As regional bank liquidity fears recede and the Federal Reserve Board softened its language about future rate hikes after hiking its key lending rate by 25 basis points (bps) on March 22, saying “some additional policy firming may be appropriate,” U.S. equities rallied during the Refinitiv Lipper fund-flows week ended March 29, 2023, but fund flows remained defensive.

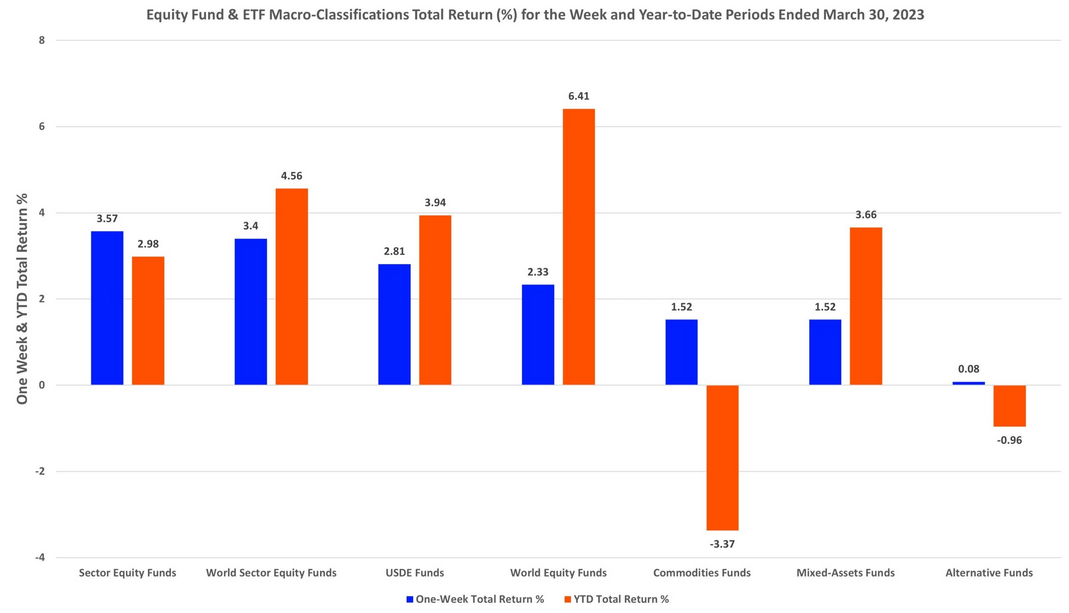

The average equity fund rose 2.55% for the performance week ended March 30, with the Sector Equity Funds (+3.57%, including ETFs) and Global Sector Equity Funds (+3.40%) macro-classifications posting the strongest returns while their U.S. Diversified Equity (USDE) Funds and World Equity Funds cohorts returned 2.81% and 2.33%, respectively.

For the performance week, the Latin American Funds classification (including ETFs and conventional funds) posted the strongest returns in the equity funds universe, rising 7.44%, followed by Natural Resources Funds (+5.53%), Real Estate Funds (+5.50%), and Energy MLP Funds (+5.40%).

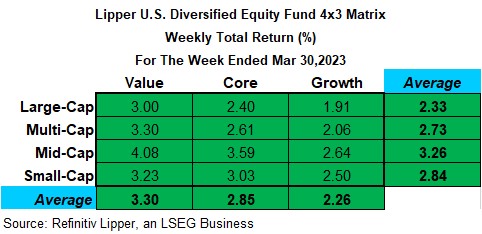

While Equity Leverage Funds (+5.84%) benefitted from the broad-based rally in equities in the USDE macro-classification, investors appeared to prefer mid-cap funds (+3.26%) and value-oriented funds (+3.30%) over the other capitalization and valuation groups, pushing Mid-Cap Value Funds (+4.08%) to the top to the 4×3 matrix leaderboard for the week, while Large-Cap Growth Funds (+1.91%) was the relative laggard of the subset.

