Investing.com’s stocks of the week

With the Swiss making a loud departure from the minimum exchange mechanism and thus effectively exiting the currency war, traders are combing financial markets for the next weakest link in the chain. What happened in Switzerland is rather unsurprising considering the circumstances and balance sheet risks. The amount of Euro buying was unsustainable especially as the value was plummeting and imminent quantitative easing was forecast. However, it is noteworthy that other countries are facing similar problems and faced with increasingly difficult choices when it comes to protectionist monetary policies. Denmark is one such notable European nation facing up to those difficult choices in the wake of the Swiss National Bank decision.

Denmark is Not Switzerland

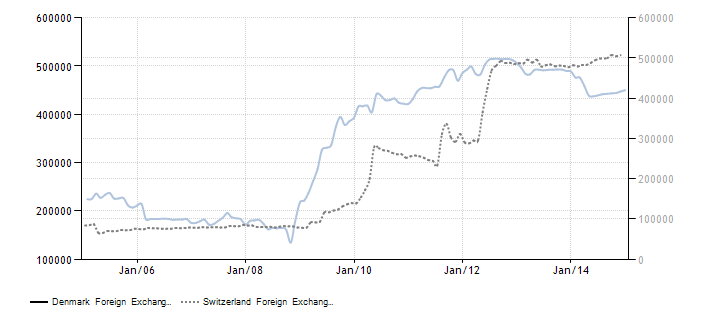

Many parallels can be drawn between Denmark and Switzerland, but on the basis of a side-by-side economic comparison, the differences are easily highlighted. The first obvious point is that Switzerland is a major player within the existing global financial paradigm while Denmark remains a minor element. With nominal GDP of $331 billion, Denmark’s annual gross domestic product stands at approximately half the comparable Swiss benchmark ($651 billion). A quick look at the nation’s foreign exchange reserves shows that they have risen steadily since implementation of the peg. Denmark’s Central Bank has correspondingly also followed the SNB’s foray into negative interest rate territory as the country seeks to stem safe haven inflows.

Even though a minor player in the global financial markets, the relative benefits of a AAA-credit rating in an increasingly precarious investment environment should not be overlooked. Denmark boasts a debt-to-GDP ratio of 44.50% and unemployment rate of 3.90% versus Switzerland’s 35.40% and 3.40% respectively. A quick at central bank balance sheets however shows that Denmark is not quite at the tipping point of Switzerland. While Switzerland’s balance sheet ballooned to nearly the equivalent of annualized GDP, Denmark has actually seen the balance sheet shrink over a comparable time period. However, the one big difference that stands out is the relative stability that comes in conjunction with gold reserves. Switzerland controls the largest gold reserves on a per capita basis of any country on the planet. By contrast, that figure is almost 16 times greater than the measly 66.55 tonnes of gold held by the Danish Central Bank. Although stable and secure, Denmark does not have quite the firepower the Swiss command at their central banking fingertips.

Pegs Notoriously and Spectacularly Fail

Despite their differences, the situation surrounding the Danish currency peg has the propensity to have similar implications as the Swiss, especially as the ECB embarks on its own version of quantitative easing. The Danes have pegged their currency to the Euro Area since the 1980s and there remains a strong bilateral agreement between the two regions, unlike the unilateral moves of the Swiss. However, as has been proven historically, currency pegs inevitably fail or in the case of Switzerland can bring national economies to the brink of destruction. Another great modern example was George Soros and his speculative actions aimed at the Bank of England in 1992 which resulted in a massive devaluation in the Pound.

While Denmark has a degree of flexibility to fight a speculative run against the Krone (DKK), the nation has neither the resources or firepower to defend the peg indefinitely. On a relative basis, the country is in a strong position financially, however not considered to have the same haven status for which Switzerland is renowned. Low unemployment and low inflation are hallmarks of a stable economy, yet any major inflows that result in a move out of the EUR could drastically limit the Danish Central Bank’s ability to influence exchange rates unless the ECB steps in with swap lines to alleviate any pressure of Euro Area outflows.

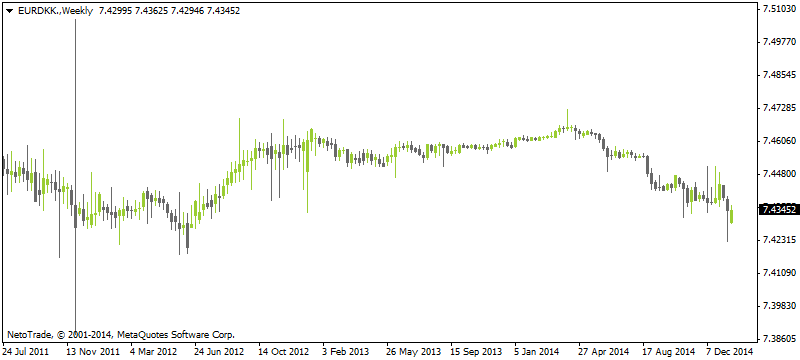

In the meantime, the willingness of Denmark’s politicians and bankers to speak out against the possibility of a speculative run against the Krone implies that very possibility. With interest rates below zero, the Danish Central Bank is quickly running out of conventional monetary policy tools and is only left with jawboning to scare off speculators. However, deep down, these very talkative individuals must know that the threat to the peg is tangible and very real. With EUR/DKK trending near multi-year lows, the propensity for the pair to dive further if haven flows accelerate is exceedingly probable. Furthermore, quantitative easing to be announced from the ECB later in the week will see renewed pressure on the Euro, making the Danish Krone an excellent opportunity for speculators. While volatility will not mirror that of what was witnessed in the Swiss Franc, rationality and history remind us that pegs do not last forever.