The chaos in the world markets over the past few weeks has been blamed on everything from a slowing China economy to the ideology of austerity.

Follow up:

Professor Paul Krugman believes the cause is a mix of factors:

Population growth is slowing worldwide, and for all the hype about the latest technology, it doesn’t seem to be creating either surging productivity or a lot of demand for business investment. The ideology of austerity, which has led to unprecedented weakness in government spending, has added to the problem. And low inflation around the world, which means low interest rates even when economies are booming, has reduced the room to cut rates when economies slump.

Unfortunately, Professor Krugman continues to concentrate on austerity as the root cause of all economic ills. While austerity does have economic effects the deployment of private capital is a more important factor in the global economy. For most thinking people, investing is placing money in the spot where the most money can be made. Over the past weeks, it seems the players became overly concerned whether the markets were priced correctly. This puts at jeopardy not only the gains, but the initial investment also. Market players made moves to sideline money or place it in other investments.

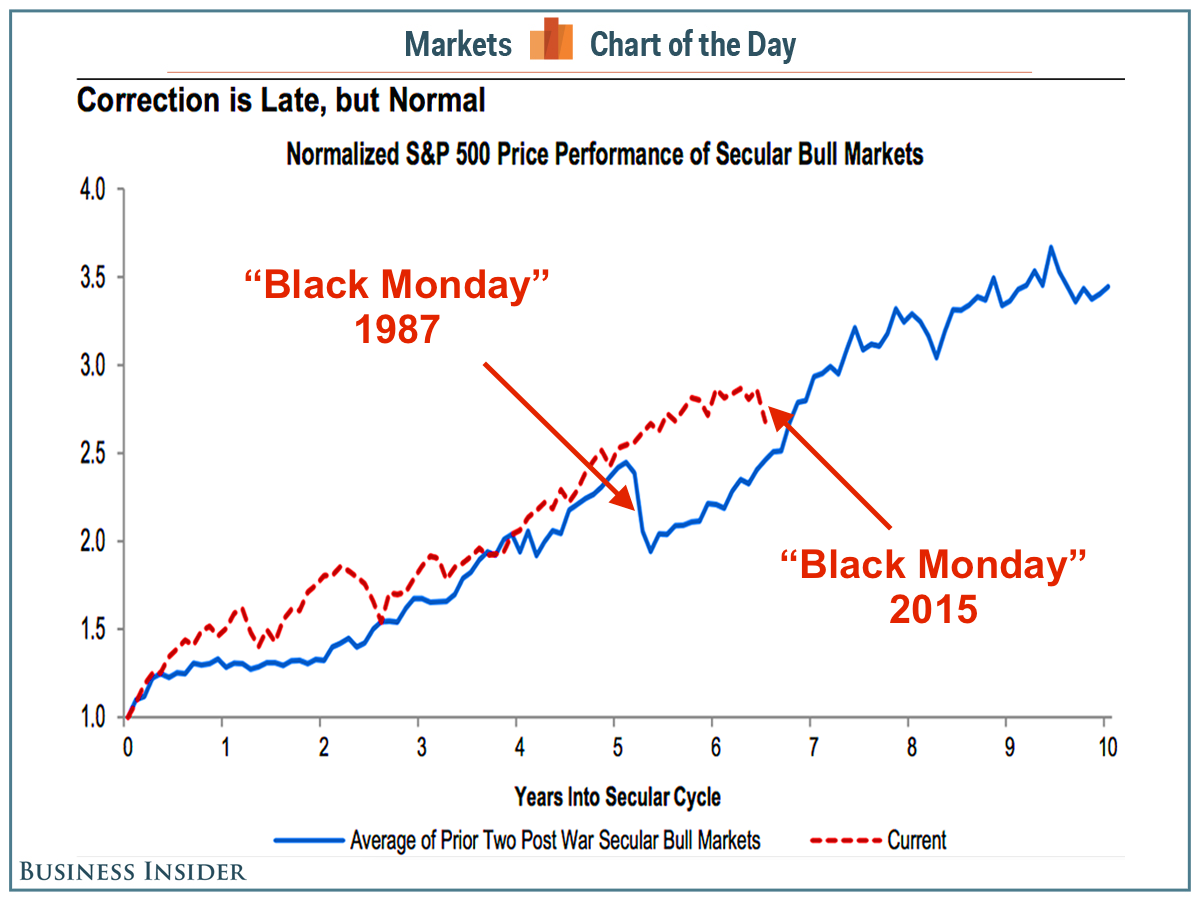

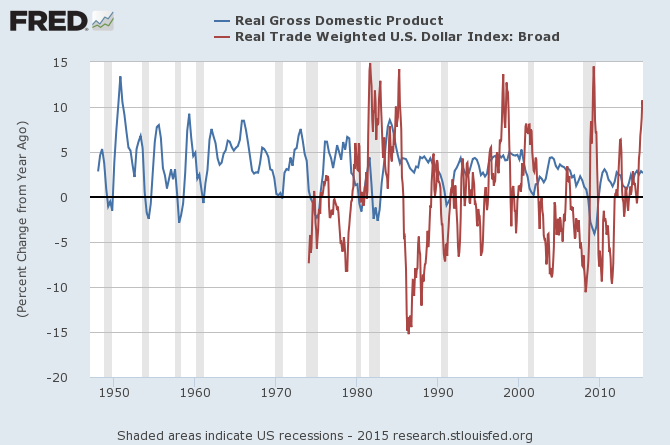

Looking at only one investment type (and the forces acting on that investment type) will lead to incorrect conclusions. People use money to make money - and put money where the most money can be made. That is why charts like the one below make as much sense as blaming austerity for the current market corrections.

