Now the world’s most valuable precious metal, Palladium prices have continued to soar this year after surpassing gold’s value in March. Yet its bump at the highs suggests a much-needed correction is underway.

High demand and low supply palladium has been a key driver for spot prices, since about 85% of its supply is used in exhaust systems in cars to help turn toxic pollutants into water vapour and carbon dioxide. Since 2016 it has nearly tripled in price, although the 40% rally from the October low goes to show how parabolic its trend has been of late.

Gains from trough to peak:

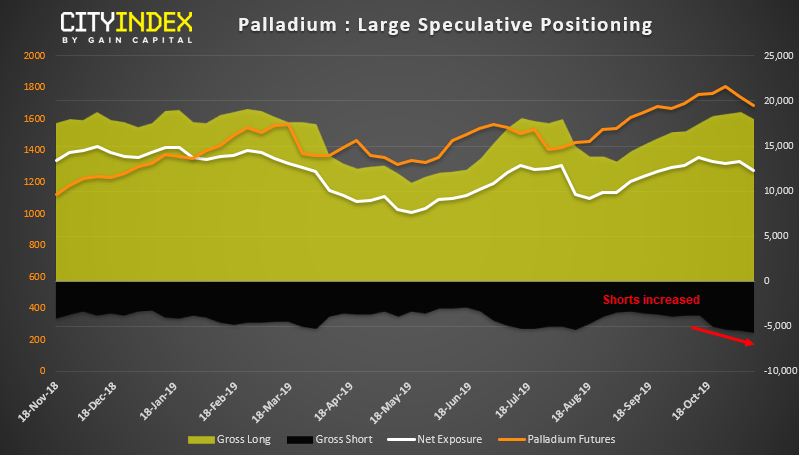

Whilst we cannot claim to have predicted the top, it wasn’t without warning either. We can see that gross short exposure had been creeping up into the price highs and has dragged net-long exposure to a 6-week low, ahead of last week’s top. Gross-long exposure had also peaked around levels that have been associated with corrections since mid-2018, so whilst positioning is not flagging a sentiment extreme, it could point towards a deeper retracement for the metal.

Technically, palladium appears poised for a re-test of its bullish trendline. Since peaking just beneath 1,800, a lower high formed before breaking a prior low and warning of a change in trend. Given it has fallen over 7% in the last two sessions, bearish momentum is clearly picking up and further losses appear more likely. Yet despite these losses, price action remains overextended relative to its 200-day MA.

Moreover, if we’re to see similar levels of volatility today that we have over the past two, it could retest 1,600 later today.

Taking this a step further, the palladium/gold ratio suggests there could be further downside for palladium. Whilst the relationship is not perfect, we can see the ratio crossing above/below its 20-day MA has picked some decent turning points on spot palladium. We’ve outlined a bearish scenario on gold yet palladium still remains relatively high and possibly over stretched from its long-term average. Therefor we’ll continue to monitor to see if the ratio remains beneath its 20-day MA, as it could suggest palladium may consider breaking its long-term bullish trendline.