Dick’s Sporting Goods (NYSE:DKS) deliver its latest earnings report on Tuesday, Nov. 15 before the opening bell. Here are the factors that could lead to a beat or a miss.

On average, Wall Street analysts are looking for Q3 EPS of $0.42, which is the high end of the company’s own guidance of $0.39 to $0.42. Last year's third-quarter earnings were $0.45 per share. Analysts are also expecting Q3 revenue growth of 7.5% to $1.77 billion.

Comparable sales, also known as same-store sales or simply “comps,” are expected to rise between 2% and 3%, versus just 0.4% last year and +2.8% in Q2. Comps are considered a key indicator of a retailer’s health since they measure the performance of stores open at least 12 months.

Dick’s already provided full-year 2017 EPS guidance of $2.90 to $3.05, with comps rising between 2% and 3%. That outlook was raised last quarter from a prior forecast of $2.60 to $2.90, so the company has grown increasingly bullish on its growth prospects recently.

Thanks Chapter 11

With multiple competitor bankruptcies in the sporting-goods space, DKS has benefitted greatly. Both The Sports Authority and Sports Chalet were liquidated this year and Dick’s also won a bankruptcy auction for the U.S. business of Golfsmith for about $70 million. Other recent tailwinds include the historic championship wins this year of the Cleveland Cavaliers and Chicago Cubs, which likely spurred massive merchandise buys. The Summer Olympics is also likely to have had an impact on earnings.

In terms of valuation, DKS currently trades at about 20x earnings, which is quite high for a brick-and-mortar retailer, although its recent growth may allow the company to grow into its lofty market cap.

Tune in Tuesday morning, when we’ll have full coverage of the company’s latest report.

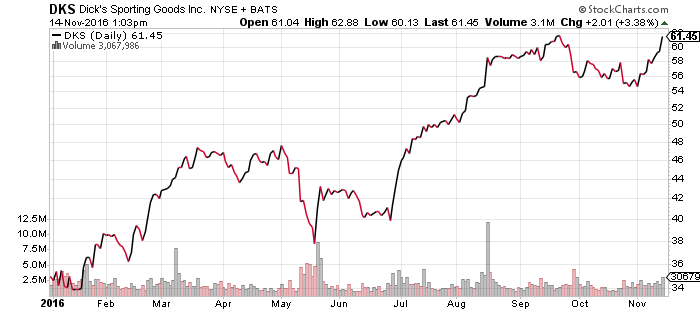

Dicks Sporting Goods shares rose $2.01 (+3.38%) to $61.45 in Monday afternoon trading. Year-to-date, DKS has gained 73.75%.