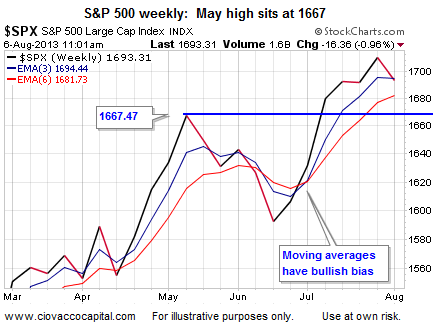

Since the S&P 500 bottomed on June 24, the calls on Twitter for an imminent peak have been frequent. At some point a true trend reversal will come, but thus far Monday’s and Tuesday’s weakness can be placed in the normal volatility category. For the record, even as the S&P was down 10 points Tuesday morning the gain over the last five weeks still sits at 136 points.

Improvement On Labor Front

Major peaks or the early stages of a bear market are typically associated with slowing economic growth. Economic news Tuesday pointed toward improvement, rather than contraction. From Reuters:

The ratio of unemployed Americans to every job opening fell in June to its lowest level in over four years, a positive sign for wages and the broader economy. Job openings - a measure of labor demand - climbed marginally to 3.936 million during the month from 3.907 million in May, the Labor Department said on Tuesday. That meant just under three workers sought each open job, marking a good deal of progress from the dark days of 2009, when the ratio was nearly seven workers per one job. The reading in June was the lowest since October 2008.

Weekly Technicals Still Intact

Trends help us discern between volatility to ignore and volatility that requires defensive action. As of midday Tuesday, we are looking at volatility to ignore. For those concerned about an imminent stock market peak, last weekend’s video showed there is little in the way of similarities between 2013 and 2007-2008.

Credit Worthy Again

While many of us do not like it or agree with it, our economy is heavily dependent on borrowing and spending. Like the Fed’s money printing policies, the reliance on credit is probably not going to change anytime soon. After regrouping somewhat in the aftermath of the home equity loan bubble, Americans are ready to pull out the credit card again. From Bloomberg:

Americans have made progress putting their finances in order and are ready to borrow again — giving the world’s largest economy another driver of spending and growth. “Household finances are in the best shape in decades,” said Joseph Carson, director of global economic research at AllianceBernstein LP in New York, with $435 billion in assets under management. “We now have a creditworthy borrower. It’s a powerful ingredient” for the U.S. expansion and “definitely a step up from where we have been.”

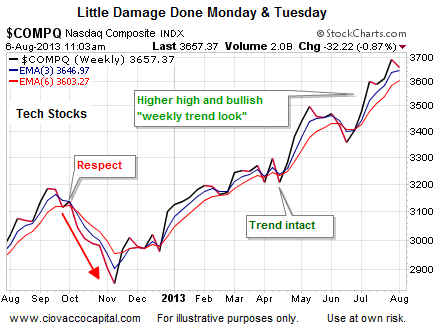

Little Damage Done Monday and Tuesday

Charts allow us to monitor how the markets are interpreting the fundamental news of the day. For an investor’s longer time horizon, a check of the charts shows weekly trends that remain bullish.

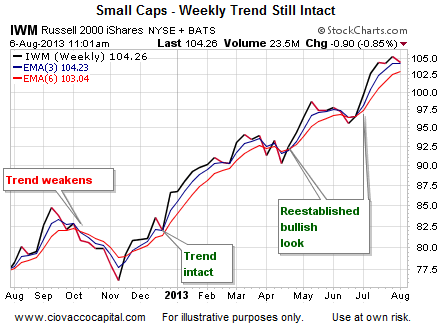

Similar to the chart of tech stocks above, as of 11 a.m. EDT Tuesday, the look of small caps (IWM) from a weekly perspective remained favorable.

Investment Implications

Markets often look weak on Monday, Tuesday, and Wednesday only to rebound before the close on Friday. From our perspective, we need to see significant damage to the markets that carries into the close on Friday before becoming open to booking profits or reducing long exposure. Therefore, the current plan is to continue to hold the S&P 500 (SPY), financials (XLF), technology (QQQ), small caps (IWM), and mid caps (MDY). If the evidence changes, we are open to making allocation adjustments.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Despite Weakness, Big Picture Remains Bullish

Published 08/07/2013, 01:03 AM

Updated 07/09/2023, 06:31 AM

Despite Weakness, Big Picture Remains Bullish

Bears Calling For Another Top

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.