Despite the relative calm in the banking sector and a rally in technology issues during the fund-flows week, both ETF and conventional fund investors remained risk averse, injecting net new money only into money market funds (+$61.5 billion) while being net redeemers of equity funds (-$20.5 billion, their fifteenth largest weekly net outflows on record), taxable bond funds (-$983 million), and tax-exempt fixed income funds (-$194 million) for the week.

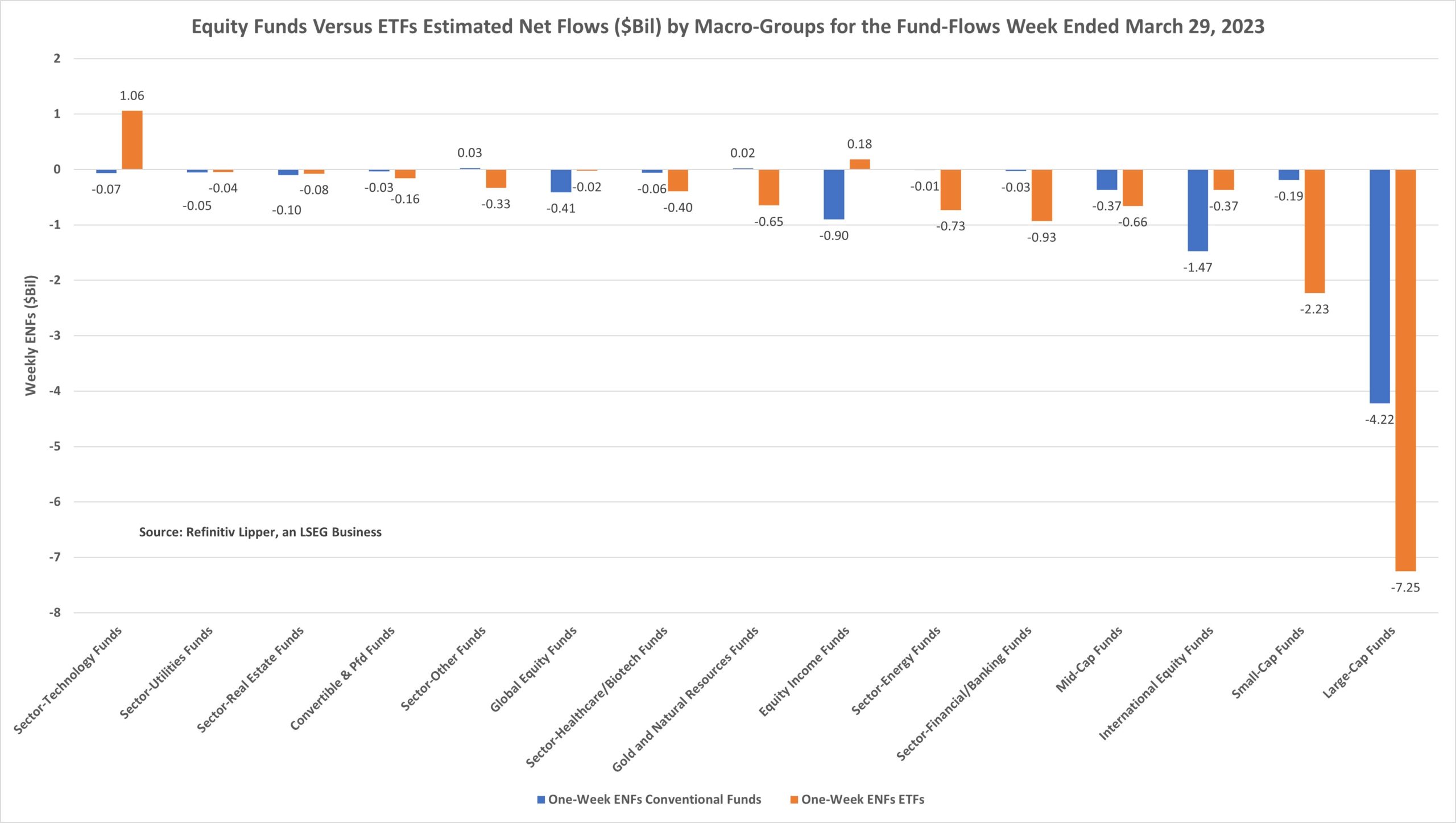

On the equity side of the equation, both equity ETF (-$12.6 billion) and conventional equity funds (-$7.9 billion) witnessed net outflows for the week, with conventional fund investors giving a cold shoulder to large-cap funds (-$4.2 billion), international funds (-$1.5 billion), and equity income funds (-$901 million). The commodities-focused and/or short-biased sector-other funds (+$27 million) and gold and natural resources funds (+$23 million) macro-groups witnessed the only net inflows for the flows week.

Equity ETF investors turned their collective backs on the large-cap ETF (-$7.3 billion) macro-group, small-cap ETFs (-$2.2 billion), sector-finance/banking ETFs (-$933 million), and sector-energy ETFs (-$730 million) while being net purchasers of sector-technology ETFs (+$1.1 billion) and equity income ETFs (+$185 million).

First Trust Nasdaq Semiconductor ETF (FTXL, +$781 million) and First Trust Consumer Discretionary AlphaDEX Fund (FXD, +$770 million) attracted the largest amounts of net new money of all individual equity ETFs. At the other end of the spectrum, SPDR S&P 500 ETF (NYSE:SPY) (SPY, -$3.6 billion) experienced the largest individual net redemptions and Invesco QQQ Trust 1 (QQQ, -$2.8 billion) suffered the second largest net redemptions of the week.

