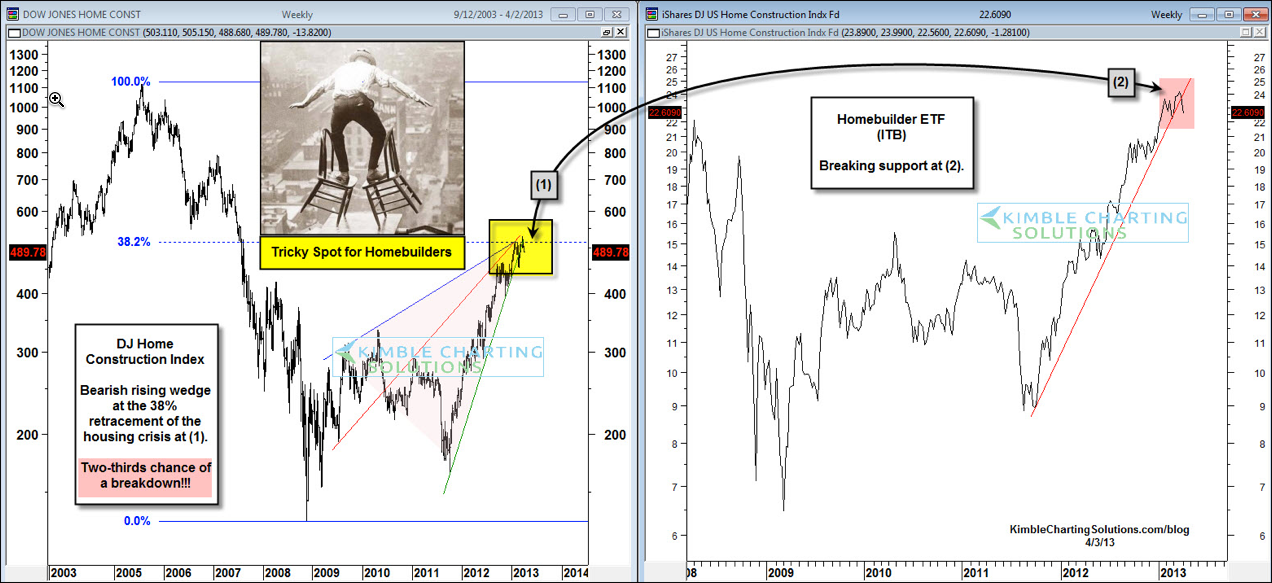

Housing lead the economy and the broad markets down back in 2006-2009. The DJ Home Construction index has created a multi-year, bearish rising-wedge pattern, with the apex of the pattern at its 38% Fibonacci retracement level at point 1 below.

Two-thirds of the time the result of this pattern is lower prices. The chart to the right is the iShares Dow Jones U.S. Home Construction Index Fund (ITB) -- the homebuilders ETF -- which is breaking support at point 2.

Beyond Important

So just as housing goes, so, too, goes the broader markets and the economy. What this sector does over the next few weeks is beyond important for the broad markets.

If the breakdown continues, look for the ProShares UltraShort Real Estate fund (SRS) to do rather well in the weeks ahead.

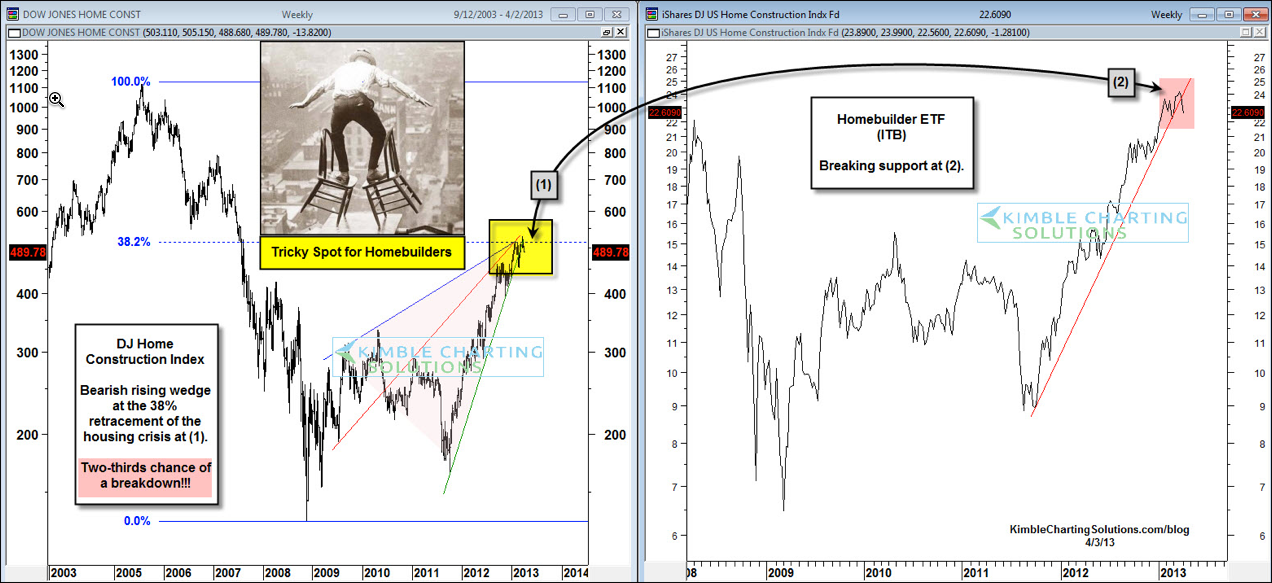

Two-thirds of the time the result of this pattern is lower prices. The chart to the right is the iShares Dow Jones U.S. Home Construction Index Fund (ITB) -- the homebuilders ETF -- which is breaking support at point 2.

Beyond Important

So just as housing goes, so, too, goes the broader markets and the economy. What this sector does over the next few weeks is beyond important for the broad markets.

If the breakdown continues, look for the ProShares UltraShort Real Estate fund (SRS) to do rather well in the weeks ahead.