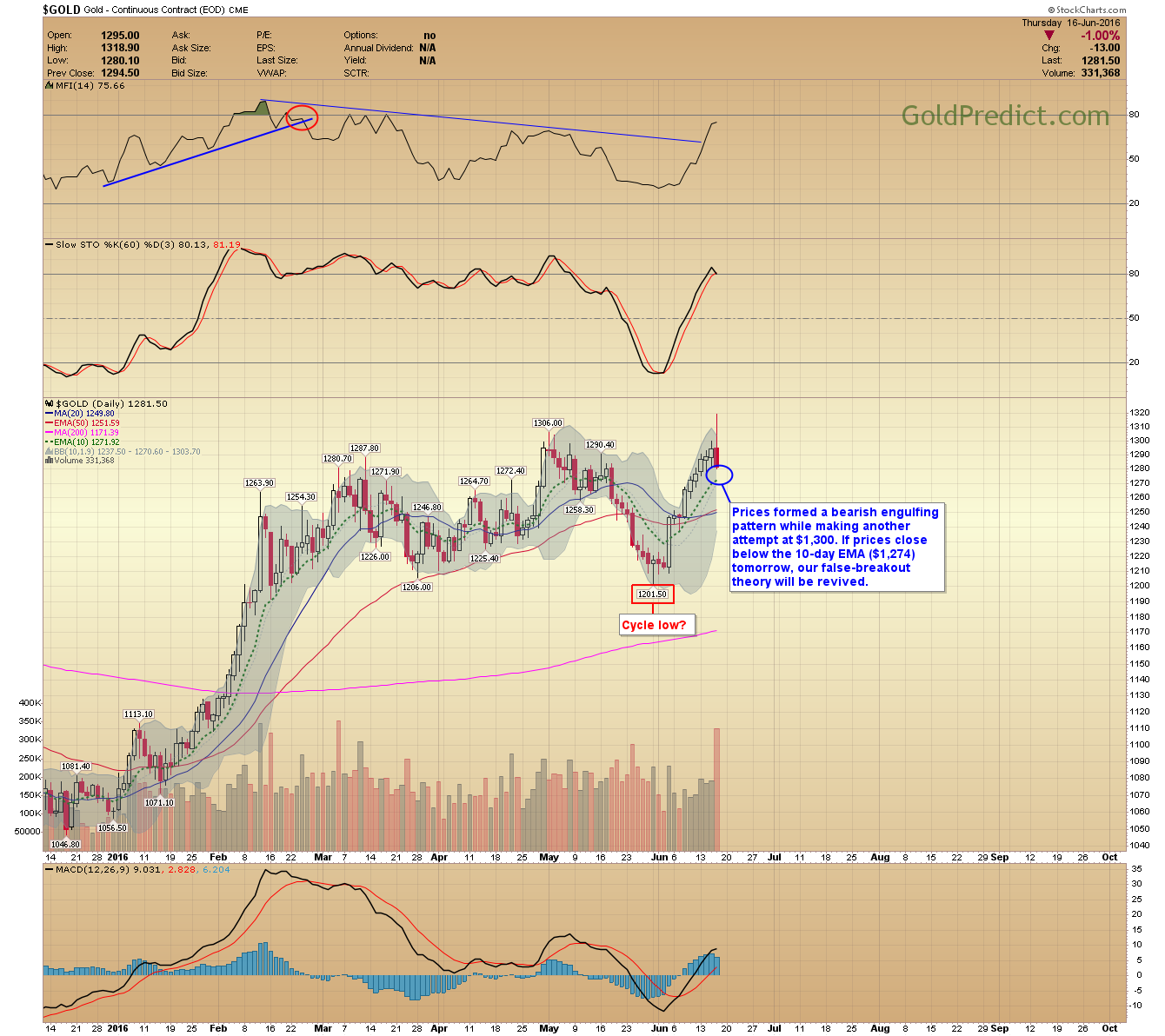

I’ve questioned the moves higher in gold, silver and miners the last few weeks, and we will soon find out if my skepticism was warranted. The 6-month cycle lows didn’t seem sincere enough, especially in miners, as something seemed awry. Well, it's make or break time for my false-breakout theory and tomorrow’s close is important.

There was a significant turnaround in metals and miners today keeping our false-breakout theory alive. If prices drop further tomorrow, the odds will increase substantially for sustained moves lower toward the 200-day moving averages in gold, silver and miners.

