Key Points:

- Rising Wedge pattern is forming.

- Current support looks likely to hold firm.

- Strong EMA evidence for continued bullishness.

Following a sizable stumble in the wake of the FOMC meeting and FFR decision, the Swissy is now ata pivotal point which could see a long-term rising wedge complete. As a result, whilst a bullish correction for the USD/CHF is likely to eventuate in the short to medium-term, the pair might be setting up for a large breakout in the long-term.

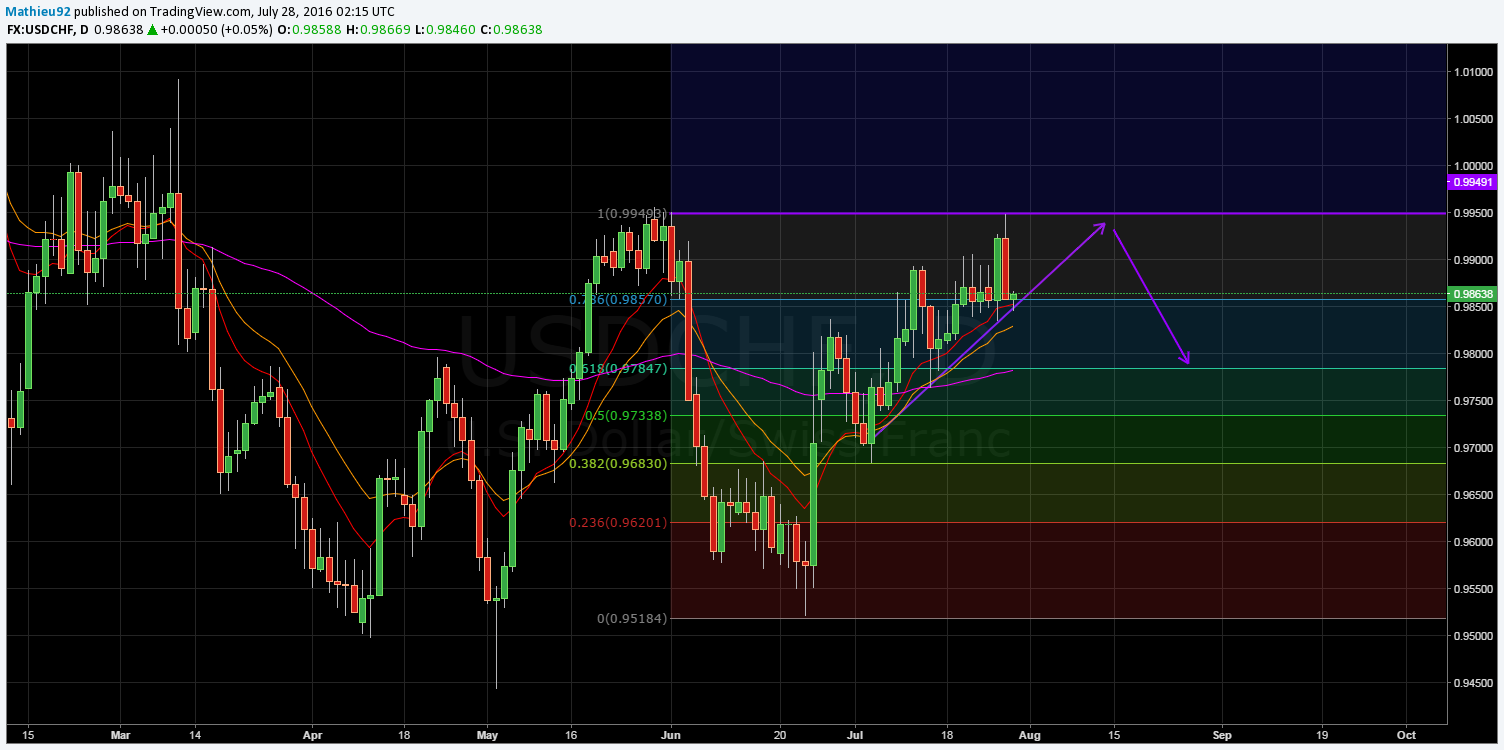

Looking firstly at the daily chart, there is a fairly self-evident trend of higher lows forming for the Swissy. It will come as little surprise then, that the 12, 20, and 100 day EMA’s are fixed in a highly bullish configuration. Consequently, buying pressure is already building which could rectify the rather substantive fall back to support.