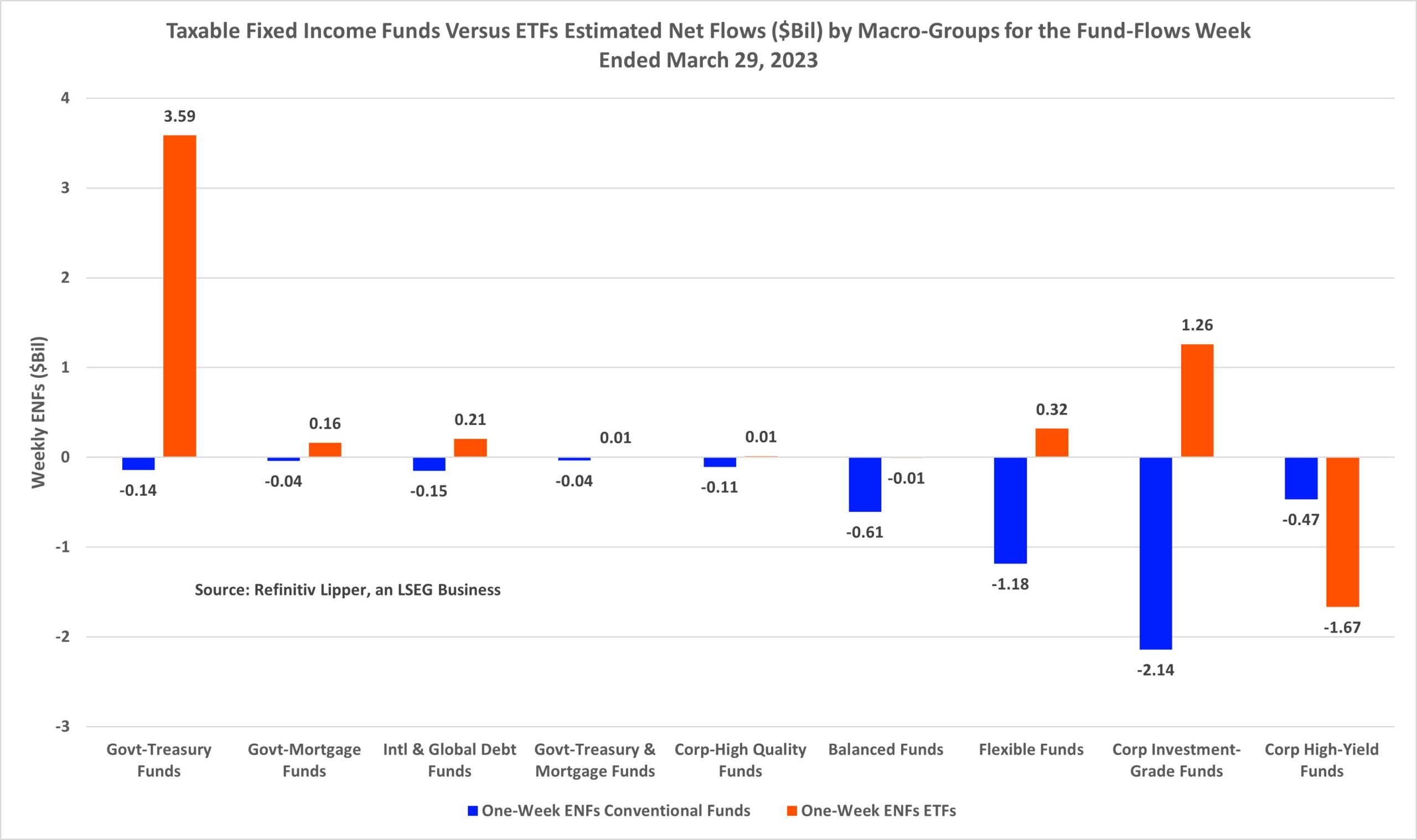

With some investors betting that the Fed might be considering a pivot toward a looser monetary policy sometime in 2023 after its expected 25-basis-point (bp) interest rate hike the week before, conventional bond fund and ETF investors took markedly different paths this week, with ETF investors padding the coffers of taxable fixed income ETFs, injecting a net $3.9 billion for the fund-flows week, while their conventional taxable bond fund counterparts were net redeemers, withdrawing a little less than $4.9 billion.

For the sixth week in a row, taxable bond funds (ex-ETFs) witnessed net outflows—handing back $4.9 billion this past week, with none of the taxable fixed-income fund macro-groups attracting net inflows for the week. Corporate investment-grade debt funds (-$2.1 billion) suffered the largest net redemptions, bettered by flexible funds (-$1.2 billion) and balanced funds (-$607 million).

In contrast and also for the sixth consecutive week, taxable fixed-income ETFs witnessed net inflows, taking in $3.9 billion this week. APs were net purchasers of government-Treasury ETFs (+$3.6 billion), corporate investment-grade debt ETFs (+$1.3 billion), and flexible ETFs (+$320 million) while being net redeemers of corporate high-yield ETFs (-$1.7 billion).

Schwab 5-10 Year Corporate Bond ETF (NYSE:SCHI) (SCHI, +$2.0 billion), iShares 20+ Year Treasury Bond (NASDAQ:TLT) ETF (TLT, +$948 million), and iShares 7-10 Year Treasury Bond (NYSE:IEF) ETF (IEF, +$738 million) attracted the largest amounts of net new money of all individual taxable fixed income ETFs. Meanwhile, iShares iBoxx $ High Yield Corporate Bond ETF (HYG, -$975 million) and iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD, -$432 million) handed back the largest individual net redemptions for the week.

