renewed performance for DGSs and lower money market rates are expected in Denmark. EUR/DKK is not expected to react much.

Moody's announced its rating actions on Danish banks and Danish covered bonds yesterday. The downgrade on the banks was more or less as expected. The average Danish bank rating is now Baa1, thus the banks got 1-2 notches, but note that most have a stable outlook. The impact on the market should be fairly limited. The mortgage banks got three notches on the issuer rating and negative outlooks. Futhermore, between 1-3 notches on the covered bond ratings. The few AAA-ratings (Danske Bank and some of Nykredit's capital centres) were lost - Moody's took a hard-line stance here. However, Nykredit has ended its cooperation with Moody's and we expect that DLR will do the same. When one looks at what happened with RD and BRF when they announced the end of their cooperation with Moody's, the rating news should have limited impact on the pricing of Danish covered bonds. The latest statistics on foreign ownership of Danish covered bonds from the Danish Central Bank show that foreigners have increased their share of the short-dated non-callable.

In Norway it is time for retail sales at 10:00 CET. We believe that the strong growth of 2.4% m/m in March was due partly to the final shopping days before Easter falling at the end of that month. It is hard to gauge just how much of an impact this might have had but we anticipate a significant correction in the April figures. We therefore predict a drop in retail sales of 1.5% m/m in April, which leaves private consumption on track for growth of 0.5% in Q2. The non-seasonal adjusted unemployment rate for May will also be published today. We expect it to drop to 2.3% from 2.6% in the previous month. The drop is primarily due to the data not being seasonally adjusted, but they will underline that the labour market is still very tight. Specifically the FX market will keep an eye on the Norges Bank announcement (also at 10:00 CET) regarding the daily purchase of foreign currency in June. Given the updated oil price forecast and the so-called oil-corrected deficit for 2012 in the revised budget we expect that Norges Bank will revise its daily purchase up from NOK350m a day to NOK600-700m a day in June. It might weigh on NOK together with the weak retail sales and the sell-off in oil that accelerated yesterday.

Disclosure

This research report has been prepared by Danske Research, a division of Danske Bank A/S ("Danske Bank").

Analyst certification

Each research analyst responsible for the content of this research report certifies that the views expressed in the research report accurately reflect the research an alyst’s personal view about the financial instruments and issuers covered by the research report. Each responsible research analyst further certifies that no part of the compensation of the research analyst was, is or will be, directly or indirectly, related to the specific recommendations expressed in the research report.

Regulation

Danske Bank is authorized and subject to regulation b y the Danish Financial Supervisory Authority and is subject to the rules and regulation of the relevant regulators in all other jurisdictions where it conducts business. Danske Bank is subject to limited regulation by the Financial Services Authority (UK). Details on the extent of the regulation by the Financial Services Authority are available from Danske Bank upon request.

The research reports of Danske Bank are prepared in accordance with the Danish Society of Financial Analysts’ rules of ethics and the recommendations of th e Danish Securities Dealers Association.

Conflicts of interest

Danske Bank has established procedures to prevent conflicts of interest and to ensure the provision of high quality research based on research objectivity and independence. These procedures are documented in the research policies of Danske Bank. E mployees within the Danske Bank Research Departments have been instructed that any request that might impair the objectivity and independence of research shall be referred to the Research Management and the Compliance Department. Danske Bank Research Departments are organised independently from and do not report to other business areas within Danske Bank.

Research analysts are remunerated in part based on the over -all profitability of Danske Bank, which includes investment banking revenues, but do not receive bonuses or other remuneration linked to specific corporate finance or debt capital transactions.

Financial models and/or methodology used in this research report

Calculations and presentations in this research report are based on standard econometric tools and methodology as well as publicly available statistics for each individual security, issuer and/or country. Documentation can be obtained from the authors upon request.

Risk warning

Major risks connected with recommendations or opinions in this research report, including as sensitivity analysis

of relevant assumptions, are stated throughout the text.

Expected updates

Danske Daily is updated on a daily basis.

First date of publication

Please see the front page of this research report for the first date of publication. Price-related data is calculated using the closing price from the day before publication.

General disclaimer

This research has been prepared by Danske Markets (a division of Danske Bank A/S). It is provided for informational purposes only. It does not constitute or form part of, and shall under no circumstances be considered as, an offer to sell or a soli citation of an offer to purchase or sell any relevant financial instruments (i.e. financial instruments mentioned herein or other financial instruments of any issuer mentioned herein and/or options, warrants, rights or other interests with respect to any such financial instruments) ("Relevant Financial Instruments").

The research report has been prepared independently and solely on the basis of publicly available information which Danske Bank considers to be reliable. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness, and Danske Bank, its affiliates and subsidiaries accept no liability whatsoever for any direct or consequential loss, including without limitation any loss of profits, arising from reliance on this research report.

The opinions expressed herein are the opinions of the research analysts responsible for the research report and reflect their judgment as of the date hereof. These opinions are subject to change, and Danske Bank does not undertake to notify any recipient of this research report of any such change nor of any other changes related to the information provided in the research report.

This research report is not intended for retail customers in the United Kingdom or the United States.

This research report is protected by copyright and is intended solely for the designated addressee. It may not be reproduced or distributed, in whole or in part, by any recipient for any purpose without Danske Bank’s prior written consent.

Disclaimer related to distribution in the United States

This research report is distributed in the United States by Danske Markets Inc., a U.S. registered broker-dealer and subsidiary of Danske Bank, pursuant to SEC Rule 15a-6 and related interpretations issued by the U.S. Securities and Exchange Commission. The research report is intended for distribution in the United States solely to "U.S. institutional investors" as defined in SEC Rule 15a-6. Danske Markets Inc. accepts responsibility for this research report in connection with distribution in the United States solely to “U.S. institutional investors.”

Danske Bank is not subject to U.S. rules with regard to the preparation of research reports and the independence of research analysts. In addition, the research analysts of Danske Bank who have prepared this research report are not registered or qualified as research analysts with the NYSE or FINRA, but satisfy the applicable requirements of a non-U.S. jurisdiction.

Any U.S. investor recipient of this research report who wishes to purchase or sell any Relevant Financial Instrument may do so only by contacting Danske Markets Inc. directly and should be aware that investing in nonU.S. financial instruments may entail certain risks. Financial instruments of non-U.S. issuers may not be registered with the U.S. Securities and Exchange Commission and may not be subject to the reporting and auditing standards of the U.S. Securities and Exchange Commission.