Growing distribution business

Diaxonhit, (ALEHT) continues to grow its distribution activities using InGen’s existing sales organisation by in-licensing proprietary products, adding new exclusive contracts and expanding territories, while accelerating the development of novel diagnostic products. Since the acquisition of InGen in December 2012, distribution agreements have been signed with XDx, CODASY, Tohosh and now Samsung. Diaxonhit’s integration of Exonhit and InGen BioSciences appears to be making good progress towards the formation of a fully integrated IVD company. The combination of the two companies’ operations should enable cost improvements and a reduction in cash burn.

Samsung distribution agreement

Diaxonhit has entered into a distribution agreement with Samsung’s Health Medical Equipment division for the commercialisation of point-of-care (POC) diagnostic tests. The agreement covers the marketing of IB10, PT10 and HC10 equipment, together with associated reagents, in France and its overseas territories. This deal strengthens Diaxonhit’s portfolio of immunoassay and POC tests for clinical laboratories and emergency services.

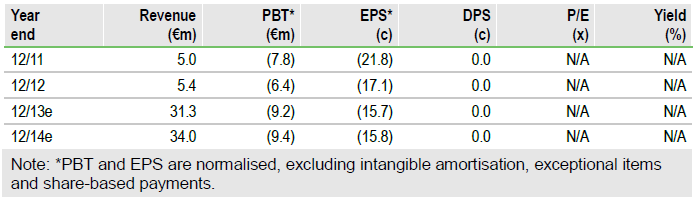

Financials: Funded to H115

We estimate that Diaxonhit ended FY13 with cash of around €3m, which combined with a SocGen €6.5m equity line should be sufficient until H115. Diaxonhit should have a cash runway to complete the AclarusDx clinical studies and market the product in France.

Valuation: Risk-adjusted NPV of €88m

We maintain our rNPV of €88m based on prudent assumptions of its development products’ probability of success in each indication, launch date, pricing and market penetration. By comparison, the EV is €53m, based on a market cap of €56m and estimated cash of around €3m.

To Read the Entire Report Please Click on the pdf File Below