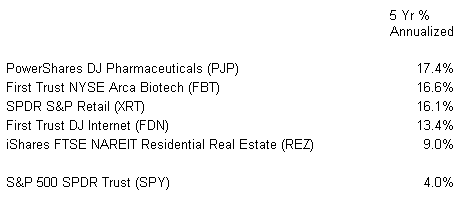

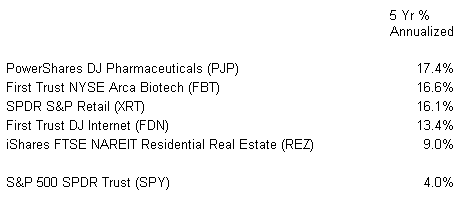

In previous years, consumers spent more money when the value of their 401ks and the value of their homes were rising. That goes a long way toward explaining the performance of the third best sub-sector ETF on a rolling 5-year basis. Specifically, SPDR S&P Retail (XRT) annualized at 16.1% over the past 5 years while the S&P 500 SPDR Trust (SPY) only annualized at 4.0% (2/1/2008 to 1/31/2013).

The idea that we tend to spend more when our chief assets are climbing is known as the “wealth effect.” And there was a time when leading economists estimated that we were likely to spend three cents for every $1 gain in stock portfolios as well as eight cents on every $1 gain of home price appreciation.

The chairman of the U.S. Federal Reserve, Ben Bernanke, still believes in those metrics… at least conceptually. He recently told Congress that the Fed’s quantitative easing efforts to depress interest rates lead to economic growth via consumer spending as well as business hiring. Even a number of investors must believe in the notion of increased consumer spending, or they wouldn’t have bid up the prices on SPDR S&P Retail (XRT) over the last 5 years.

5 Best Performing Sub-Sector ETFs (2/1/2008-1/31/2013)

On the other hand, what if the “wealth effect” offers diminishing returns? The U.S. government (through tax relief) and the U.S. Federal Reserve (through drastic rate cuts) were remarkably stimulative in the wake of the 2000 tech bubble and the 2001 attack on 9/11. Consumers did begin spending and businesses did begin hiring at a modest pace. In the aftermath of the 2008 real-estate related collapse, the U.S. government added tax relief and billions in government spending, while the Fed reduced rates to 0% and employed electronic money printing to buy U.S. treasuries. Consumers have begun spending again, but not in the same manner that they did after the 2000-2002 period; businesses did begin hiring, but nowhere near the levels of job creation after the 2000-2002 period.

If the stimulus measures after the 2007-2009 financial catastrophe have not been as effective at getting businesses to hire or the economy to grow, what does that say about the current state of affairs? If Congress now chooses to stimulate by refusing to make meaningful deficit cuts and the Fed intends to stimulate by staying the course on its present manipulation of interest rates, will this “de facto” stimulus be enough to enhance the economy significantly? Conversely, is 2% GDP with labor force participation rates near 30-year lows the best we should expect?

If there is a silver lining at all, it is for investors. One can anticipate that any deficit cutting arrangement will be the furthest thing from austerity… at least in the short term. Similarly, the Fed has been emboldened by its quantitative easing, and will not choose to risk recessionary pressure by exiting the strategy anytime soon.

Stock assets may get whacked for any combination of reasons, from euro-zone debt troubles in Spain or Italy to another debt ceiling showdown in the U.S. to lower corporate profits to sub-par economic data to generic or seasonal profit-taking. Yet one should still look to pick up “faves” on pullbacks… until and unless rising rates genuinely alter the relative attractiveness of stock shares.

Stock investments that could outperform whether rates remain the same or even rise include “Big Pharma” and Internet mainstays. Yep… as surprising as it sounds, I’d go right to the top of the 5-year leader-board on any pullback.

Realistically, pharmaceuticals aren’t particularly sensitive to economic changes, interest rates or household debt. I would favor PowerShares Dynamic Pharma (PJP) or Market Vectors Pharma (PPH). Moreover, First Trust Internet (FDN) may see a bit of volatility, yet there’s always demand for wide moat winners like the Googles and the eBays of the world. A healthy correction in FDN would pique my interest.

In contrast, real estate via REZ and retail via XRT would be less likely to handle any rate sensitivity. And while I don’t foresee much in the way of significant rate increases in 2013, it still might be beneficial to rotate out of these Fed-fueled superstars.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

The idea that we tend to spend more when our chief assets are climbing is known as the “wealth effect.” And there was a time when leading economists estimated that we were likely to spend three cents for every $1 gain in stock portfolios as well as eight cents on every $1 gain of home price appreciation.

The chairman of the U.S. Federal Reserve, Ben Bernanke, still believes in those metrics… at least conceptually. He recently told Congress that the Fed’s quantitative easing efforts to depress interest rates lead to economic growth via consumer spending as well as business hiring. Even a number of investors must believe in the notion of increased consumer spending, or they wouldn’t have bid up the prices on SPDR S&P Retail (XRT) over the last 5 years.

5 Best Performing Sub-Sector ETFs (2/1/2008-1/31/2013)

On the other hand, what if the “wealth effect” offers diminishing returns? The U.S. government (through tax relief) and the U.S. Federal Reserve (through drastic rate cuts) were remarkably stimulative in the wake of the 2000 tech bubble and the 2001 attack on 9/11. Consumers did begin spending and businesses did begin hiring at a modest pace. In the aftermath of the 2008 real-estate related collapse, the U.S. government added tax relief and billions in government spending, while the Fed reduced rates to 0% and employed electronic money printing to buy U.S. treasuries. Consumers have begun spending again, but not in the same manner that they did after the 2000-2002 period; businesses did begin hiring, but nowhere near the levels of job creation after the 2000-2002 period.

If the stimulus measures after the 2007-2009 financial catastrophe have not been as effective at getting businesses to hire or the economy to grow, what does that say about the current state of affairs? If Congress now chooses to stimulate by refusing to make meaningful deficit cuts and the Fed intends to stimulate by staying the course on its present manipulation of interest rates, will this “de facto” stimulus be enough to enhance the economy significantly? Conversely, is 2% GDP with labor force participation rates near 30-year lows the best we should expect?

If there is a silver lining at all, it is for investors. One can anticipate that any deficit cutting arrangement will be the furthest thing from austerity… at least in the short term. Similarly, the Fed has been emboldened by its quantitative easing, and will not choose to risk recessionary pressure by exiting the strategy anytime soon.

Stock assets may get whacked for any combination of reasons, from euro-zone debt troubles in Spain or Italy to another debt ceiling showdown in the U.S. to lower corporate profits to sub-par economic data to generic or seasonal profit-taking. Yet one should still look to pick up “faves” on pullbacks… until and unless rising rates genuinely alter the relative attractiveness of stock shares.

Stock investments that could outperform whether rates remain the same or even rise include “Big Pharma” and Internet mainstays. Yep… as surprising as it sounds, I’d go right to the top of the 5-year leader-board on any pullback.

Realistically, pharmaceuticals aren’t particularly sensitive to economic changes, interest rates or household debt. I would favor PowerShares Dynamic Pharma (PJP) or Market Vectors Pharma (PPH). Moreover, First Trust Internet (FDN) may see a bit of volatility, yet there’s always demand for wide moat winners like the Googles and the eBays of the world. A healthy correction in FDN would pique my interest.

In contrast, real estate via REZ and retail via XRT would be less likely to handle any rate sensitivity. And while I don’t foresee much in the way of significant rate increases in 2013, it still might be beneficial to rotate out of these Fed-fueled superstars.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.