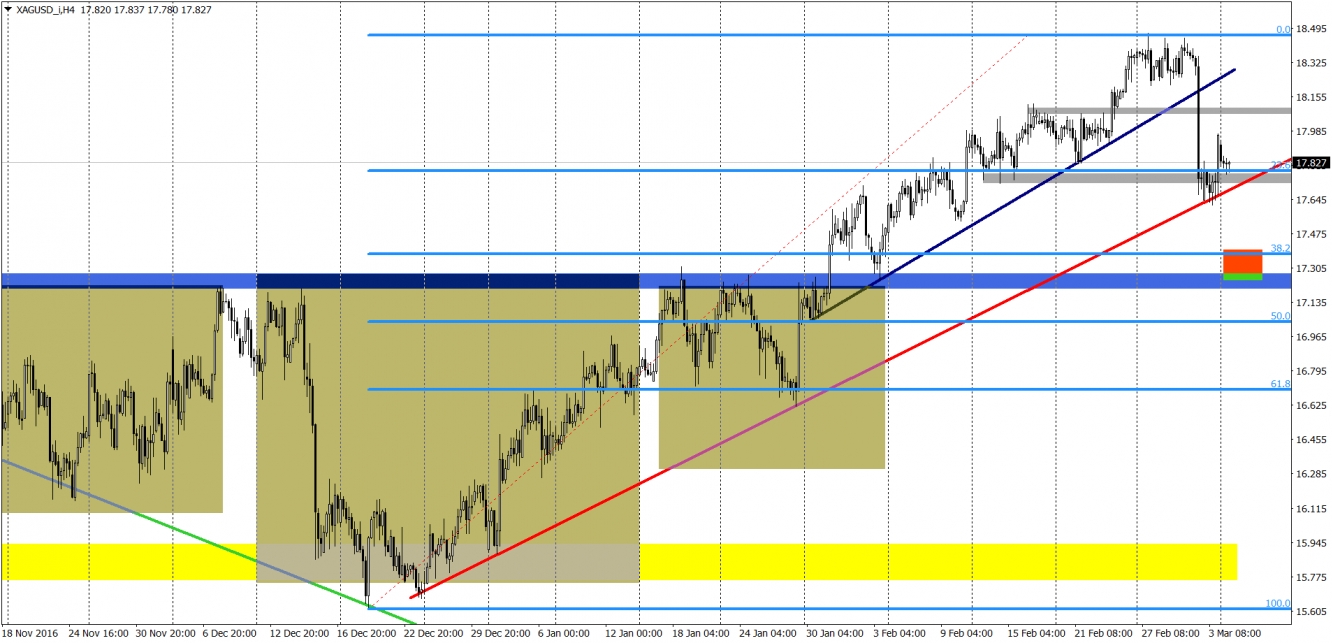

At the end of the February, we were wondering if that was a time for a correction on Silver. After our article, the price went a little bit higher and then in the beginning of March, crashed heavily. The drop happened after the European session closed and the origin of it was not precise. Till now, there are various speculations, why Silver dropped few percent in such a short time. Putting the reason aside, what does it change in the current situation on Silver?

The answer is: not much. We broke the short-term up trend line (black), but it was steep anyway, so it was expected that it will be broken sooner or later. In addition to this, we did not even reach the 38,2% Fibonacci or the neckline of the long-term iH&S (blue area). In one word, the retracement so far is mild. What is more, currently we stopped on the long-term trendline (red), where we can spot a bullish reaction, so the buyers are back in the game.

All those factors show us that situation is under control and many investors used that drop as a great bargain and opened long positions with better prices. As long, as the price stays above the trendline and even deeper, above the 38,2% Fibo, the sentiment is still positive and bullish scenario has a higher probability of success.