Diaxonhit, (ALEHT) integration of the Exonhit and InGen BioSciences appears to be making good progress towards the formation of a fully integrated IVD company. Diaxonhit is implementing its strategy of growing its distribution activities using the existing sales organisation by in-licensing proprietary products, adding new exclusive contracts and expanding territories, while accelerating the development of novel diagnostic products. The combination of the two companies’ operations should enable cost improvements and a reduction in cash burn.

Exclusive distribution agreement for AlloMap

In June, Diaxonhit agreed an exclusive licence and distribution agreement with XDx to market and perform AlloMap Molecular Expression Testing (AlloMap) in Europe. AlloMap is a blood-based test for monitoring heart transplant patients for acute organ rejection. Over 45,000 AlloMap commercial tests have been performed in more than 11,000 patients in 100 transplant centres in the US. AlloMap will be performed centrally in the renowned Jean Dausset (reference) Laboratory in Paris. The test should be available in selected European countries from early 2014.

QC Connect strengthens the quality control portfolio

Diaxonhit recently signed an exclusive agreement with CODASY to distribute QC Connect software in France. Although it already offers a range of quality control tests and reagents to clinical laboratories in France, QC Connect will enable Diaxonhit to offer an integrated solution for the implementation and management of quality to clinical laboratories. Therefore, Diaxonhit will be able to help French clinical laboratories to meet the new ISO 15189 requirement more easily, while providing a one-stop shop for quality control products.

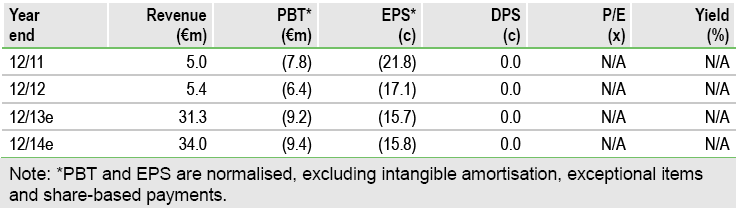

Financials: Funded to H115

Diaxonhit ended H113 with cash of €5.9m, which combined with a SocGen €6.5m equity line should be sufficient for nearly two years. H113 operating expenses were €10.5m, a reduction of €400k. It appears that Diaxonhit has a cash runway to complete the AclarusDx clinical studies and market the product in France.

Valuation: Risk-adjusted NPV of €88m

We maintain our rNPV of €88m based on prudent assumptions of its development products’ probability of success in each indication, launch date, pricing and market penetration. By comparison, the EV is €31m, based on a market cap of €37m and gross cash of €5.9m.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Diaxonhit: In It Together

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.