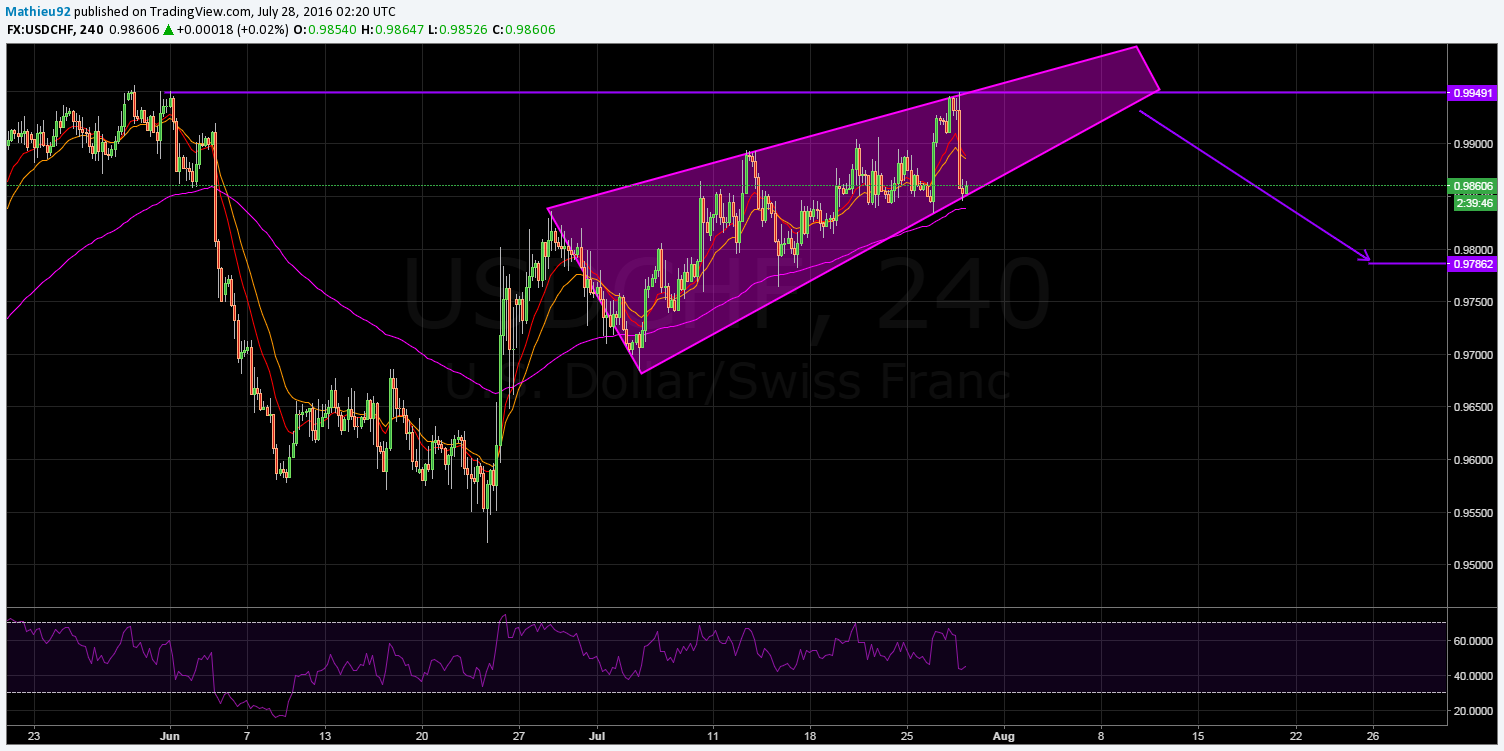

On the topic of support, the current level is highly likely to remain in place over the next number of sessions. Specifically, the current level of support at 0.9857 coincides with the 78.6% Fibonacci retracement level which should help it to hold firm. Furthermore, as is seen on the H4 chart, the 100 period EMA is supplying some dynamic support which should keep the pair from breaking out on the downside.

In the long run however, there could actually be some significant downside potential present for the USD/CHF. This is largely by virtue of the rising wedge pattern which has been forming over the past few weeks. As a result of the structure, the pair is highly likely to ascend once again until reaching the long-term zone of resistance around 0.9949. At this point, the Swissy will begin to run out of momentum which could result in a downside breakout.

Ultimately, this pair has been highly bullish for a relatively lengthy period of time but hasn’t quite run out of steam just yet. While yes, the FOMC meeting has put a dampener on the Swissy, there remains scope for it to complete the rising wedge pattern. Consequently, we can expect to see some more bullishness going forward but keep an eye on the 0.9949 mark as it could prove to be a turning point.