Digital Realty Trust, Inc.’s (NYSE:DLR) second-quarter 2017 core funds from operations (“FFO”) per share of $1.54 exceeded the Zacks Consensus Estimate of $1.49. The core FFO per share also came higher than the year-ago quarter tally of $1.42. Results were supported by growth in revenues.

The company reported revenues of $566.0 million for the second quarter, which also surpassed the Zacks Consensus Estimate of $556.8 million. The revenue figure also marked 9.9% growth year over year. Further, the company reiterated its 2017 core FFO per share outlook.

Signed total bookings during the reported quarter are estimated to generate $34 million of annualized GAAP rental revenue. This would include an $8 million contribution from interconnection. Notably, the weighted-average lag between leases signed during second-quarter 2017 and the contractual commencement date was six months. Per the company, this was in line with the long-term historical average.

Moreover, the company signed renewal leases, marking $65 million of annualized GAAP rental revenue. Rental rates on renewal leases signed during the reported quarter rolled up 6.5% on a cash basis and expanded 9.3% on a GAAP basis.

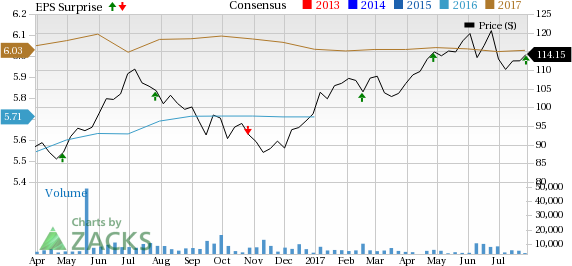

Note: The EPS numbers presented in the above chart represent funds from operations (“FFO”) per share.

Portfolio Activity

Notably, in Jun 2017, Digital Realty announced that it is set to acquire DuPont (NYSE:DD) Fabros Technology, Inc. (DFT), in an all-stock transaction for an enterprise value of about $7.6 billion. The transaction, which is expected to close in the second half of 2017, is conditioned upon the approval of shareholders of both DuPont Fabros and Digital Realty, as well as other customary closing norms.

The move would enhance Digital Realty’s portfolio in top U.S. data center metro areas across Northern Virginia, Chicago and Silicon Valley. In addition, the transaction is anticipated to be immediately accretive to financial metrics. (Read more: Digital Realty to Acquire DuPont Fabros in $7.6 Billion Deal)

Apart from this, in May 2017, the company acquired a 264,000 square foot industrial building on a 13-acre site neighboring the company's present campus in Franklin Park, IL, for $14 million. Also, in June 2017, the company acquired a five-acre land parcel next to its current development project in Amsterdam, the Netherlands for $6 million. In the same month, Digital Realty invested $8 million for acquisition of a 4.9% stake in Megaport, which is a leading provider of software-defined networking interconnection solutions.

Balance Sheet

Digital Realty exited the second quarter with cash and cash equivalents of around $22.4 million, up from $15.0 million at the prior-quarter end.

Additionally, as of Jun 30, 2017, the company had around $6.4 billion of total debt outstanding, substantially all of which was unsecured. Also, as of the same date, the company’s net debt-to-adjusted EBITDA was 5.1x, while fixed charge coverage was 4.3x.

Outlook

Digital Realty reaffirmed its 2017 core FFO per share outlook at $5.95–$6.10. The Zacks Consensus Estimate for the same is currently pegged at $6.03.

The full-year outlook provided by the company is backed by revenue expectations of $2.2–$2.3 billion, year-end portfolio occupancy growth of +/- 50 bps and "same-capital" cash NOI growth of 2.0–3.0%.

Our Take

We are encouraged with the better-than-expected performance of Digital Realty in the second quarter. The company is poised to ride on the growth curve backed by robust fundamentals of the data center market. The company’s business has significantly grown since its launch. Further, its accretive acquisitions and development efforts augur well for long-term growth. However, exposure of earnings to foreign currency translation, cut-throat competition in the industry and a substantial debt burden remain concerns.

Digital Realty currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

The stock has rallied 16.2% year to date, substantially outperforming the 3.2% gain of the industry it belongs to.

Let us now look forward to the earnings releases of AvalonBay Communities, Inc. (NYSE:AVB) , Alexandria Real Estate Equities, Inc. (NYSE:ARE) and Extra Space Storage Inc. (NYSE:EXR) , all of which are expected to report quarterly figures in the next week.

Note: FFO, a widely used metric to gauge the performance of REITs, is obtained after adding depreciation and amortization and other non-cash expenses to net income.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaries," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

AvalonBay Communities, Inc. (AVB): Free Stock Analysis Report

Digital Realty Trust, Inc. (DLR): Free Stock Analysis Report

Extra Space Storage Inc (EXR): Free Stock Analysis Report

Alexandria Real Estate Equities, Inc. (ARE): Free Stock Analysis Report

Original post

Zacks Investment Research