After reporting in-line earnings in the first quarter of fiscal 2017, DICK'S Sporting Goods, Inc. (NYSE:DKS) witnessed negative earnings surprise of 4% in the fiscal second quarter. However, the top line met estimates after a miss in the previous quarter.

Moreover, comparable store sales (comps) fell short of expectations. Also, management lowered its fiscal 2017 guidance.

Consequently, shares of this sporting goods retailer declined nearly 23% yesterday, highlighting investors’ fears associated with the company’s forward prospects.

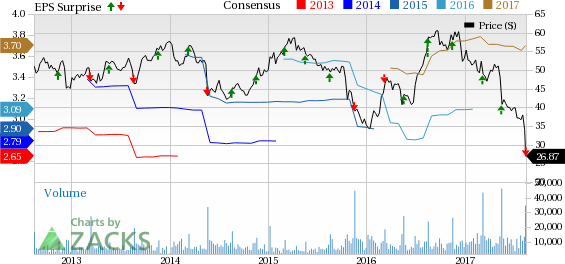

In fact, this Zacks Rank #4 (Sell) stock has declined 35.6% in the last three months, wider than the industry’s loss of 10.6%. The industry is currently placed at the bottom 4% of the Zacks classified industries (245 out of 256). On the contrary, the broader Retail-Wholesale sector, of which they form part, gained 1.6%.

Q2 Highlights

DICK’S Sporting posted adjusted earnings of 96 cents per share in the second quarter that rose 17.1% from the year-ago quarter but fell short of the Zacks Consensus Estimate of $1.00. Also, the reported figure came below the company’s guidance range of $1.02–$1.07 per share. On a GAAP basis, the bottom line increased 25.6% to $1.03 per share.

Net sales of $2,156.9 million met the Zacks Consensus Estimate and grew 9.6% from the prior-year quarter. Consolidated comps inched up 0.1%, lagging the company’s forecast of 2–3% increase.

Comps improvement was backed by 2.1% rise in ticket, which was somewhat compensated by 2% decline in transactions. This growth amid a tough retail backdrop is attributable to improvement in the golf and footwear categories, along with solid eCommerce performance. However, sales remained soft at the hunting, athletic apparel, licensed and electronics businesses.

Delving Deeper

Backed by growth of its omni-channel network, DICK’S Sporting’s eCommerce sales rose 19% in the quarter. Notably, the eCommerce business constituted 9.2% of total sales, slightly higher than 8.5% in the year-ago period.

Gross margin contracted 82 basis points (bps) to 29.54%. This reduction was due to lower merchandize margins, coupled with occupancy de-leverage as well as increased shipping and fulfillment expenses, as a percentage of sales.

However, the operating income grew 8.2% to $159.2 million, while the operating margin contracted 10 bps to 7.4%.

Financial Aspects

DICK’S Sporting ended the quarter with cash and cash equivalents of $131.6 million and total shareholders’ equity of $1,921.3 million. Further, the company had $186.8 million outstanding borrowings under its revolving credit facility as of Jul 29, 2017.

Management amended the revolving credit facility by increasing its limit to $1.25 billion from $1 billion, and also extended the maturity to August 2022, retaining the same terms.

During the first half of fiscal 2017, DICK’S Sporting generated roughly $244.5 million cash from operating activities. Total inventory at the end of the quarter grew 11.8% on a year-over-year basis, while total capital expenditures during the quarter amounted to nearly $122 million (on a gross basis) and $83 million (on a net basis).

Dividend and Share Repurchases

DICK’S Sporting has always created value for shareholders by returning capital in the form of dividends and share repurchases.

The company paid dividends worth nearly $18.2 million during the quarter. On Aug 10, management declared a quarterly cash dividend of 17 cents per share. This is payable on Sep 29 to shareholders of record as on Sep 8, 2017.

Furthermore, DICK’S Sporting repurchased roughly 3.4 million shares worth $143 million during the quarter, following which it had shares worth nearly $875 million remaining under its standing authorization that extends through 2021.

Store Update

During the quarter, the company inaugurated 13 namesake stores, while it shuttered one specialty concept outlet. These actions took the total store count, as of Jul 29, 2017 to 704 DICK'S Sporting Goods outlets across 47 states, 98 Golf Galaxy stores in 32 states, and 29 Field & Stream stores in 14 states.

Guidance

Management remains hopeful about driving future growth and capturing market share driven by the success of its eCommerce platform and impressive progress on the recent merchandise plan of reducing vendor base, concentrating on areas with greater growth potential and optimizing collection. Also, the company remains focused on cutting down costs and amending its operating structure in an attempt to sponsor long-term growth initiatives.

However, the company lowered its fiscal 2017 outlook. For fiscal 2017, which will have an additional week, management now expects adjusted earnings in the range of $2.80–$3 per share versus $3.65–$3.75, guided earlier. In fact, the guidance includes nearly 5 cents from the 53rd week. Also, the Zacks Consensus Estimate is pegged higher at $3.61, which is likely to witness downward revisions.

Further, consolidated comps for the year are anticipated to be flat to low single-digit negative, compared with 1–3% growth projected earlier. Operating margins are also expected to decrease on a year-over-year basis.

For the third quarter of fiscal 2017, the company envisions earnings per share to lie in the band of 22-30 cents. The Zacks Consensus Estimate for the quarter is pegged higher at 55 cents. For the said quarter, management anticipates comps on low single-digit negative.

Stocks to Consider

Better-ranked stocks in the same industry include Build-A-Bear Workshop, Inc. (NYSE:BBW) , Five Below, Inc. (NASDAQ:FIVE) and Sally Beauty Holdings, Inc. (NYSE:SBH) carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Build-A-Bear Workshop, with a long-term earnings growth rate of 22.5% pulled off an average positive earnings surprise of 73.7% in the last four quarters.

Five Below, with a long-term earnings growth rate of 28.5% delivered an average positive earnings surprise of 6.3% in the last four quarters.

Sally Beauty, with a long-term earnings growth rate of 5.6% came up with positive earnings surprise of 6.1% in the last reported quarter.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Sally Beauty Holdings, Inc. (SBH): Free Stock Analysis Report

Dick's Sporting Goods Inc (DKS): Free Stock Analysis Report

Build-A-Bear Workshop, Inc. (BBW): Free Stock Analysis Report

Five Below, Inc. (FIVE): Free Stock Analysis Report

Original post

Zacks Investment Research