Norfolk Southern Corporation (NYSE:NSC) is scheduled to report third-quarter results on Oct 25, before the market opens.

Last quarter, the company delivered a positive earnings surprise of 4.3%. Also, the company’s bottom line surpassed the Zacks Consensus Estimate in all the trailing four quarters with an average beat of 5.9%.

Let’s see how things are shaping up for this announcement.

Earnings Whispers

Our proven model shows that Norfolk Southern is likely to beat estimates this quarter because it has the perfect combination of two key ingredients.

Zacks ESP: Norfolk Southern has an Earnings ESP of +0.67% as the Most Accurate estimate is pegged at $1.66, higher thanthe Zacks Consensus Estimate of $1.64. A positive ESP is an indicator of a likely positive earnings surprise. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Norfolk Southern carries a Zacks Rank #3 (Hold). Notably, stocks with a favorable Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 have significantly higher chances of an earnings beat.

Conversely, the Sell-rated stocks (Zacks Rank #4 or 5) should never be considered going into an earnings announcement, especially when the company is seeing negative estimate revisions.

Factors at Play

Norfolk Southern has been making constant efforts to streamline its operations to increase productivity. The company is looking to cut costs in order to drive the bottom-line growth this third quarter. Also, similar to the previous quarter, its operating ratio is likely to improve in the quarter to be reported.

The company’s efforts to reward shareholders through share repurchase and dividends are also impressive. In a bid to enhance its shareholders’ value, the company’s board of directors approved a new share buyback program earlier in September. The company is now authorized to buy back an additional 50 million shares through Dec 31, 2022.

The company further anticipates improving coal volumes to boost its third-quarter results. The Zacks Consensus Estimate for coal revenues stands at $437 million. This apart, expansion in intermodal volumes and pricing are projected to enhance results in the third quarter.

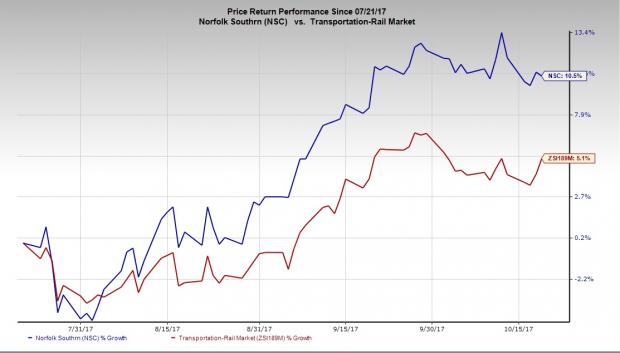

Shares of the company have outperformed the industry in the last three months, owing to the aforesaid tailwinds. The stock has rallied 10.5% compared with the industry’s 5.2% gain during the period.

However, the company’s performance in automotive and chemicals unit is likely to disappoint in the third quarter of 2017.

Other Stocks to Consider

Investors interested in the broader Transportation sector may also consider Triton International Limited (NYSE:TRTN) , SkyWest, Inc. (NASDAQ:SKYW) and Expeditors International of Washington, Inc. (NASDAQ:EXPD) with the stocks comprising the right combination of elements to beat on earnings in their next releases.

Triton International has an Earnings ESP of +3.45% and a Zacks Rank #3. The company is expected to report third-quarter earnings numbers on Nov 9. You can see the complete list of today’s Zacks #1 Rank stocks here.

SkyWest has an Earnings ESP of +1.03%. This Zacks #3 Ranked company will report third-quarter earnings numbers on Oct 25.

Expeditors is also #3 Ranked with an Earnings ESP of +1.68%. The company will reportthird-quarter 2017 financial numbers on Nov 7.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

SkyWest, Inc. (SKYW): Free Stock Analysis Report

Triton International Limited (TRTN): Free Stock Analysis Report

Norfolk Souther Corporation (NSC): Free Stock Analysis Report

Expeditors International of Washington, Inc. (EXPD): Free Stock Analysis Report

Original post