We are in the New Normal which has significantly different dynamics than the previous secular bull markets. In reality the current bull market's rate of growth was running out of steam.

What was going on? Likely:

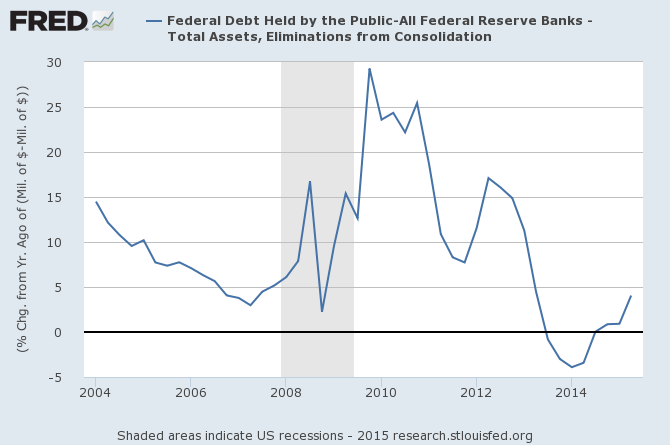

- the end of quantitative easing opened the door wider to investing in treasuries (as more Treasuries were available),

- the continued strengthening of the dollar caused US dollar inflows to protect moneys from devaluation in other currencies, and

- the ignition of the fire was China (continued worry about how much the economy is slowing confirmed by currency devaluation and interest rate cuts).

Food For Thought - Federal Debt Held by Public (excluding Debt on Federal Reserve Balance Sheet)

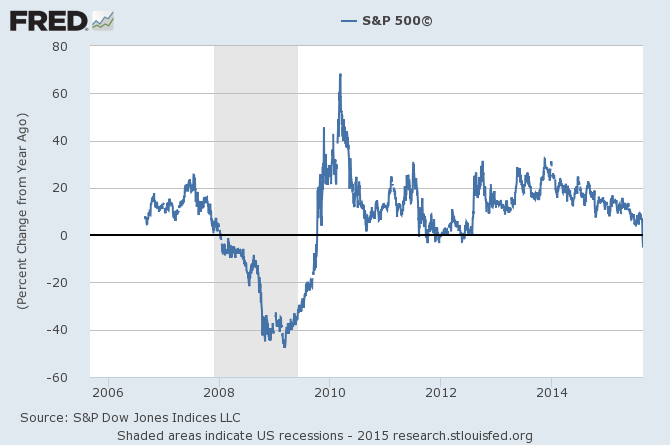

The rate of growth of most investment classes has slowed. There is a lot of uncertainty - even the Fed is screwing up their signals on whether they will raise the federal funds rate.

There seem to be few growth spots in the world which could warm investors souls. Mostly this was the effect of the dollar strengthening as money flowed towards the USA to escape the weakening of other currencies. A rapidly strengthening dollar can be a sign of an impending USA recession - especially in a situation where the economy is relatively weak.

It seems the last few days that global markets may have stabilized. Is this to continue forward or is it just the eye of the hurricane?

Other Economic News this Week:

The Econintersect Economic Index for August 2015 declined to the lowest level since April 2010. The tracked sectors of the economy remain relatively soft with most expanding at the lower end of the range seen since the end of the Great Recession. Our economic index has been in a long term decline since late 2014.

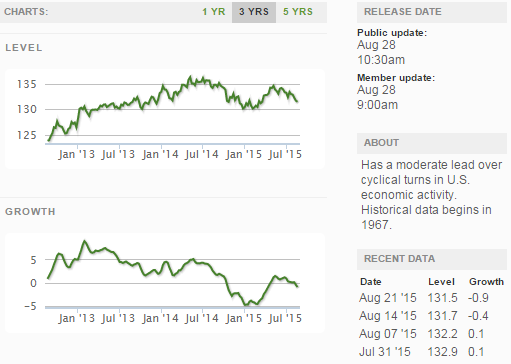

The ECRI WLI growth index is now in positive territory but still indicates the economy will have little growth 6 months from today.

Current ECRI WLI Growth Index

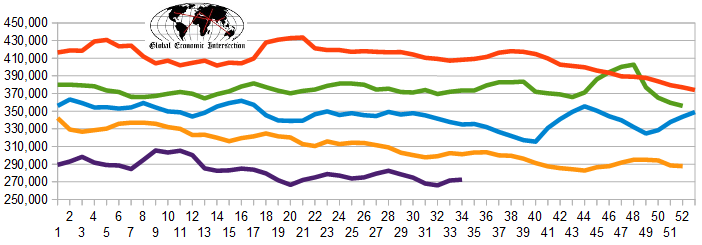

The market was expecting the weekly initial unemployment claims at 268,000 to 275,000 (consensus 270,000) vs the 271,000 reported. The more important (because of the volatility in the weekly reported claims and seasonality errors in adjusting the data) 4 week moving average moved from 271,500 (reported last week as 271,500) to 272,500. The rolling averages generally have been equal to or under 300,000 since August 2014.

Weekly Initial Unemployment Claims - 4 Week Average - Seasonally Adjusted - 2011 (red line), 2012 (green line), 2013 (blue line), 2014 (orange line), 2015 (violet line)

Bankruptcies this Week: Sebring Software, Santa Fe Gold

Click here to view the scorecard table below with active hyperlinks

Weekly Economic Release Scorecard: