On Oct 17, secondary and post-secondary education provider DeVry Education Group, Inc. (NYSE:DV) was raised by a notch to a Zacks Rank #2 (Buy).

DeVry Education’s medical schools post strong outcome, with incredibly low cohort-default rates and high job placement. In particular, the medical and health care segment, Chamberlain and Ross, gained on strong demand for jobs in the field of healthcare across the U.S. In fact, the segment reported revenues of $231.2 million, up 8% year over year in the fourth-quarter fiscal 2016, driven by strong enrollment at Chamberlain College of Nursing.

Lately, the company has adopted multiple initiatives to boost the top line in the face of tough competition from schools like Lincoln Educational Services Corporation (NASDAQ:LINC) , TAL Education Group (NYSE:XRS) , Universal Technical Institute, Inc. (NYSE:UTI) .

The company has also taken up transformational initiatives at the DeVry University like improvement of student experience, affordability of programs and strategic marketing. It also announced plans of offering more technology-focused stackable programs at the DeVry University.

Recently, Becker Professional Education, part of DeVry Education, announced a new partnership with the Chicago Medical Training Center, wherein the latter will offer USMLE preparation courses allowing medical students access to efficient, comprehensive training and study options in one centralized location.

Apart from that, Ross University School of Veterinary Medicine (RUSVM), also part of DeVry Education, announced the launch of a program under which students will be provided with a custom-designed iPad for a digitally advanced multimedia learning experience.

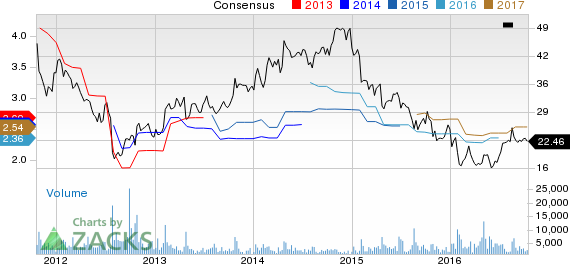

Also, upward estimate revisions reflect optimism regarding the stock’s prospects. The Zacks Consensus Estimate for fiscal 2017 has moved north by 4.1% to $2.54 per share, over the last sixty days. The company has witnessed two upward revisions for fiscal 2017 over the past 60 days, as against one downward revision.

DeVry Education currently has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Confidential from Zacks

Beyond this Analyst Blog, would you like to see Zacks' best recommendations that are not available to the public? Our Executive VP, Steve Reitmeister, knows when key trades are about to be triggered and which of our experts has the hottest hand. .Click to see them now>>

DEVRY EDUCATION (DV): Free Stock Analysis Report

UNIVL TECH INST (UTI): Free Stock Analysis Report

TAL EDUCATN-ADR (XRS): Free Stock Analysis Report

LINCOLN EDUCATL (LINC): Free Stock Analysis Report

Original post