So I have mentioned a few times over the last couple of months that I hold a strongly bearish bias when it comes to the Euro. Some of you may know, and some of you may not yet know, that these bias’ I form serve as a sort of background to my strategy – they do not dictate the direction of my entry 100% of the time, but they lean on one side of an entry I’m not sure about and serve as a sort of filter for my discretion. Something I’ve not yet done here on the site is explain the reasoning behind a particular bias I hold, and so I thought it might make things a little clearer for everyone if I started doing so.

So, with this said, let’s start with the Euro – why am I primarily looking short?

A few different factors have played into this bias over the last 6 months or so, so let’s take a quick look at each.

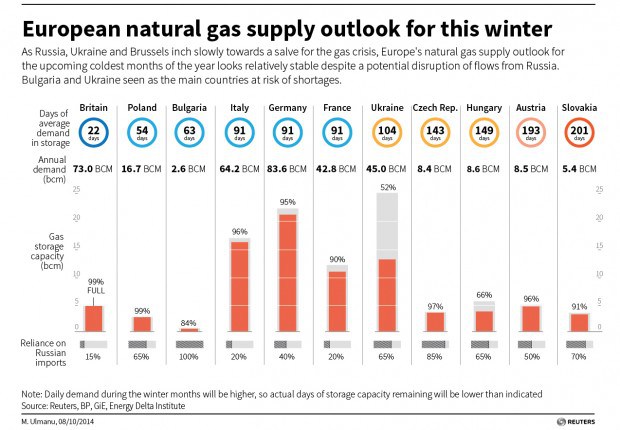

First came the geopolitical tension in Russia/Ukraine earlier on in the year. The situation suggested a bearish Euro for two main reasons – first, military tension anywhere generally sparks risk-off sentiment. At time of risk-off sentiment, investors pull capital out of risky assets (of which the Euro is very much one at the moment) and reallocate to – initially – the safe haven currencies such as the USD and (to some extent) the JPY, and -beyond this initial reallocation – to gold. The second reason is more operational. With Russia and Ukraine at loggerheads, the Eurozone’s access to natural gas is severely limited. Russian gas comes straight through Ukraine to reach Euro nations, and with Russia limiting the amount of gas it gives Ukraine, we will get an inevitable “siphoning” off of Euro-bound gas by Ukraine. Take a quick look at the infographic below, and you will see why this is a bad, bad thing.

Source: Reuters

Next up is the monetary policy implemented by Draghi and his cronies in June/July. By revising the deposit rate at the ECB to a negative figure, he was hoping to encourage interbank lending. At the time this was referred to as unprecedented and aggressive. Maybe so, but take a look at a similar revision in 2012 (down to 0.0) and you will see that – in reality – the move is far less likely to have the stimulatory impact many hoped it would. For me, it was not enough, and suggested that we would definitely need to see some sort of QE program near term. The recent rate cut has reinforced this belief, and whatever its long term impact, QE is essentially an increase in the supply of money. Increased supply = lower value = weak Euro. Every time.

Finally, and most recently, we come to Germany. Germany is generally seen as a strong nation, having emerged from the most recent crisis relatively unscathed (when compared to its fellow Eurozone constituents). There is a reason for this however, and that reason is China. When all other nations were struggling to generate output as a result of damp domestic demand, Germany was able to offset any internal weakness by demand for its exports from the – then booming – China. A quick look at the Chinese property market and you will see that this demand is not likely to remain over the coming quarters. In fact, German exports declined nearly 6% last month. When you consider that exports account for more than 50% of German GDP you can see why China’s slowdown could put Germany in real trouble. And what happens when Germany suffers? The Eurozone is no longer propped up, and thrown into deflation and contraction.

So there you have it. A brief explanation of why I’m struggling to look long in anything Euro related right now. I hope you didn’t find this too much of a tedious read and – if not – I will keep you updated on the drivers behind my various bias’ as we go forward.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Diary of a Currency Trader: Euro

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.