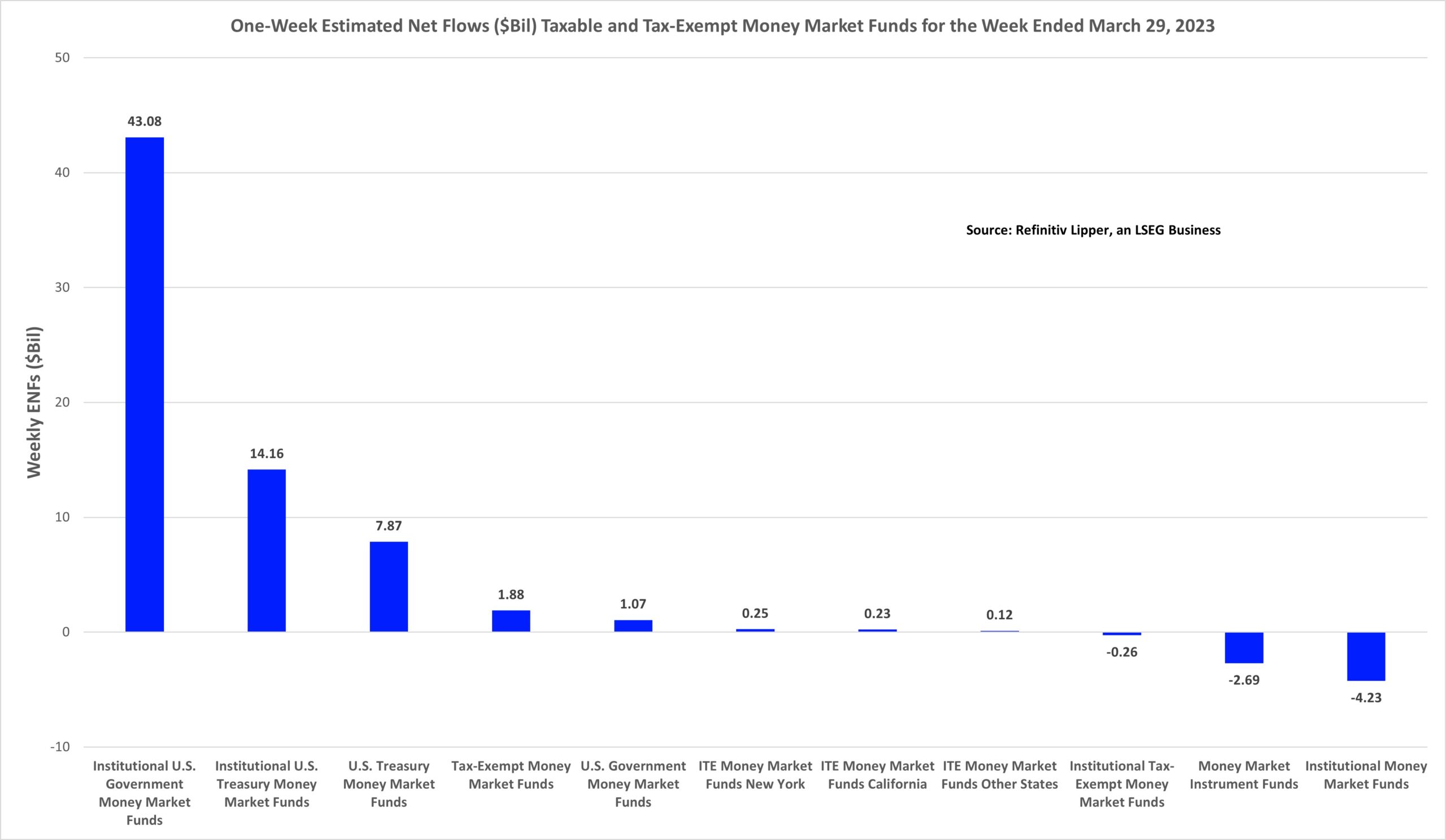

With Q1 earnings season just around the corner and banking stability still a concern, many investors are keeping some of their powder dry—looking for a place to park their money—while awaiting opportunities in this whipsaw market. As a result, money market funds (+$61.5 billion) witnessed their seventeenth largest weekly net inflows on record dating back to 1992, taking in net new money for the third consecutive week, with investors focusing on the higher-quality government and Treasury money market funds while ignoring prime money funds (which generally invest in slightly riskier floating rate debt and non-government commercial paper—as compared to government-backed securities).

Institutional U.S. Government Money Market Funds (+$43.1 billion) took in the largest draw of net new money for the week, followed by Institutional U.S. Treasury Money Market Funds (+$14.2 billion), U.S. Treasury Money Market Funds (+$7.9 billion), and U.S. Government Money Market Funds (+$1.1 billion).

Meanwhile, Institutional Money Market Funds (-$4.2 billion) experienced the largest net redemptions this week, bettered by Money Market Instrument Funds (-$2.7 billion).

So far for the month of March, the money market funds macro-group attracted some $283.1 billion, its strongest monthly net inflows since April 2020.