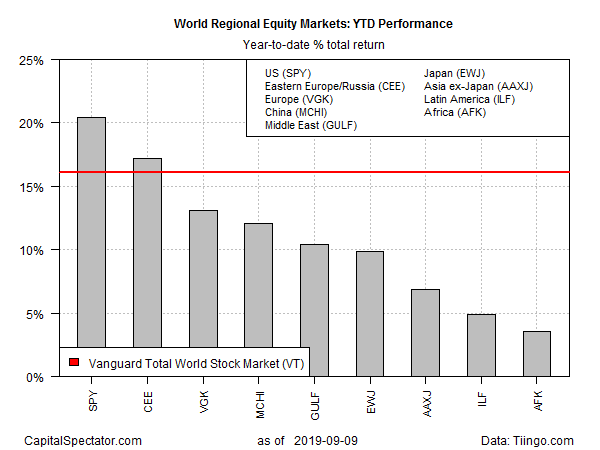

The world economy appears to be slowing, with some analysts warning that recession risk is rising. Judging by year-to-date equity performances for the planet’s main economic regions, however, suggests that the crowd isn’t particularly worried.

Although markets have been volatile lately, looking through the noise reminds that across-the-board gains roll on around the world, based on a set of representative exchange-listed products. Leading the field (still): US stocks.

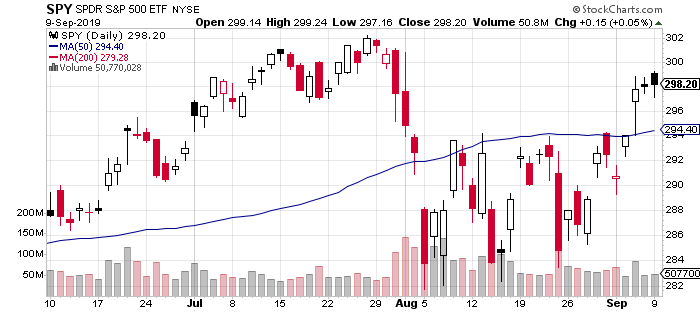

SPDR S&P 500 (NYSE:SPY), a broad measure of American shares, closed yesterday’s session (Sep. 9) with a 20.4% year-to-date total return. Although the ETF has had a rough ride over the past month, yesterday’s slight gain leaves the fund close to a record high, which was set in late-July. Discounting economic turbulence, in short, is a low priority at the moment.

Even the weakest regional equity performer this year is sitting on modest gain: VanEck Vectors Africa (NYSE:AFK)is up 3.5% so far this year.

For global stocks generally the year so far has certainly been kind to the bulls. Vanguard Total World Stock (NYSE:VT) is up a robust 16.1% in 2019.

Despite the positive tailwind for 2019 to date, economic worries continue to lurk in the background. But the current variety of macro risk strikes some analysts as a strange beast. Lou Crandall, chief economist for Wrightson ICAP (LON:NXGN), tells MarketWatch.com:

“Recessions are always hard to predict,” says Crandall, who’s been watching the Fed and the economy for three decades. But after looking deeply into the economic data, he concludes that “there’s no reason” for the economy to topple into recession. The usual suspects are missing. For instance, there’s no inventory overhang, nor is monetary policy too tight.

However, “political risks have a logic of their own,” he says. He’s talking about Donald Trump’s trade war, of course, but also such geopolitical risks as Brexit, North Korea, Iran, and others.

“I think we’ll continue to take risks on trade and push us over the edge,” he predicts, putting the odds of recession by the end of 2020 at slightly more than 50-50.

If the potential for trouble is worrying investors, it’s not obvious in SPY’s strong performance this year.

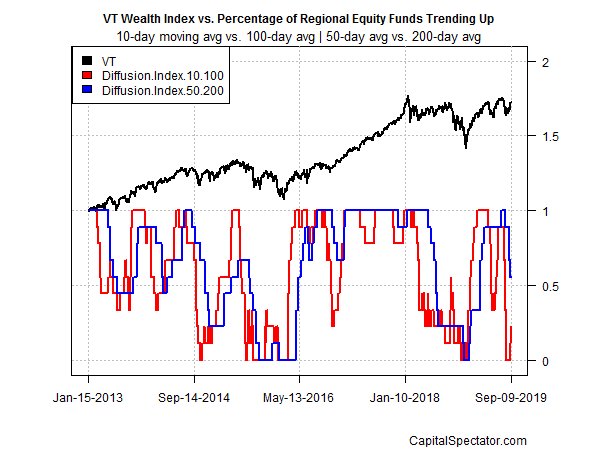

Despite 2019’s upbeat rearview mirror, headwinds appear to be brewing via a sets of moving averages for the funds listed above. The first compares the 10-day moving average with its 100-day counterpart — a proxy for short-term trending behavior (red line in chart below). A second set of moving averages (50 and 200 days) represent an intermediate measure of the trend (blue line).On both fronts, momentum has conspicuously weakened recently, suggesting that downside risk is elevated.