Johnson & Johnson (NYSE:JNJ) is having the best of times and the worst of times. As for the best of times, its third-quarter earnings call showed the stock rebounding following a tumultuous last year.

But 2019 has been utter chaos for J&J. First, it was the subject of a major controversy when Bloomberg revealed that the company's talc powder was linked to cancer, resulting in a criminal investigation into the company.

Then there was the time every drug company under the sun got sued for the opioid crisis. Or how about recently, the two completely different cases of a judge mishandling the amount of money in a lawsuit awarded in two different states? And who could forget this priceless moment: J&J was ordered to pay a man, not a woman, billions for breast growth. The drug involved in that verdict was antipsychotic, by the way.

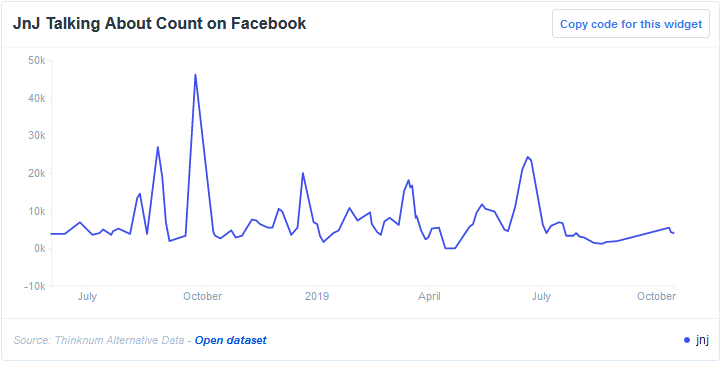

The wild, back and forth nature of all of these storylines has manifested itself in our Facebook (NASDAQ:FB) 'Talking About' data. You could go so far as to pinpoint the spikes in social media buzz to each of the above-hyperlinked headlines.

But back to the good news: Johnson & Johnson's data is trending in the right direction, at least for investors.

As you can see, the stock falls and rises with the global staff count. The same goes for the job listings data, which follows the same curve in stock price. At least everything is going up slightly now, 24% since June.

In the future, don't spend upwards of $832 million a year to fight roughly 100,000+ legal battles. Just don't do it.

About the Data:

Thinknum tracks companies using information they post online - jobs, social and web traffic, product sales and app ratings - and creates data sets that measure factors like hiring, revenue and foot traffic. Data sets may not be fully comprehensive (they only account for what is available on the web), but they can be used to gauge performance factors like staffing and sales.