Meta finally launched digital collectibles on Facebook (NASDAQ:META) and Instagram amidst an evergrowing threat of the NFT bubble bust.

Following months of waiting, Meta finally announced that Facebook and Instagram users can now display their digital collectibles on both platforms. The new move would allow users to share the non-fungible token (NFTs) between both apps by connecting their digital wallets to any one of them once.

Despite the laudable achievement, questions still abound over the timing of the move. Especially as the entire NFT market experiences a downturn threatening to bust the “NFT bubble.”

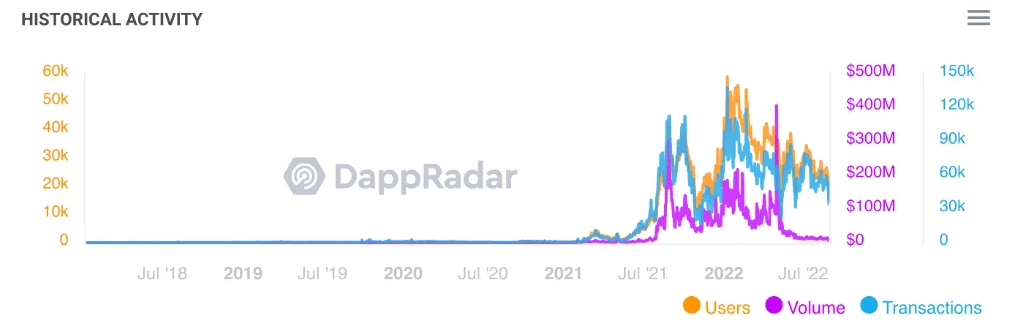

Data from DappRadar revealed that OpenSea, the premier NFT marketplace, recorded a 99% volume drop in 90 days. According to the analytics platform, Opeansea handled roughly $5 million in NFT transactions on Aug. 28. The recorded value significantly decreased from its previous peak of $405.75 million set on May 1.

Meta Launches Amidst Waning NFT Interest

Since Meta’s pivot into a metaverse-focused company, it has strived to harness blockchain tools to push and inspire creators globally. Its latest efforts would allow these artists to showcase their digital collectibles on their Instagram and Facebook profiles while earning an income from it. Fans can also support their favorite creators by buying these NFTs.

Unfortunately, the new move has coincided with the drastic fall in interest levels, as seen in OpenSea’s NFT trading volume. The data on the NFT marketplace is notable because it paints the overall picture of the declining interest in the NFT space.

The waning interest has also affected several NFT collections, with several notable ones seeing their floor prices plummet. The Bored Ape Yacht Club (BAYC), whose community recently voted to launch a news website, has suffered a 57% drop in its floor price.

Its current floor price is 79.98 ETH ($121,310). Meanwhile, the same digital pieces traded for 153.7 ETH on May 1 at its all-time high, as seen above. Similarly, CryptoPunks, another top NFT collection, saw its floor price fall about 20% from its high of 83.72 ETH in July.

In addition to falling prices, the NFT space is facing a liquidity crisis as NFT Lending Platform BendDAO ran outof reserves as defaults surged. Last week the protocol voted to change the code of its protocol to make its NFT collateral more liquid. BendDAO allows NFT owners to pledge their digital collectibles as collateral for loans (in ETH) amounting to 30%–40% of the NFT’s floor price.

However, the recent spike in the price of Ether boosted the dollar value of loans in ETH. On the other hand, the value of the collateral held by BendDAO decreased due to the sharp decline in NFT values.

Consequently, borrowers cannot repay their dollar-denominated loans, and lenders are having trouble recouping their borrowed funds due to declining collateral values. This has resulted in BendDAO facing a debt crisis of its own.

Meta May Be Betting On A Promising Future

Meta’s launch of NFT sharing on its social media platform may indicate a positive sentiment beyond the current market condition. After the crypto winter, the company may be banking on a renewed interest in NFTs.

Amidst soaring inflation, macro headwinds, and interest rate hikes, the financial sector and cryptocurrencies have seen their prices pull back significantly. The drawdown has resulted in disinterest amongst participants, which has extended to its subsectors, including NFTs.

Notably, NFT prices are quoted in ETH. Therefore the fall in the value of Ethereum would cause a corresponding decrease in the value of these digital collectibles and vice versa.

Consequently, Meta would be hoping that the current bear market condition would not last long and usher in the next bull run. This would see ETH’s value grow and, subsequently, rub off on NFTs prices. If that does not happen, it would mean that Meta may be holding onto a dying trend.