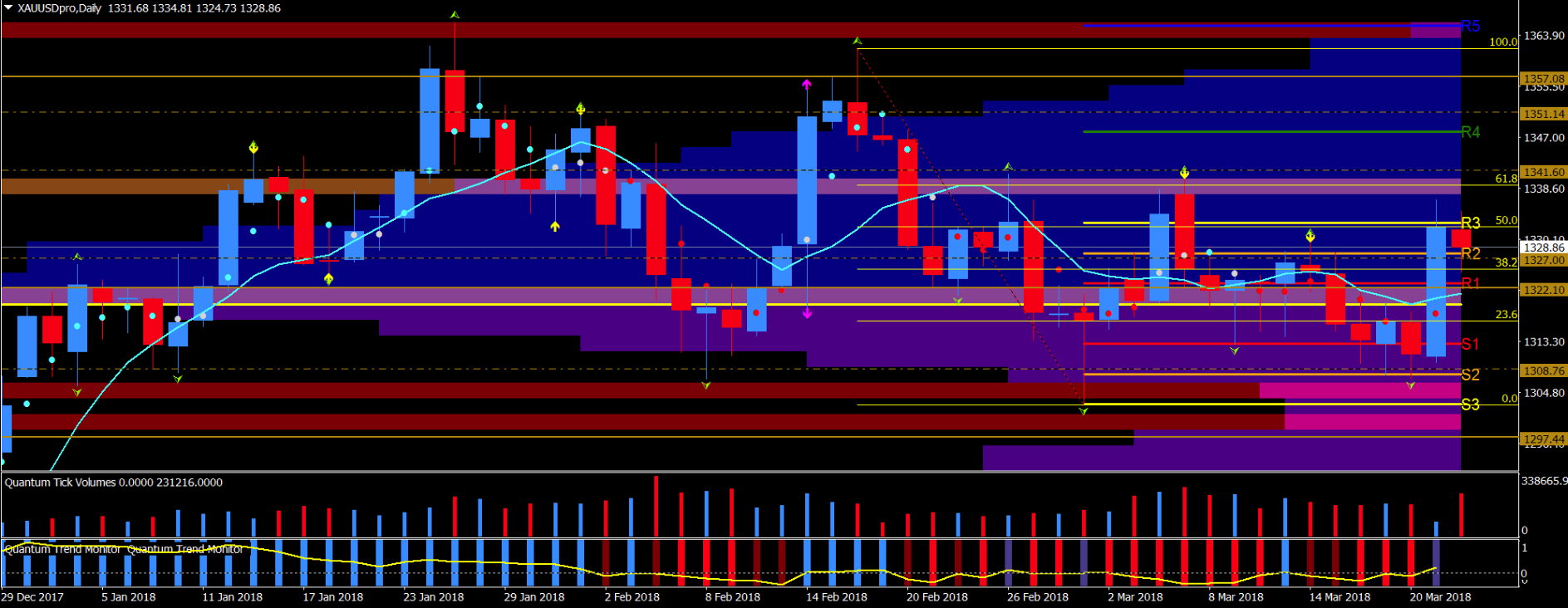

At times of market turbulence, traders and investors have traditionally turned to gold as a safe haven and store of value, but Thursday's announcement by Donald Trump of tariffs against China and the threat of trade wars have failed to move the precious metal significantly higher. By contrast the majority of the price action in Wednesday's wide spread up candle occurred during the FOMC and Powell’s press conference when the price of gold rose over $20 per ounce before closing out at $1332.27 and very close to our R3 Camarilla level. This move was also given impetus by sharp falls in the USD.

However, despite this dramatic move higher, the volume on the day was well below average and at odds with Wyckoff’s third law of effort and result. These were clearly not in agreement, so it has been no surprise to see the gold price pull back, and at time of writing once again pause at our R3 level. In addition, this resistance level coincides with a 50% retracement from the March 1st low of $1302. Volumes on Thursday were significantly higher, but we will need to see whether these are sufficient to take gold through the $1332 price point. If so, then the next important level is $1340 and thereafter $1347.

To the downside $1322 will provide initial support before the volume point of control comes into play at $1319.21.

But once again the overriding question still remains as to why the precious metal has yet to benefit from its traditional fundamental drivers.