Morgan Stanley (NYSE:MS) is a preeminent global financial services firm that maintains leading market positions in each of its three primary businesses: securities; asset management; and credit services. The company combines global strength in investment banking and institutional sales and trading with strength in providing full-service and on-line brokerage services, investment and global asset management services and, primarily through its Discover Card brand, quality consumer credit products.

Earnings season for the big, “too big to fail” banks continues, and the latest TBTF institution to report, Morgan Stanley, has also posted good results for the latest quarter. Today, Morgan Stanley reported net revenues of $10.6 billion for the second quarter ended June 30, 2018 compared with $9.5 billion a year ago. For the current quarter, net income applicable to Morgan Stanley was $2.4 billion, or $1.30 per diluted share, compared with net income of $1.8 billion, or $0.87 per diluted share, for the same period a year ago.

James P. Gorman, Chairman and Chief Executive Officer, said:

We reported robust revenue and earnings growth this quarter with strength across all businesses and geographies. The second quarter performance reflected active markets and healthy client engagement. Our strong global franchise positions us well to continue to grow organically across each of our businesses and to deliver operating leverage.

Great numbers for Morgan Stanley–and for the other big banks, show that– for now, there is little impact from the Trump Administration’s trade policies on this sector. Of course, one might also be cautioned by the fact that the last time Morgan Stanley posted results like this for two consecutive quarters, it was 2007–just before the housing crisis and financial crash.

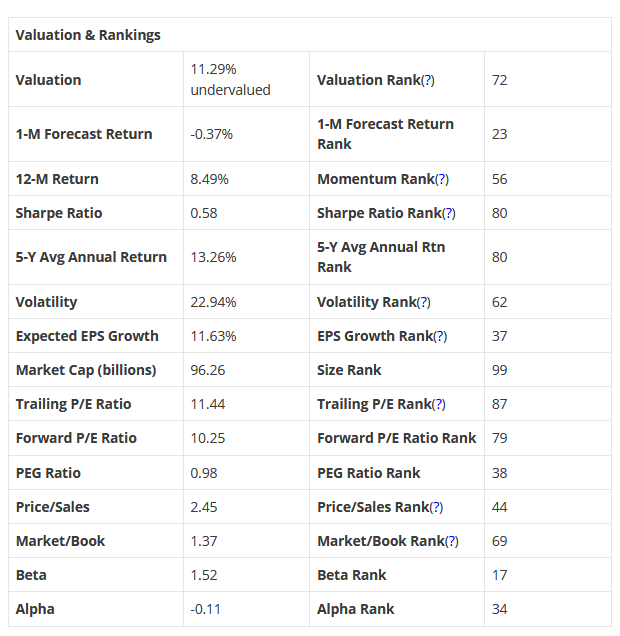

Our models however, are not as sanguine about this stock. We currently rate it a SELL. This may change if analysts adjust their estimates of the earnings potential and our forecast figures change accordingly.

VALUENGINE RECOMMENDATION: ValuEngine continues its SELL recommendation on MORGAN STANLEY for 2018-07-17. Based on the information we have gathered and our resulting research, we feel that MORGAN STANLEY has the probability to UNDERPERFORM average market performance for the next year. The company exhibits UNATTRACTIVE Earnings Growth Rate and Price Sales Ratio.

You can download a free copy of detailed report on Morgan Stanley (MS) from the link below.