Investors continued to plow money into taxable (+$32.0 billion) and tax-exempt (+$4.8 billion) bond funds (including ETFs) for the month of September, despite a 22-basis-point rise in the 10-year Treasury yield by month end and signs that inflation appears to be, at least temporarily, raising its ugly head. For the month, the average taxable and tax-exempt fixed income mutual fund posted a 0.48% and 0.75% decline, respectively, for September and are up 0.50% and 1.27% so far this year.

At the same time, higher energy costs, supply-chain disruptions, debt ceiling worries, and an increasing likelihood of tighter monetary policy, while playing into inflationary concerns, were contributing factors to investors applying the brakes to our most recent rally in stocks.

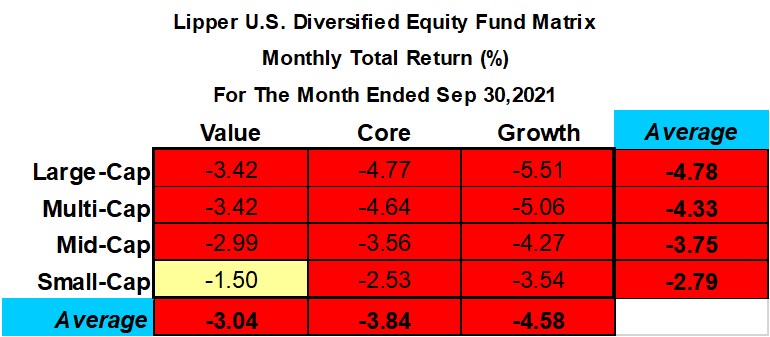

For the month of September, the average equity fund (-3.57%) posted its first monthly loss in 11. Mind you, year-to-date, the average equity fund is still up a handsome 11.47% through Sept. 30, 2021. However, for the month, equity funds (including ETFs) witnessed their first month of outflows in eight, handing back $1.0 billion.

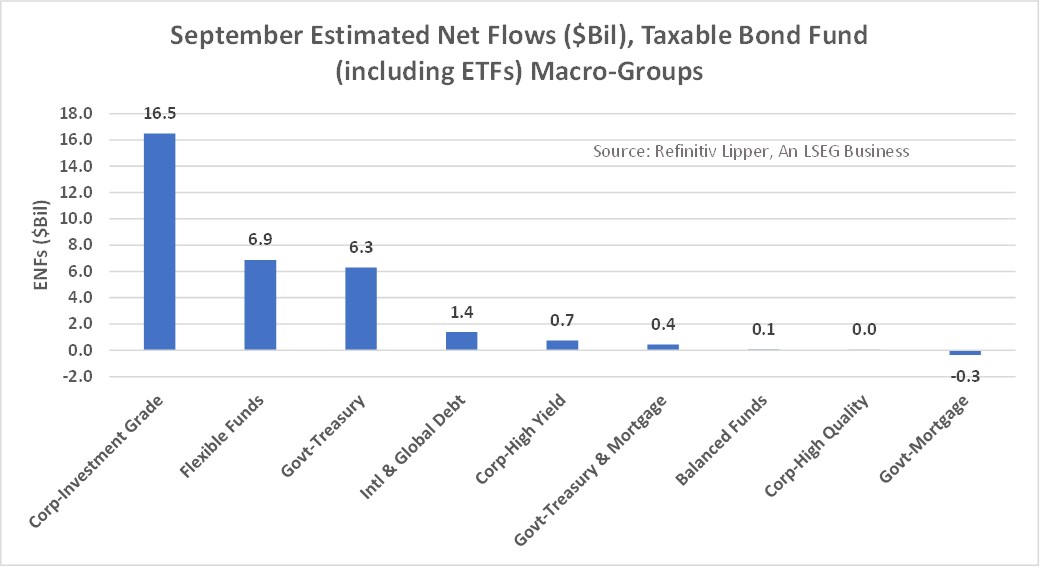

On the taxable bond funds side of the equation, the corporate-investment grade debt funds (including ETFs) macro-group attracted the largest amount of net inflows, taking in $16.5 billion, followed by flexible funds (+$6.9 billion), government-Treasury funds (+$6.3 billion), and international and global debt funds (+$1.4 billion).

However, digging a little deeper into the estimated net flows of the actual taxable bond fund classifications, we see while investors still favored Core Bond Funds (+$7.6 billion, aka corporate intermediate investment-grade debt funds), they did turn their attention to yield, inflation-related, and safe-haven plays, with Multi-Sector Income Funds (+$4.3 billion), Short Investment-Grade Debt Funds (+$3.3 billion), Loan Participation Funds (+$2.9 billion), General U.S. Treasury Funds (+$2.5 billion), and Inflation Protected Bond Funds (+$2.4 billion) attracting the largest draws of net new money.

