Gold has been on a tear since July. At the start it was just another bounce in a mainly sideways motion. But that changed at the end of August when it broke that sideways range to the upside and held over $1300. It continued higher from there reaching a top last week when it touched over 1350 and then stalled. It began a pullback this week and finds itself $25 lower as I write Friday morning.

So is this just a digestive pullback in the uptrend before it continues to new higher highs? Or was 13590 a top and the bull run in gold has ended? Nobody really knows until the shiny yellow rock tells us through market price action. Last week I noted why I think it is in a long term uptrend with a change of character. That may hold up or fail. But the short-term chart gives some clues and price levels to watch to help determine which path it follows.

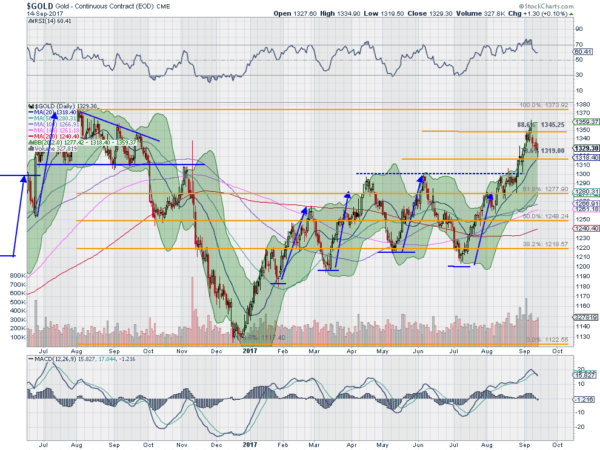

The chart above shows gold's price action over the last 2 years. It made a top last summer and started lower in the fall, finding a bottom near the end of the year. The bounce from there ran into resistance and then spent 6 months in that channel we talked about earlier. Then came the push higher. There are two things to note on the chart catch that caught my attention and may offer a sense of direction in the short term.

The first is the 20-day SMA. Gold moved above that moving average in July and has remained above it ever since. The current pullback touched the 20-day SMA Thursday and bounced. If it continues to hold over the 20-day SMA it is positive for a short term reversal back higher. The second is where it reversed. It stalled last week right at a 88.6% retracement of the move to the downside. This is a key level for traders and many would be selling then. A push back over that would be very bullish for gold.

The backdrop remains positive with momentum bullish, although waning. And the Bollinger Bands® are driving higher along with all the short term moving averages. Bottom line: Gold remains in an uptrend, but a move under the 20-day SMA would shift the view lower. Conversely a push back above 1350 renews the bull run.