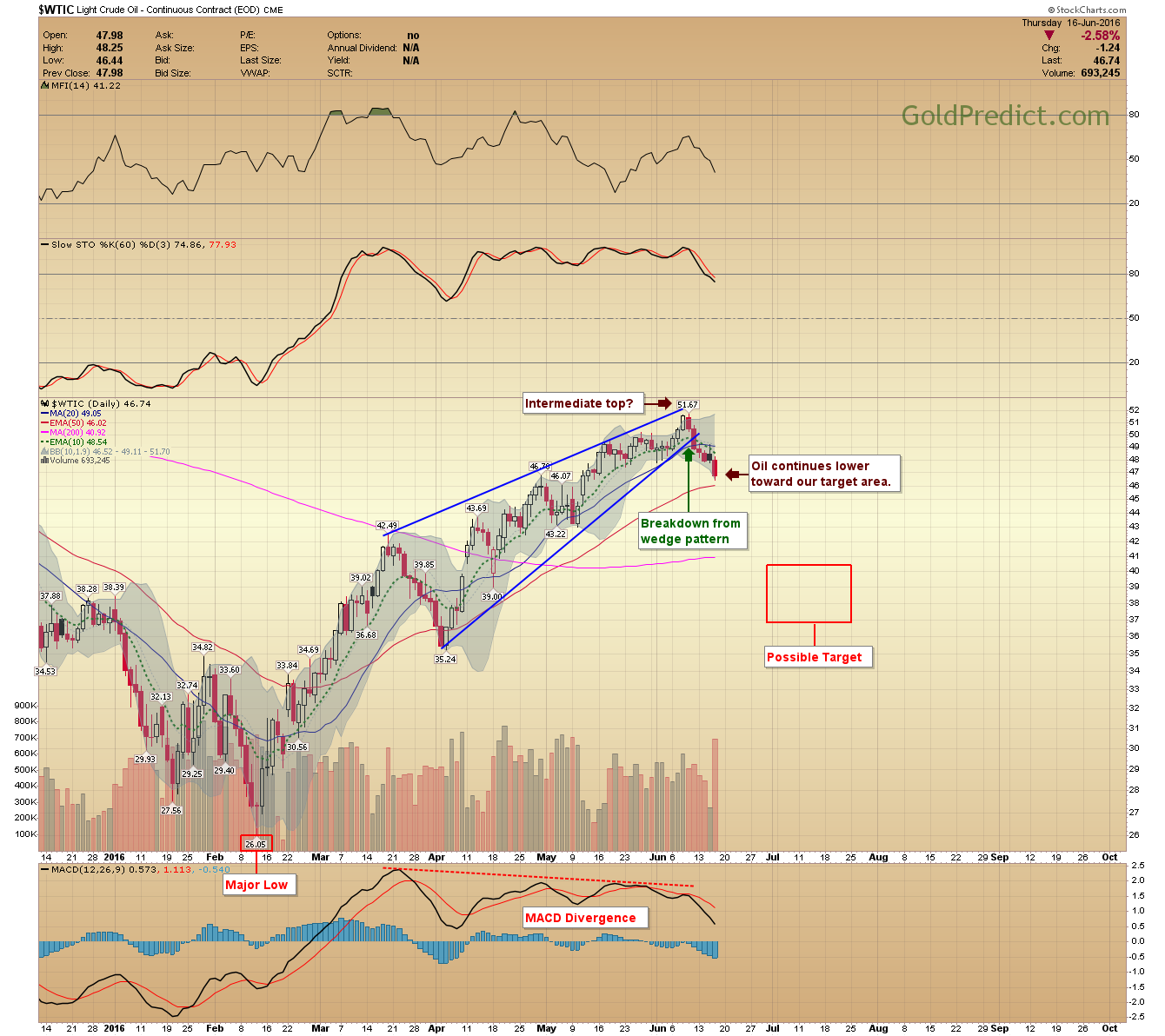

Oil prices continue lower to their July target area.

US DOLLAR - The dollar moved sharply in both directions today but ended up with a slight gain. We are only on day six of a new cycle.

GOLD - Prices formed a bearish engulfing pattern while making another attempt at $1,300. If prices close below the 10-day EMA ($1,274) tomorrow, our false-breakout theory will be revived.

SILVER - Silver Prices also made a large bearish engulfing pattern today. Follow-through lower tomorrow is paramount to our analysis. I would like to see prices close out the week below $17.00.

VanEck Vectors Gold Miners (NYSE:GDX) - Miners opened trading with a gap higher and then prices sold off the rest of the day, keeping the bearish drop to the 200-day MA alive. Follow-through lower tomorrow will increase the odds significantly.

