Successful realisations confirm broader capability

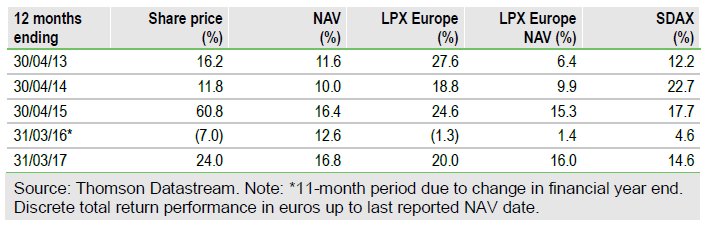

Deutsche Beteiligungs (DE:DBANn) announced four divestments in May 2017, confirming FY17 as an exceptional year for portfolio activity, with five new investments and six realisations agreed. The sale of private tutoring services firm Schülerhilfe proved DBAG’s ability to complete deals successfully beyond its four traditional sectors of core expertise, while the investment in Vitronet Projekte was DBAG ECF’s first buyout transaction, and More than Meals Europe is the first investment that will use DBAG Fund VII’s top-up fund to finance add-on acquisitions. Recent realisation gains suggest that FY17’s NAV total return could exceed 22%, which would be the highest level since FY12.

FY17: A year of exceptional portfolio activity

DBAG announced four divestments in May 2017, taking the number of realisations in FY17 to six, with five new investments also expected to be completed in FY17. This represents an exceptional pace of portfolio divestment for DBAG, which recorded two realisations in each of the last five financial years other than FY15, when no investments were sold. Based on transactions announced to date, new investment completed in FY17 (to 30 September 2017) should significantly exceed the expected average investment rate of €60m pa based on DBAG’s investment commitments to DBAG Fund VII and DBAG ECF.

To read the entire report Please click on the pdf File Below: