Investors are currently mourning the victims of the St. Petersburg Metro and the Colombia flash flood. The financial markets don't always react to terrorist incidents or natural disasters.

However, looking at global stock Indices marked in red and gold making fresh highs seems more like a salute to the fallen than any sort of attempt to position portfolios for safe haven trading.

Today's Highlights

Tesla (NASDAQ:TSLA) Overtakes Ford (NYSE:F)

South African Rand On Edge

Legalize it! Smart Contracts

Please note: All data, figures and graphs are valid as of April 4th. All trading carries risk. Only risk capital you can afford to lose.

Market Overview

Crazy times indeed. Yesterday we saw a very rare phenomenon in the markets that clearly demonstrates a core principle of price discovery.

Sometimes, feelings matter much more than data.

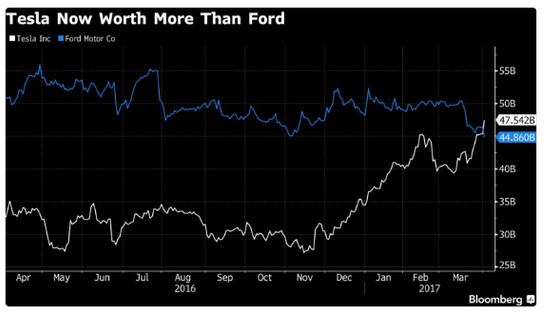

This story pits a monster truck against a bicycle. As far as the size of the business, Ford is a much larger company than Tesla in every way. Ford's assets, income, and cash flow, and overall value are far superior to the much younger company. As far as car sales, ford pumps out more than 6.7 million vehicles a year, while tesla has sold less than 190,000 units since it was founded in 2008.

Yet, somehow investors have placed more capital behind Elon Musk and his vision of a cleaner future than they do behind Mark Fields, the CEO of Ford (I had to google it).

In this chart, we can see the total market cap for both companies and the magic moment that Tesla passed their older more established competitor, looking likely to leave them in the dust.

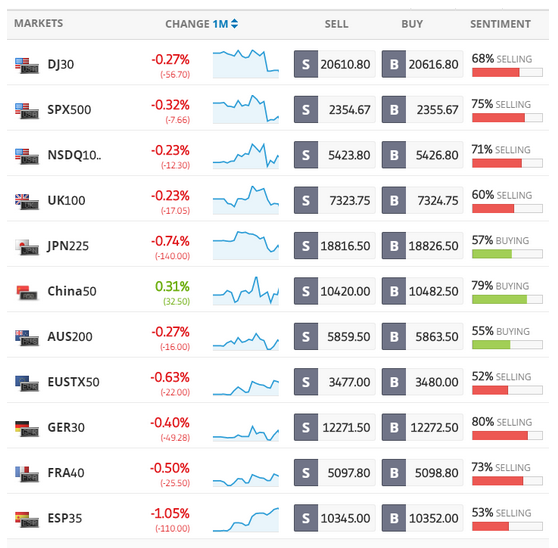

Overall, eToro clients are very bearish on the global indices as we can see in the watchlist...

Who knows? The markets rose nearly 40% in 2013 so it can certainly happen again.

Zuma and the Rand

The drama continues. Franco Lanza has written the following post about the situation on the ground. You can read his full post and join the discussion at this link.

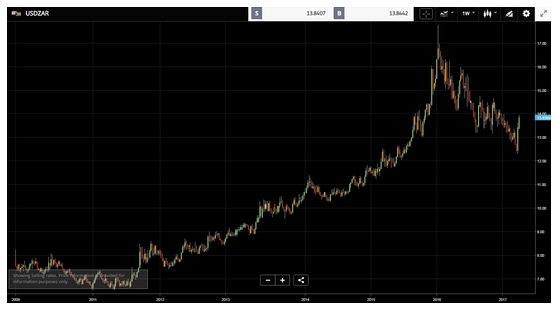

Franco's risk is a bit high to consider copying him but you can see in which direction he's trading the USD/ZAR.

This pair is up from under 12.50 to the dollar last week and is pushing towards 14 this morning.

Last night the S&P rating agency downgraded South Africa's credit to junk status. Of course, this is only one credit agency. Other agencies are likely reviewing their books at present time.

According to the long-term trend and current value, there's still plenty of room to grow if things continue to deteriorate.

Digital or Paper

As Mario Draghi unveils the new €50 Bill in Frankfurt today, confidence in blockchain technology is rising fast. Digital assets still don't compare to their paper counterparts when it comes to the number of people transacting and storing wealth, but as we saw with Tesla and Ford, these type of things can change quite quickly under the right circumstances.

The approximate value held in all Cryptocurrencies at the moment is $28 billion, about half of the amount currently being created by the European Central Bank on a monthly basis.

Following yesterday's integration of digital money into the regular economy, courts in Arizona are now recognizing Smart Contracts and other Blockchain Signatures as law. This, as three states in the US have already implemented laws with the assistance of the Congressional Blockchain Caucus in the United States government.

The more we see local and international legislation that supports Cryptocurrencies, the more they will be able to gain traction and eventually compete against paper as legal tender.

Disclosure: This content is for information and educational purposes only and should not be considered investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital you're prepared to lose.