26 days.

That’s how much diesel America has in its collective tank. Imagine that: a fuel that powers the shipment of goods pretty well everywhere. And only 26 days of it left.

It’s a crisis no one is talking about. Except folks in the shipping business. Or those who’ve had to buy home heating oil (a diesel derivative) recently.

Okay, I’ll admit I’m being a tad dramatic, as that 26-day figure is a rolling number: new diesel is added at one end as it’s burned at the other. But even so, the amount of diesel in storage has sunk to its lowest levels in 70 years.

You can imagine what that’s doing to prices.

If you’re interested in energy markets, I highly recommend following the Energy Information Administration—it’s the best game in town for production and consumption stats.

Its latest Winter Fuel Report is sobering: as a base case, the EIA has the average home paying 27% more for heating oil this winter than last. And that’s the base case. If we get a colder winter, that increase could jump to 40%!

The situation at the pump is no better: as of the end of October, diesel was going for $5.32 a gallon across the US, up 42% from a year ago, again according to the EIA.

Refiners Are Our Best Dividend Play on Surging Diesel

If you’re like me, you’re wondering about the best way to play this situation for dividends and upside. We’re always looking for trends, and the diesel shortage has been on our radar for weeks now.

As diesel and home-heating oil come from crude, most first-level investors look to oil producers as the best way to play higher fuel prices. But we second-level thinkers go one step further, to refiners.

Most folks avoid refiners because they don’t understand them. But they’re the perfect types of stocks to own when energy prices are high, not least because of their rising dividend payouts (which tend to pull their share prices higher, as we’ll see in a moment).

We prefer refiners because there’s a bear market in the number of refineries in America. We have fewer and fewer facilities to do the work of turning raw product into end product.

That didn’t matter much when America was a net importer of oil. But now that we’re a net exporter, it’s a big deal for the few refineries left. There’s simply more crude waiting to be processed than they can handle.

That’s resulted in wide “crack spreads,” or the difference between the price of crude and the price of the fuels refineries sell. It’s driven an earnings bonanza in the industry.

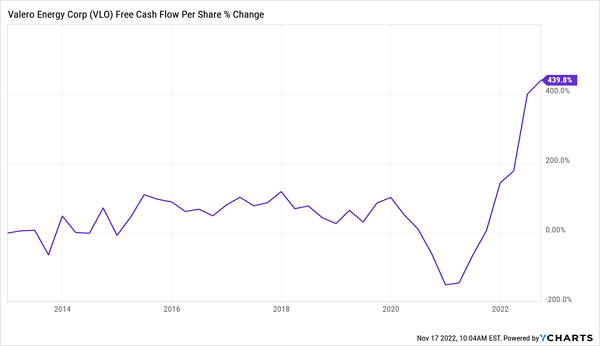

Take Valero (NYSE:VLO), the leader in the space, which yields 2.9% today. This is the stock we contrarians salivate over. In the last quarter, VLO earned $3.8 billion, up from $545 million a year ago as its refineries cranked along at a 95% utilization rate. Cash flow has spiked, as well, as we’ll see in a moment.

There’s zero chance of new refineries being built to ease the pressure, because refineries are big, sprawling facilities that nobody wants in their backyard. There hasn’t been a major one built in the US since 1976, and more than half of US refineries have been shut down in the last 25 years. Woe to the refinery construction firms, but good for those already built.

Regulators aren’t approving any more refinery real estate, and Valero already owns the “beachfront properties.” If we close our eyes and buy VLO today, chances are high that shares will trade much higher in five or 10 years.

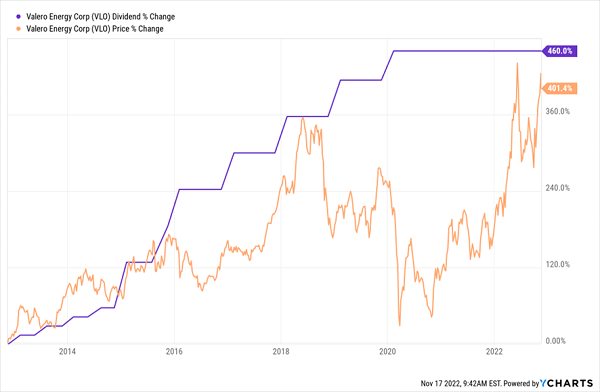

But the path from here to there is likely to be greasy. If we buy Valero right, we can quickly double our money. Investors who swing too early, however, can be frustrated. Sure, VLO’s payout tends to act as a “dividend magnet” that eventually pulls its share price higher. But there can be wild swings, too:

Timing Is Everything When Buying VLO

VLO bounces around with crude prices. Day-to-day and even month-to-month can be stomach-churning. But VLO is due for a dividend increase. We can see this reflected in the company’s recent cash flow “spike.” Talk about a catalyst! The company’s plateaued dividend should get moving again soon enough:

Rising Cash Flow Boosts the Odds of a Payout Hike

Why hasn’t management already boosted its dividend, given these cash-flow gains? Probably for the same reason I haven’t formally recommended Valero.

That would be the Federal Reserve.

We all know the Fed is on a quest to tank the economy. You only need to look as far as Jay Powell’s last press conference, which was about as hawkish as they come (and was received so badly that it tanked markets by 3% in moments).

A recession is a sure thing—a real one, not this “technical” recession in the headlines, but one where people lose jobs and stop spending.

We’re already seeing this in the earnings of shippers like FedEx (NYSE:FDX) and trucking giant JB Hunt (NASDAQ:JBHT), the latter of which said it’s considering “right-sizing” some parts of its business as demand slows.

Long-term, I love the refinery space and VLO, in particular. It’s a solid business with a dividend that’s likely to grow again in the years ahead. Its stock price should follow.

But right now the shares are near historic highs, even though they only trade at 5-times forward earnings. I’d rather see us buy at a lower point, so let’s put VLO on our watch list and be ready to pounce when our next buy window (inevitably) opens.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."