From a September returns point of view, Loan Participation Funds (+0.53%) was the only classification in that subgroup that posted plus-side returns, while General U.S. Treasury Funds (-1.97%) suffered the largest declines.

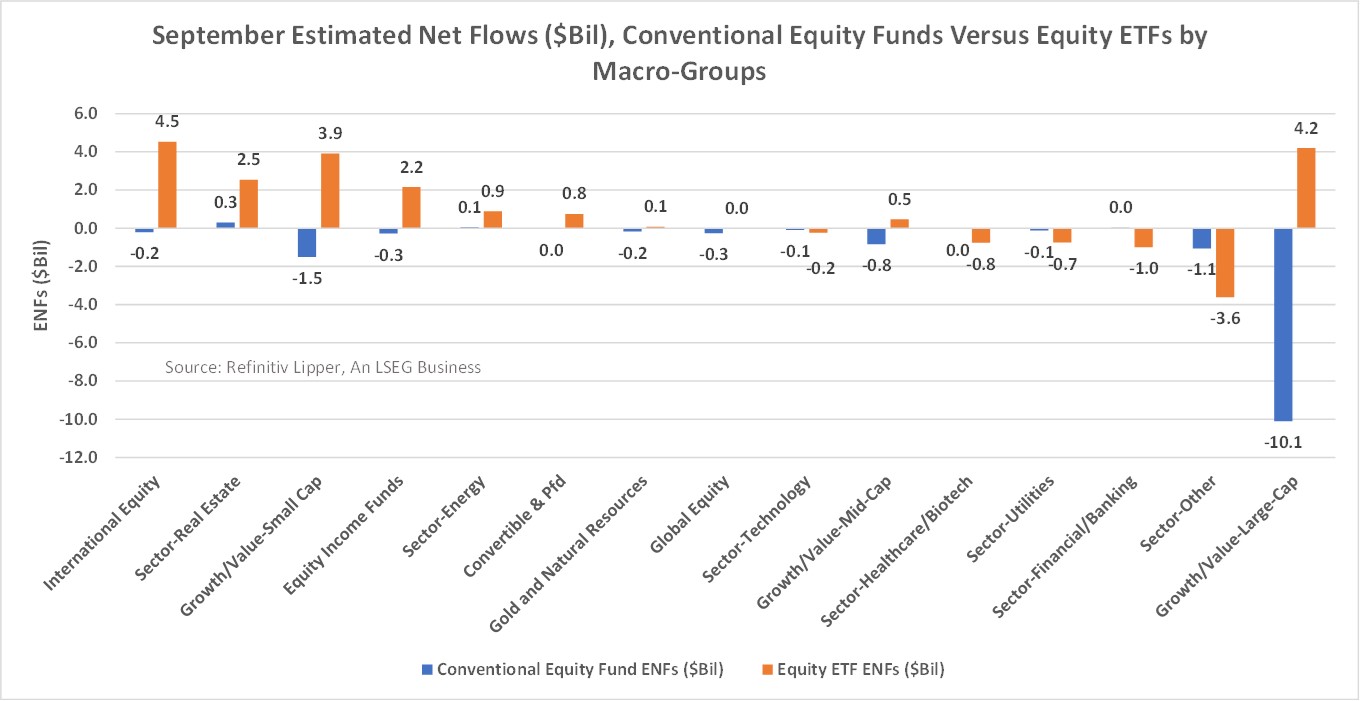

On the equity side of the fence, there continued to be a strong dichotomy between conventional equity fund flows (-$14.2 billion) and equity ETF flows (+$13.2 billion). But overall, the international equity funds (including ETFs) macro-group witnessed the largest draw of net new money, attracting $4.3 billion in September, followed by sector-real estate funds (+$2.8 billion), small-cap funds (+$2.4 billion), and equity income funds (+$1.9 billion), while large-cap funds (-$5.9 billion) experienced the largest net redemptions.

Drilling down to the equity classification level, we see that Equity Leveraged Funds (+$3.5 billion, while posting one of the worst one-month returns [-7.85%] in September of the U.S. diversified equity funds) attracted the largest amount of net new money for September, followed by S&P 500 Index Funds (+$3.4 billion), International Multi-Cap Core Funds (+$3.0 billion), Real Estate Funds (+$2.7 billion), and Small-Cap Core Funds (+$2.4 billion), while Large-Cap Growth Funds (-$10.6 billion) witnessed the largest net outflows for the month.

Large-Cap Growth Funds posted the worst average one-month return of all the classifications included in Lipper’s 4×3 style and cap matrix. Large-Cap Growth Funds and ETFs witnessed the largest net outflows of both subsets, handing back $8.5 billion and $2.1 billion, respectively.