Deribit continues to attract retail investors and small funds. But as institutional interest picks up, CME could make up the lost ground.

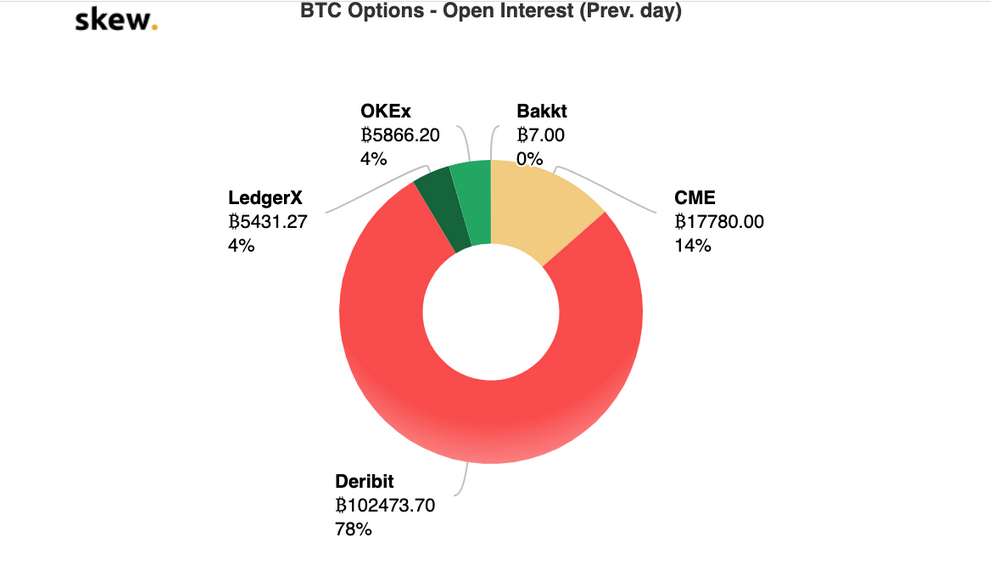

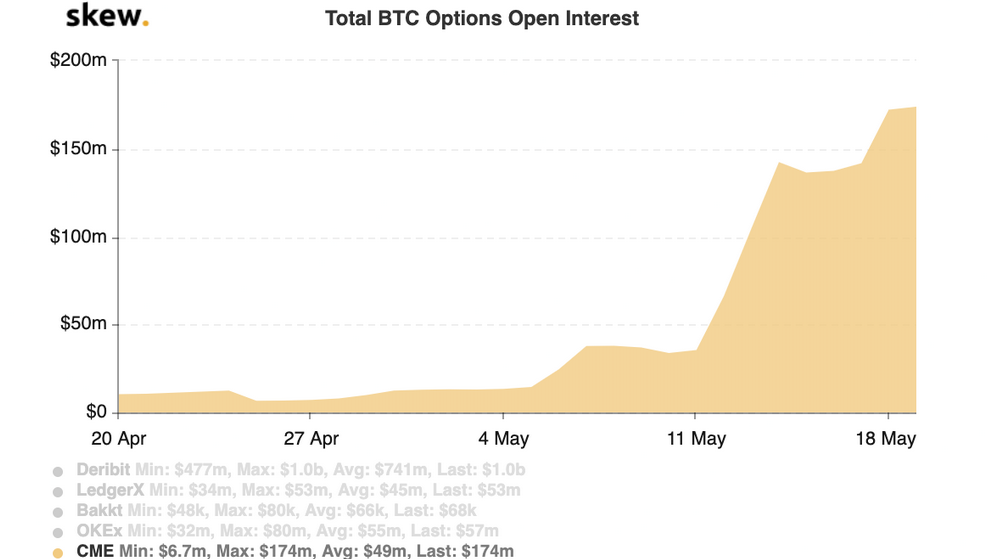

Deribit’s Bitcoin options surged past 100,000 BTC of open interest. But as CME catches up, recording a 13x increase in open interest during May 2020, is Deribit’s position as the market leader in danger?

The Crypto Options Race

Deribit is the most liquid options market in all of crypto, attracting both retail and institutional investors.

Yesterday, the exchange crossed the 100,000 BTC threshold in open interest with over 10,000 BTC in daily trading volume.

The dominance of Deribit in the crypto options market has been longstanding. Still, the exchange’s place as the venue of choice for institutions could be imperiled as CME’s open interest increased from $13 million to $175 million this month.

Significant hedge funds like Rentech and Tudor Investment Corp that added Bitcoin derivatives to their investment mandates chose CME for the platform’s reputation.

Retail investors are the minority in the Bitcoin options market. If CME options continue to gain traction, Deribit could lose significant market share as institutions move to the former.

Deribit’s saving grace in this regard is the onerous capital requirement to trade CME’s Bitcoin options.

Each option contract on Deribit represents one BTC, while each CME contract is five BTC or around $50,000 at the time of press.

According to Su Zhu and Hasu, authors of Deribit Insights, one must have an initial margin of 40% to trade CME options. This is capital inefficient as it requires the trader to keep a large portion of their trading account dormant.

Further, trading is only available from Monday to Friday, as opposed to Deribit, which is open 24×7.

Institutional liquidity in options may be rising, but CME is the platform of choice only for large funds. Smaller hedge funds and traders, however, will find the capital efficiency and accessibility to be Deribit’s trump card over CME.