Key Points:

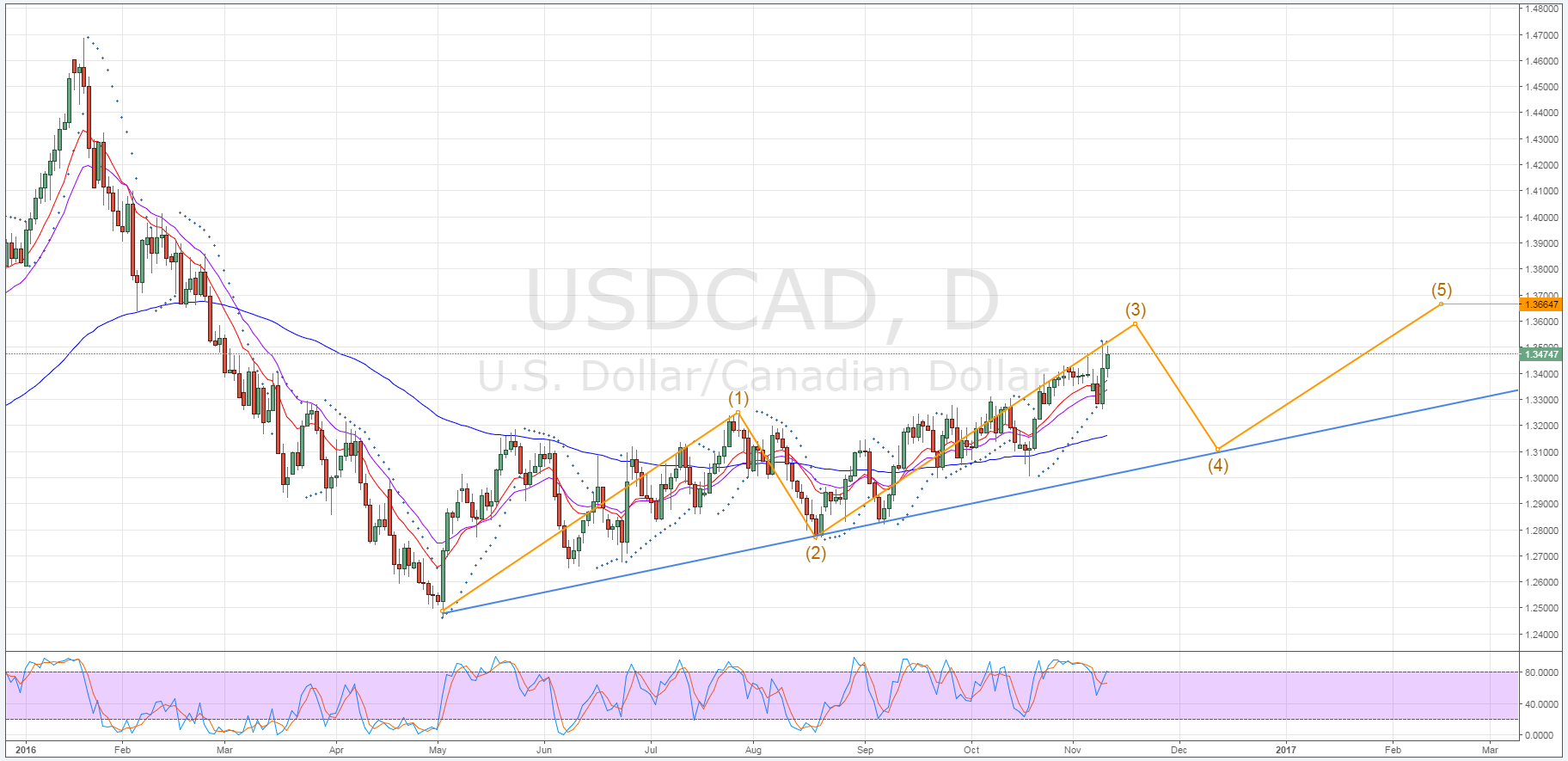

- Elliot wave should encourage a near-term tumble and subsequent recovery.

- Parabolic SAR indicating that bullish momentum is running short.

- Stochastics could be the trigger needed to spark a reversal.

Despite the general boost to the USD resulting from an uncharacteristically restrained Donald Trump, the loonie could be about to encounter some headwinds on its journey towards recovery. Specifically, the pair is beginning to see a number of its key technical indicators switch their bias which could mean a slip occurs within the next few sessions.

Two key technical indicators signalling that a reversal is on the cards for the loonie are the Parabolic SAR and the stochastic oscillator. The former of these two readings has recently seen a swing from bullish to bearish, spelling an imminent end for the latest push higher. However, the second of the two indicators, the stochastic oscillator, still has a small margin to move higher prior to becoming overbought which could mean a slide is fended off until early next week.

However, one could be somewhat dubious over the likelihood of a tumble moving forward due to the protracted, if sedate, inclining trend line that has dominated the pair’s chart for some time.

Even more damming, the daily EMA configuration remains highly bullish which could seriously hamper the bear’s ability to wrest control of the loonie from the bulls. Fortunately, the presence of an Elliot wave can largely explain these apparently countervailing technical forces.

As demonstrated above, the USD/CAD’s ascent has fairly faithfully been taking the form of an Elliot wave which infers two things. Firstly, somewhere between its current price and the 1.3594 mark we expect to see a retracement occur for the pair. Given the current Parabolic SAR reading, this is looking like a relatively certain prospect.

The second inference is that, in the long-term, we should see the pair become bullish once again which could take the loonie as high as the 1.3664 level. This forecast is validated by the recent shift in the 100 day EMA to bullish and the presence of the inclining trend line.

Ultimately, due to the recent political upsets, fundamentals will still play a strong role in impacting just when we see major shifts in the pair’s movements.

Furthermore, we mustn’t forget that the Fed is currently pegged to raise interest rates in December which could go a long way in seeing this Elliot wave complete. In the meantime however, keep an eye on anything and everything Trump-related as I’m sure we are going to experience some sentiment trading moving forward.