It’s a rough world for yield-hungry investors these days. As interest rates plunge near and far, in some cases diving into negative terrain, searching for a respectable payout in the financial markets has become a race to the bottom. The standard benchmarks for what’s available are U.S. Treasuries, where current yields are plumbing extraordinary depths. What’s an investor to do? We can start by considering the alternatives, courtesy of Mr. Market’s offerings via a broad, multi-asset class portfolio a la the major asset classes.

But first, let’s review current conditions in a “risk-free” Treasury. The benchmark 110-year Note’s current yield is a mere 1.50%, as of yesterday’s close (Aug. 30), based on daily data from Treasury.gov. That’s close to an all-time low. Can you do better with a broader set of assets? Perhaps, although “better” is a relative term and one that requires adjustment for risk.

In any case, an ETF-based portfolio that proxies for the major asset classes offers an intriguing counterpoint to the thin yields in Treasuries. Caveats are in order here, but first let’s examine the numbers.

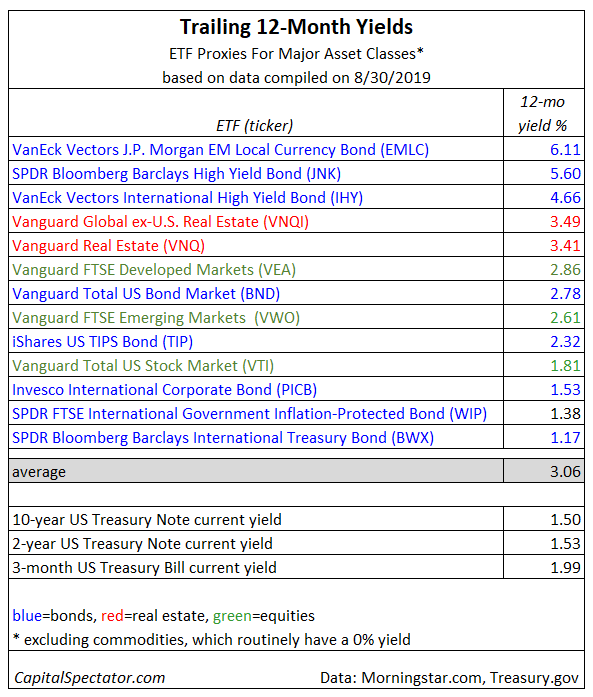

Using Morningstar.com to compile trailing 12-month yields at the moment offers the table below, which sorts the ETFs in descending order by the latest payout. (For a recent ranking of total returns for these ETFs, see Monday’s report here.) The yields range from a high of 6.11% for emerging-market debt down to 1.17% for government debt in the developed world ex-US. The average for these funds is a relatively alluring 3.06%, or roughly double the payout on a 10-year Treasury at the moment.

The yield opportunities look enticing in the chart above, but before you rush in consider the potential drawbacks. First, risk assets (in contrast with Treasuries) are volatile beasts and so capital losses can easily eat up any yield payout (and then some) in the short run, and perhaps over longer periods as well.

Another caveat: trailing yields for funds targeting risk assets is something of a fiction. The payout history over the trailing one-year period, as shown for the ETFs above, is accurate for the rear-view mirror. But there’s no guarantee that the yield for the past 12 months will prevail going forward.

Nonetheless, the table above suggests that a carefully designed portfolio can provide a respectable payout that exceeds what’s available in Treasuries. The question is how much risk can you tolerate in searching for yield beyond the safety of government bonds?

If you absolutely, positively require a yield guarantee that’s written in stone (based on the government’s promise), buying and holding a Treasury till maturity is basically the only game in town for a U.S.-based investor. (Muni bonds and high-quality corporates are a close second- and third choice.)

By contrast, if you can abide some level of risk, the possibilities expand considerably, or so it appears, based on the 12-month rear-view mirror.