Are movies about excesses on Wall Street a bad omen for the stock market?

Is Corporate America truly sitting on a record pile of cash?

And what do Humpty Dumpty and the U.S. labor market have in common?

We’re sprinkling some wisdom on all these topics (and a tad more) in this week’s edition of Friday Charts.

So let’s get to it…

Myth Busting Hollywood

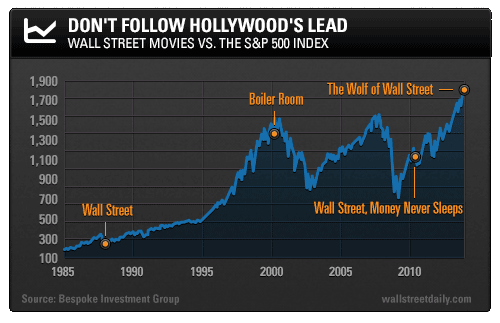

The Twitterverse exploded last week with an ominous chart from the Bond Vigilantes. Essentially, it tied stock market tops to the release of movies that vilify Wall Street.

Fear not, though. It’s a total myth!

The number crunchers over at Bespoke Investment Group looked into the situation. And they discovered that the timing of the movie releases in the original chart is a tad suspect, to say the least.

(Go figure. A bunch of bond guys were peddling misinformation about stocks. Nothing like some self-serving fear tactics, huh?)

In any event, Bespoke reconstructed the chart using accurate data. The result? The Wall Street movie indicator is anything but a surefire sell signal.

So even though The Wolf of Wall Street recently hit theaters, there’s no reason to run for cover.

Bespoke wrapped up their analysis, saying, “We’d rather look at economic data, market sentiment, technical factors and fundamental measures of stock performance than rely on Oliver Stone, Martin Scorsese, and the rest of Hollywood to pick our entries and exits.”

Can I get an “amen”?

Rethinking Record Cash

On more than one occasion, I’ve made note of the record cash piles sitting on corporate balance sheets, which is good for shareholder-friendly activities. Like dividend increases, buybacks – even mergers and acquisitions.

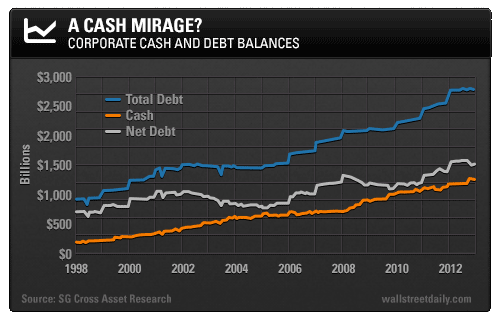

But the fine fellows over at SocGen want us to rethink that stance. They’re convinced the record cash balances are nothing more than a mirage.

No, they’re not implying that the cash doesn’t actually exist (i.e., rampant accounting fraud). Instead, they contend that the cash is already accounted for, thanks to record amounts of debt.

As they write in their report, “U.S. corporates do indeed hold lots of cash, which is currently at record levels. But they also hold record levels of debt. Net debt is 15% above the levels seen in 2008/2009.”

Point taken. But cash is still cash. It spends just the same regardless of how much debt a company holds.

I’ll start freaking out when companies deplete those cash balances and cash flows from operations (which can be used to service debt) crater, too. But that’s not happening now.

It’s All About the Jobs

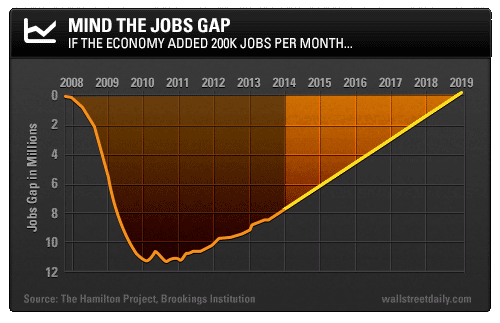

Last week, I shared a silver lining to the terrible December jobs report. This week, it’s time for a reality check.

You’ll recall, economists were expecting close to 200,000 jobs to be created in the last month of 2013. Instead, we got 74,000.

But let’s just assume the economy did add 200,000 jobs. Not only last month, but every month moving forward.

At that rate, how long would it take to bring unemployment down to pre-recession levels of 4.7%?

A Long time.

If we take into account new people entering the workforce each month, we won’t get back to normal until December 2018, according to research by the Brookings Institution’s Hamilton Project.

With a record number of Americans leaving the workforce, and the slow pace of job creation, I’m afraid there might be no way to put the employment situation back together again.