VanEck Vectors Junior Gold Miners (NYSE:GDXJ) - I would like to see GDXJ close out the week below the $38.63 reflex low.

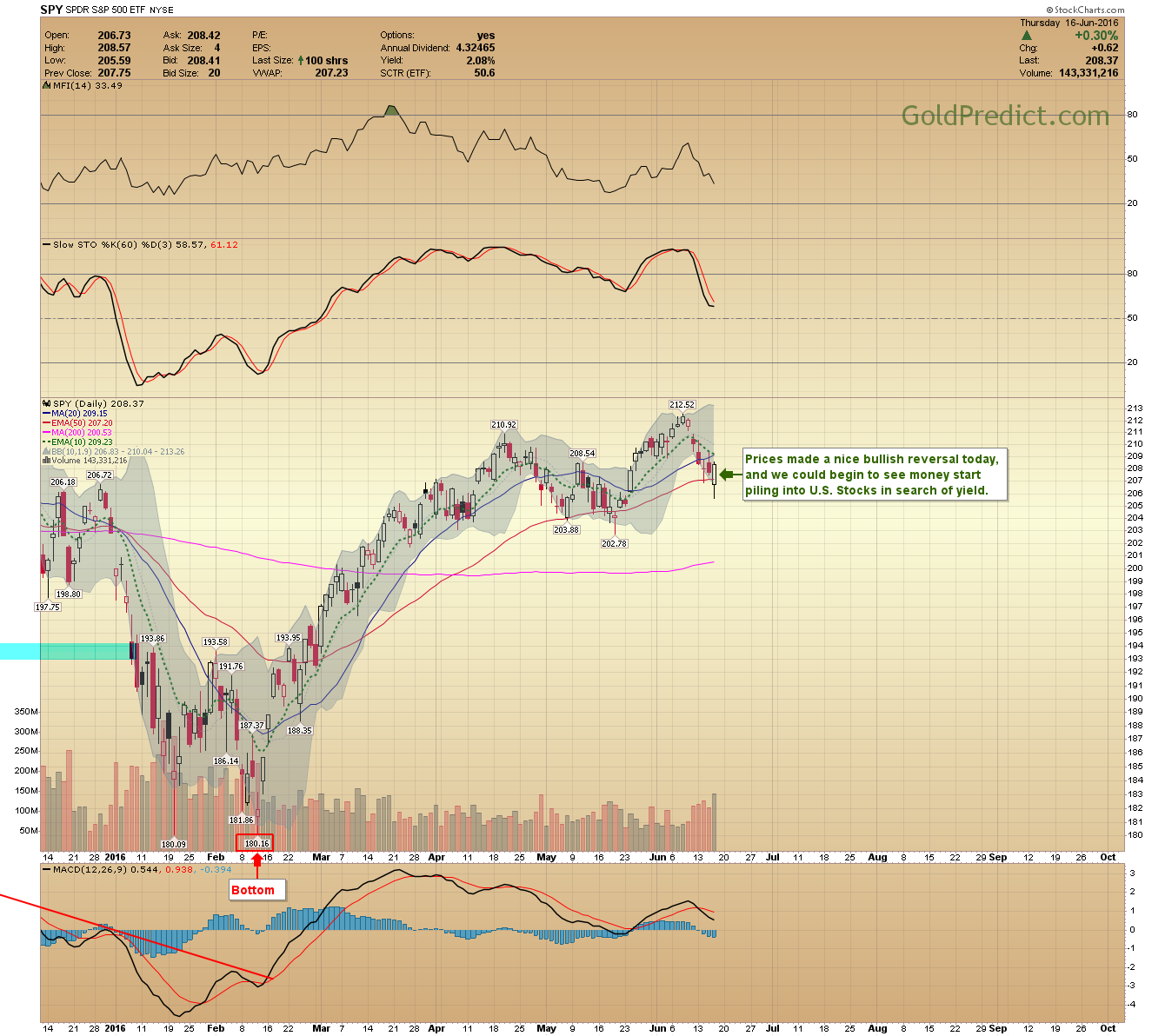

SPDR S&P 500 (NYSE:SPY) - Prices made a nice bullish reversal today, and we could begin to see money start piling into U.S. Stocks in search of yield.

WTIC - Oil continues lower toward our target area.

I will be away from my desk most of the day tomorrow but will try to check in and post an update if needed.

Have a great weekend.